The European Commission has picked a good time to try to tax internet giants more, starting with 3% of revenues made from advertising, data and digital interactions.

March 21, 2018

The European Commission has picked a good time to try to tax internet giants more, starting with 3% of revenues made from advertising, data and digital interactions.

The most significant fall-out from the overblown, but persistent Cambridge Analytica story will be for internet giants to face far more scrutiny over how they use the extensive data they gather on all of us. What seems to upset people the most is when they’re reminded of the Faustian pact they have made with said giants by being reminded of the enormous profits they’re making by exploiting all of us.

This is therefore a good time to be shaking those companies down and the European Commission must be delighted this story has broken just as it unveils its initiatives to stop that exact type of company from avoiding paying tax in the countries in which it does business, as opposed to just where it’s headquartered. No doubt the nuances of transnational tax law are riveting, but it doesn’t really matter, because the EC has spoken.

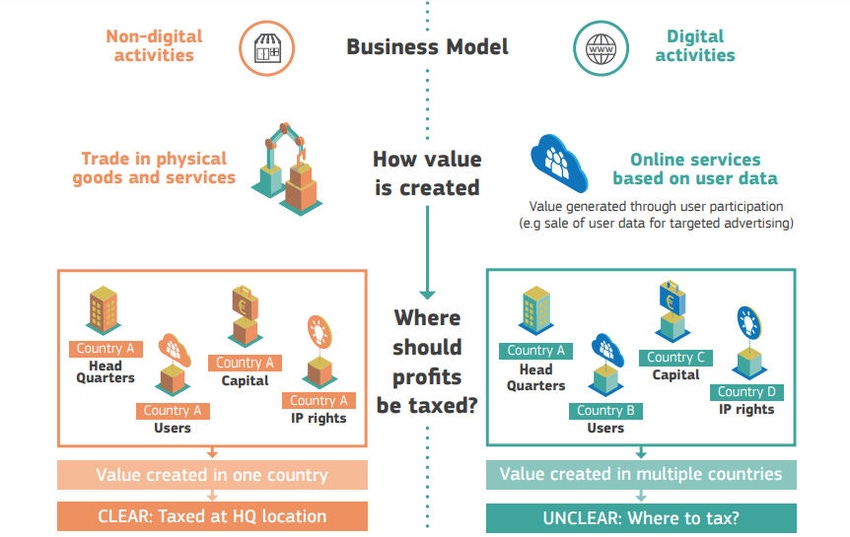

The proposed remedy to this shocking lack of revenue into EC coffers comes in two phases. Ultimately Europe wants the whole world to come to an agreement on how to tax digital products according to where the value is generated, rather than banked. But until that happens the EC thinks it’s fair enough to slap a 3% tax on revenues (not profits, mind) on online advertising, the sale of user data and digital platforms that facilitate interactions between users.

“Digitalisation brings countless benefits and opportunities, but it also requires adjustments to our traditional rules and systems,” said Valdis Dombrovskis, VP for the Euro and Social Dialogue. “We would prefer rules agreed at the global level, including at the OECD. But the amount of profits currently going untaxed is unacceptable. We need to urgently bring our tax rules into the 21st century by putting in place a new comprehensive and future-proof solution.”

“Our pre-Internet rules do not allow our Member States to tax digital companies operating in Europe when they have little or no physical presence here,” said Pierre Moscovici, Commissioner for Economic and Financial Affairs, Taxation and Customs. “This represents an ever-bigger black hole for Member States, because the tax base is being eroded. That’s why we’re bringing forward a new legal standard as well an interim tax for digital activities.”

As ever this is just the first inch forward by the glacial European bureaucratic machine and its will take sever hundred obscenely lavish lunches to really get to grips with it. More significantly things like this require all member countries to sign it off, which seems unlikely, so it could all be a massive waste of time. But if companies like Facebook know what’s good for them, they could do worse than show some goodwill when it comes to tax.

Here’s a handy vid from the EU Taxation and Customs Union explaining why tax is actually great in the kind of dumbed-down language that speaks volumes about how they perceive their client electorates.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)