With US venture capitalists increasing their total investments, but reducing the number of start-ups being funded, you have to wonder whether the US is priming itself properly for the 5G bonanza of tomorrow.

November 12, 2018

With US venture capitalists increasing their total investments, but reducing the number of start-ups being funded, you have to wonder whether the US is priming itself properly for the 5G bonanza of tomorrow.

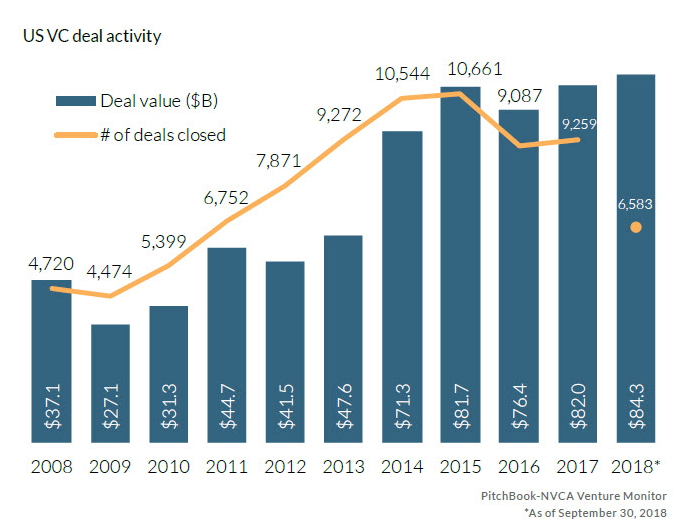

According to data from Pitchbook, the total amount invested by VCs in US firms is set to exceed $100 billion across a 12 months period for the first time, but the number of completed deals is actually decreasing. So far across 2018, VCs have invested $84.3 billion, already exceeding the total from 2017, though the number of deals has dropped to 6,583 compared to 9,259 last year. These numbers are correct to September 30, still leaving time in 2018, but you have to wonder what impact this will have on the innovators of tomorrow.

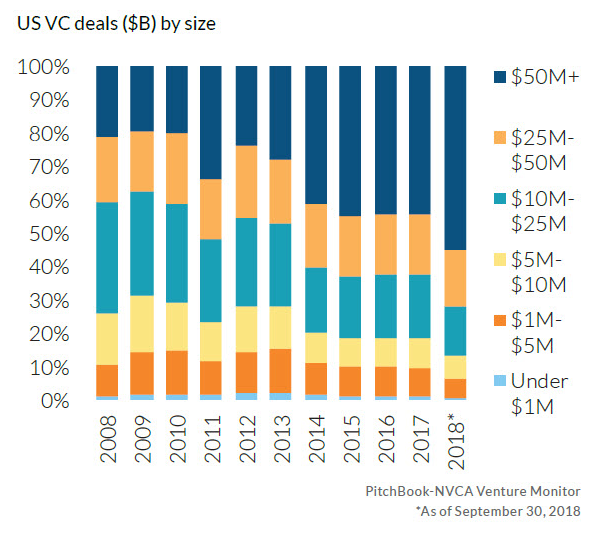

Looking at the data, the number of deals which are valued at $50 million or more is significantly on the increase, while the bottom three categories (which you can see in the table below) are decreasing. This is not necessarily a bad sign, innovation can come from larger companies and more established SMEs, though some of the brightest ideas over the last two decades have come from companies which didn’t exist in the 20th century.

Think of the likes of Facebook, Uber, AirBnB, Shopify, Android and Netflix, these are all organizations which have risen through the ranks in recent years and are defining their respective segments. All were powered by the democratization of the internet, in particular mobile internet, and the emergence of a new form of economics. They are companies which succeeded because they thought and operating differently from the status quo, leaving many traditional businesses playing catch-up today.

In short, the start-ups are an excellent source of innovation and, in many cases, a completely under-utilised resource for national economies. However, with the upcoming 5G bonanza promising fortunes for those who seize the opportunity, is a more streamlined focus from the VCs creating the right, nurturing environment?

5G is going to create a completely different playing field, though we’re not entirely sure how at the moment. Those who think they can accurately predict where future fortunes will come from are nothing but blowing hot air. They might well be right, but this is likely more to be luck than judgment. For example, back in 2005 who would have thought a relatively unknown networking website designed for university students would become one of the most powerful companies on the planet, influencing elections, stimulating fake news and completely revolutionising how companies communicate with their customers?

The point is there is a ‘build it and they will come’ attitude with 5G. If you create the right technology environments, underpin them with supportive regulations, open doors to new markets and fuel them with seeding funds, the next great idea will emerge. We don’t know what it is just yet, but that was the exciting thing about 4G and will be the exciting thing about 5G.

Another consequence of a lack of available funding for the smaller players is the risk of acquisition. Without the fuel to grow their own ideas, some entrepreneurs might be tempted to sell their business and product to an established company. This in turn would direct innovation into the acquirers main focus area. Perhaps this will leave potential usecases and the dark corners of what is possible unexplored?

The issue here is whether VCs are putting enough cash into the early stage start-ups to nurture this innovation and create the blockbuster idea of tomorrow. Fuelling companies which are already out there is not a bad idea, but it is likely going to get you a better version of what exists today. This is a perfectly acceptable approach to business and will reap rewards, but are these trends going to create a landscape in the US which will dominate the 5G world of tomorrow? We are sceptical.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)