NTT DoCoMo, KDDI, Softbank, and Rakuten have all received the 5G licences they applied for, but they come with coverage obligations and security commitment.

April 11, 2019

NTT DoCoMo, KDDI, Softbank, and Rakuten have all received the 5G licences they applied for, but they come with coverage obligations and security commitment.

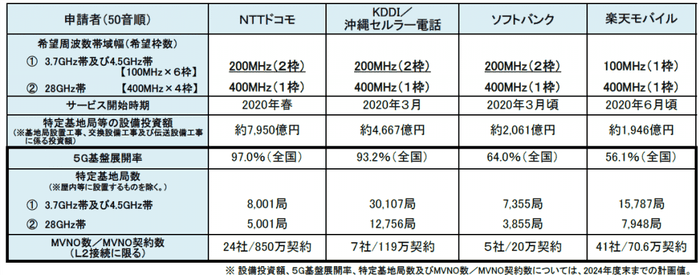

The Ministry of Internal Affairs and Communications announced on 10 April (in Japanese) that all the four applicants have been awarded radio frequencies and licences to rollout 5G services. Each licensee is awarded 400MHz spectrum on the 28GHz frequency, while three of them are awarded 200MHz on 3.7GHz except Rakuten, which has requested 100MHz.

All the operators are going to roll out 5G services starting in 2020. NTT DoCoMo, KDDI and Softbank will launch the service in spring time, with Rakuten planning to open its service in June. The total investment planned by the operators to the end of 2024 amounted to Yen 1.6 trillion ($14.4 billion).

While both NTT DoCoMo and KDDI have pledged to cover over 90% of the country within five years, Softbank only plans to cover 64% of the country and Rakuten 56%. The minimum requirement from the government is serving every prefecture within two years, and at least 50% of the whole country within five years, calculated by the number of geographical blocks the networks will cover out of the total 4,500 blocks the Ministry divides the country into.

In addition to coverage requirement, the Ministry has also attached a dozen granting conditions (pp.16-17 of the summary, in Japanese), including commitments to expand optical fibre networks (#2), to improve safety measures to minimise outage during natural disasters (#3), to prevent interference of existing radio licensees (#7) etc.

The item that may raise eyebrows is Item 4 on the list, which requires the operators to “take appropriate cyber security measures including measures to respond to supply chain risks” (unofficial translation). It refers to earlier regulations including the “”Information and telecommunications network safety and reliability standards” published by the Ministry of Post and Telecommunications in 1987, “Common Standards Group for Information Security Measures for Government Agencies and Related Agencies” issued by the National Information Security Center (NISC) in 2018, and the cross-departmental “Agreement on IT procurement policy and procedures for goods and services” published on 10 December 2018.

The last two documents, though neither of them names any particular countries or brands to be excluded, have been broadly recognised as the Japanese government’s decision to ban companies like Huawei and ZTE from public sector procurements. By invoking these regulations, it may not be too much of a stretch to read it as a message to the operators to stop using equipment supplied by the Chinese vendors. This may not cause serious disruptions to the operators’ business though, as Softbank, the only operator that has Huawei equipment on its network, is already planning to swap for Ericsson and Nokia, Nikkei reported earlier.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)