The Strategy Analytics numbers for the Q4 2019 global smartphone market are out and a couple vendors fared much better than the rest.

January 30, 2020

The Strategy Analytics numbers for the Q4 2019 global smartphone market are out and a couple vendors fared much better than the rest.

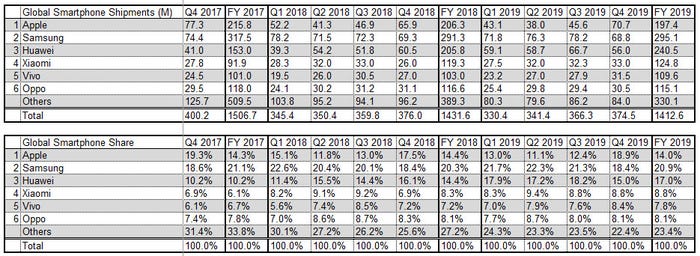

The overall market contracted for the second year running, but less so than in 2018, perhaps indicating a 5G-fuelled recovery. For the quarter the big success story was Apple, which reversed its declines in previous quarters and delivered its best shipment numbers for a couple of year. Similarly Xiaomi rescued its year with a massive 27% increase in smartphones out the door.

The big loser in Q4 2019 was Huawei, which saw the end of a two-year growth spurt by shipping 7% few phones than it did a year ago. How much of this down to all the hassle it’s getting from the US is unclear, but it can’t have helped. The long tail also contracted by 13% at the global smartphone market continued its consolidation towards the big six.

“Worldwide smartphone demand remains mixed for now, with sharp declines in China balanced by strong growth across India and Africa,” said Linda Sui of SA. “Full-year smartphone shipments hit 1.41 billion in 2019, dipping 1 percent from 1.43 billion in 2018, due to mild inventory build in the second half of the year. Looking ahead, US trade wars and the China coronavirus scare will be among barriers to growth for smartphones in 2020.

“Xiaomi had a great quarter in Western Europe and held steady in its biggest market India. Xiaomi is pushing hard into the 5G smartphone category and this will be a solid growth area for the vendor in 2020. Oppo is expanding hard into Western Europe, with new models like the Reno 5G, but it remains under persistent pressure from giant Huawei at home in China.”

“Apple is recovering, due to cheaper iPhone 11 pricing and healthier demand in Asia and North America,” said Neil Mawston of SA. “Samsung’s global marketshare stayed flat at 18 percent, the same level as a year ago. Samsung continues to perform relatively well across all price-bands, from the entry level to premium models such as Galaxy Note 10+ 5G.”

The chances are Apple will carry that momentum into this year and will probably experience a spike when it enters the 5G market in Q4. Demand for 5G phones seems to be exceeding expectations, so it wouldn’t be surprising to see the whole market return to growth in 2020.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)