Xiaomi has reported revenue and profit rises through to March 31, but let’s not forget this does not include the period of extensive lockdowns in European markets.

May 21, 2020

Xiaomi has reported revenue and profit rises through to March 31, but let’s not forget this does not include the period of extensive lockdowns in European markets.

With total revenues coming in at roughly $7 billion, a year-on-year increase of 13.6%, profits grew by 10.6% to approximately $320 million. Considering the backdrop of COVID-19, this would be considered a healthy performance through the three-months, though investors will have to brace for the impact of societal lockdowns during April and May in Western Europe, a growth region to Xiaomi.

“Although the industry is facing severe challenges, the Group still experienced growth in all segments despite the market downturn, which fully reflects the flexibility, resilience and competitiveness of Xiaomi’s business model,” said Xiaomi CEO Lei Jun.

“We believe a crisis is the ultimate litmus test for a company’s value, business model and growth potential. As the impact of the pandemic starts to ease, we will continue to focus on the ‘5G + AIoT’ strategy and strengthen our scale of investment, in order to let everyone in the world enjoy a better life through innovative technology.”

Jun might be positive, but it is dampened success in comparison to previous quarters,

Xiaomi year-on-year financial performance for 2019 |

Period |

Q4 |

Q3 |

Q2 |

Q1 |

Source: Xiaomi corporate blog, Mi Global

Although there was a dip in performance during the third quarter, which could be attributed to a slowdown in smartphone shipments in its Chinese domestic market, Xiaomi is a company which has been on the rise. Success has been in the international markets primarily, and the executive team will hope the dampened success will only be temporary as the world begins to open-up again.

The issue is April and May, which will show up in the next quarterly earnings report. International revenues have been a significant driver for Xiaomi in recent years, and this quarter saw 50% of revenues attributed to the overseas markets.

Over the first three months of 2020, IDC attributed 31.2% of shipments in India to Xiaomi, while Canalys estimated Xiaomi’s smartphone shipments grew by 58.3% year-on-year in the European markets, accounting for 14.3% market share. In Italy, France and Germany it ranked it the top four smartphone manufacturers, while it claims to be number one in Spain. The growth numbers in LATAM, the Middle East and Africa were even more impressive.

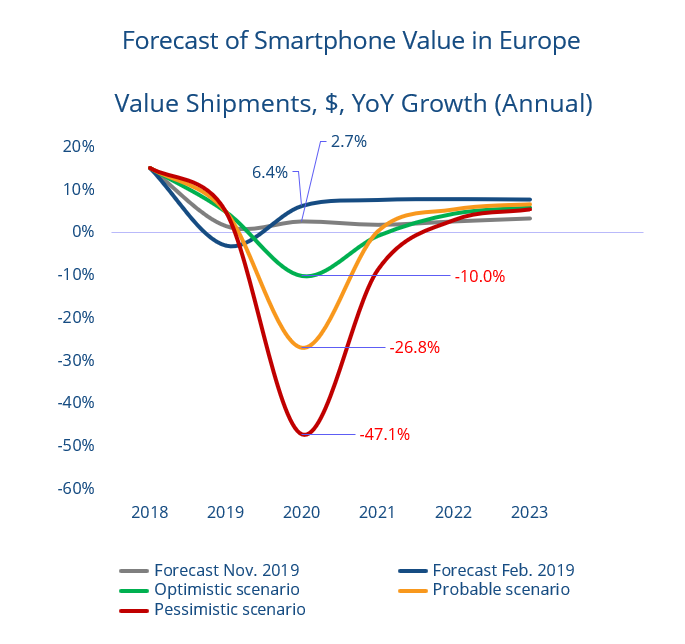

Unfortunately, the majority of markets where Xiaomi is seeing success are the ones where lockdown has been severely impacting smartphone sales. In Europe, IDC said smartphone revenues could be down 10% optimistically, but worst case scenario could see sales slashed by as much as 47%.

Xiaomi has estimated that as of mid-May, the weekly number of smartphone activations in the European market had returned to over 90% of the average weekly level in January. Sales are gradually beginning to recover, but they are still not at the levels which would have been expected and more than half of this quarter has already passed. It is not a good sign, but these are certainly extenuating circumstances.

Investors have not exactly been thrilled with the news either. Xiaomi share price, on the Hong Kong stock exchange, is down 2% at the time of writing having started the day with a brief surge.

The saving grace for Xiaomi is diversification, however.

One business unit is leveraging the Xiaomi brand and existing customer base to drive sales in IoT and lifestyle products segment. The IOT platform now has 252 million connected IoT devices on it (not including smartphones and laptops), while there have also been progress in selling TVs, wireless earphones, electric scooters, robot vacuums and wifi routers. The business seems to be passionately and aggressively embracing diversification.

The second important area of diversification is Xiaomi’s internet services. With revenues of $830 million, a year-on-year increase of 38.6%, the division accounts for 11.6% of total revenues, up from 10.1% in Q4 2020 and 9.9% in Q3 2020. This division is slowly becoming more prominent but most importantly, this is recurring cash, the holy grail in the digital economy.

Xiaomi is another Chinese company which has been embraced by the international markets in recent years, a critical driver of revenue growth, but this progress might prove to be the source of great pain during the second period of 2020.

Telecoms.com Daily Poll:

Should privacy rules be re-evaluated in light of a new type of society?

The user should be given more choice to create own privacy rights (41%, 95 Votes)

Yes, the digital economy requires a difference stance on privacy (31%, 72 Votes)

No, technology has changed but privacy principles are the same (28%, 66 Votes)

Total Voters: 233

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)