With 5G euphoria reaching fever pitch at times, the on-going importance of 4G networks is often overlooked.

June 17, 2020

With 5G euphoria reaching fever pitch at times, the on-going importance of 4G networks is often overlooked.

Ericsson’s most recent Mobility Report has given 5G a positive spin in light of the on-going COVID-19 pandemic, with the team revising forecasts upwards. China is driving 5G adoption, with Ericsson believing there will be more than 190 million subscriptions by the end of 2020, but it is the data consumption which is another interesting element of this story.

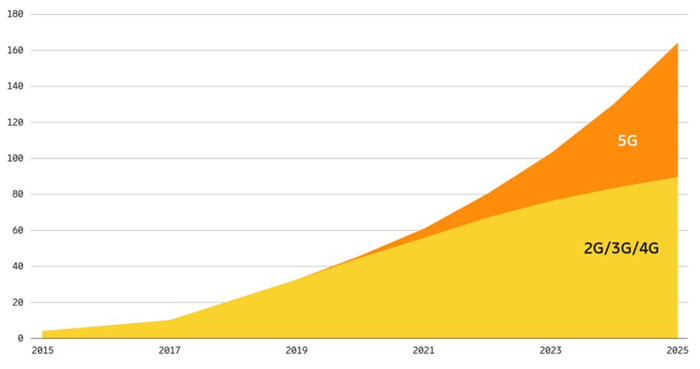

“Populous markets that launch 5G early are likely to lead traffic growth over the forecast period,” the report states. “By 2025, we expect that 45% of total mobile data traffic will be carried by 5G networks.”

45% might seem like a big number considering the world will still predominantly be on 4G connectivity tariffs as opposed to 5G (2.8 billion versus 4.4 billion), but there are a few other elements of this story worth bearing in mind.

Firstly, 5G-specific applications will consume more data than anything we have seen before. Dean Bubley of Disruptive Wireless pointed out that improved video codecs & better screens for new devices will automatically increase data consumption, in addition to the data-intensive applications which will be built for 5G. Bubley is actually surprised the 5G data consumption compared to 4G is not higher.

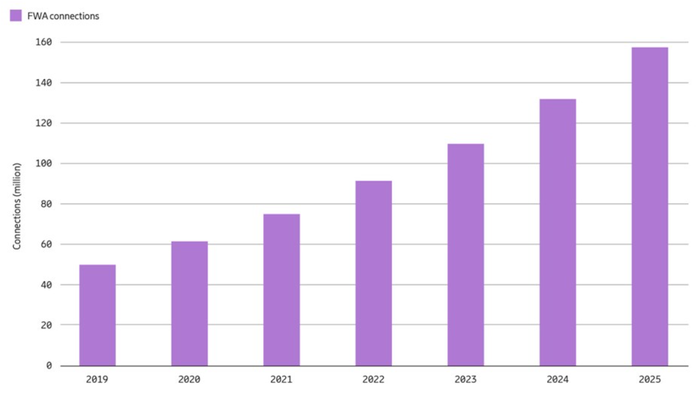

Another interesting element to consider for 5G data consumer is the adoption of fixed wireless access (FWA) services in the home broadband market.

Although the technology is not forecast to follow the same exponential trend, there is certainly a usecase for wireless home broadband solutions.

Many will tell you the FWA alternative does not have legs in terms of replacing fixed broadband connectivity, but that does not mean there is not a business case. Should Governments take a ‘outcome based’ approach to delivering the digital economy as opposed to the ‘technology based’ approach, FWA should certainly be considered in the mix, as long as the endgame is ubiquitous fibre networks.

It’s about managing this evolution in a financially sustainable manner. For the rural environments where ROI is more difficult to achieve, and perhaps the demand is not necessarily there for heavy-duty fibre infrastructure, FWA could act as a temporary measure to satisfy increased data appetites in the mid-term, but also providing necessarily flexibility for telecoms operators.

Should 5G catch on as a delivery technology for FWA, as it is forecast to by many, data consumption will increase rapidly. Data in the home is consumed in a much more aggressive fashion than via mobile networks, especially when you consider most mobile devices are handed over to a wifi router when the user enters the home.

These are two ideas which would suggest the forecasts of 5G versus 4G data could be conservative, certainly in more developed markets, but there are other complications to consider which gives credibility to the case that 4G should not be forgotten.

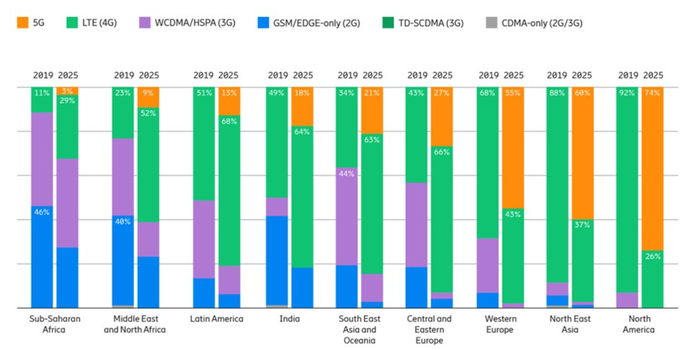

In markets such as the US, where Ericsson is forecasting 5G adoption of 74% in 2025, access to mid-band spectrum is key. One would hope the mid-band conundrum has been satisfied by this point, the FCC is spearheading several initiatives to fill the void, but it would surprise few if bureaucracy complicated matters and forced delays.

mmWave, which is being used in the US currently for 5G, has its limitations, most notably woeful coverage. The deployment of 5G networks is costly and time consuming, especially in a market as vast and geographically varied as the US. 4G coverage will be critical to fill in the 5G ‘not spots’ for years, if not decades, to come.

Dean Bubley of Disruptive Wireless also suggest indoor coverage could be an issue for 5G, forcing devices back onto 4G connectivity.

“For enterprises, most existing indoor wireless coverage systems are not suitable for 5G. Few building owners will pay for MNOs to upgrade the ‘signal-sources’ feeding the distributed antennas,” Bubley said.

“In any case, they can’t support 5G mmWave or in many cases even the 3.6 GHz band. Those frequencies won’t penetrate into many homes either. While some MNOs will use dynamic refarming of <1GHz spectrum for 4G and 5G to give outdoor-to-indoor coverage, for most users the indoor mobile experience will remain on 4G – or more likely WiFi – for many years.”

These are two notable elements for the case for 4G.

While there is certainly excitement regarding the deployment of 5G networks, it is always important to remember 4G connectivity needs attention as well.

The deployment of 4G networks is certainly not finished in some developed markets, let alone the developing markets. It can still serve a purpose and considering the delays in some 5G spectrum auctions around the world during this period of coronavirus disruption, its important role in society has been prolonged.

This is perhaps a timely reminder for those who need it; 4G is as important today as it was in yesteryear. 5G might attract the headlines as the ‘sexy’ connectivity sibling, but it is far from the only network worth considering.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)