Despite paying a heavy price for its involvement in the Chinese 5G market, Ericsson’s profitability is headed in the right direction, as is its share price.

July 17, 2020

Despite paying a heavy price for its involvement in the Chinese 5G market, Ericsson’s profitability is headed in the right direction, as is its share price.

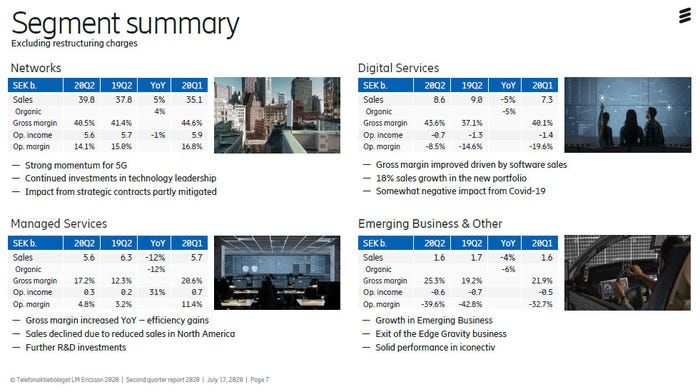

Sales were flat, year-on-year, but Ericsson managed to wring a percentage point of gross margin out of its stoical workforce, resulting in a 40% increase in net income. We had a chat with Fredrik Jejdling, the head of Ericsson’s networking division, and he put the increased profitability down to the dividends from its R&D spend, as well as just executing well on the fundamentals across the board.

SEK b. | Q2 | Q2 | YoY | Q1 | QoQ | Jan-Jun | Jan-Jun | YoY |

Net sales | 55.6 | 54.8 | 1% | 49.8 | 12% | 105.3 | 103.7 | 2% |

Sales growth adj. for comparable units and currency | – | – | 0% | – | – | – | – | -1% |

Gross margin | 37.6% | 36.6% | – | 39.8% | – | 38.6% | 37.5% | – |

Operating income | 3.9 | 3.7 | 3% | 4.3 | -11% | 8.2 | 8.6 | -6% |

Operating margin | 6.9% | 6.8% | – | 8.7% | – | 7.7% | 8.3% | – |

Net income | 2.6 | 1.8 | 40% | 2.3 | 13% | 4.9 | 4.3 | 14% |

EPS diluted, SEK | 0.74 | 0.51 | 45% | 0.65 | 14% | 1.39 | 1.21 | 15% |

Measures excl. restructuring charges and other items affecting comparability | ||||||||

Gross margin excluding restructuring charges | 38.2% | 36.7% | – | 40.4% | – | 39.3% | 37.5% | – |

Operating income excl. restr. charges & items affecting comparability in 2019[2] | 4.5 | 3.9 | 18% | 4.6 | -2% | 9.1 | 7.4 | 24% |

Operating margin excl. restr. charges & items affecting comparability in 2019[2] | 8.2% | 7.0% | – | 9.3% | – | 8.7% | 7.1% | – |

Free cash flow before M&A | 3.2 | 1.6 | 102% | 2.3 | 40% | 5.6 | 5.1 | 10% |

Net cash, end of period | 37.5 | 33.8 | 11% | 38.4 | -2% | 37.5 | 33.8 | 11% |

“The strengthened market position in Mainland China is strategically important as this market is expected to be a driver of critical future requirements and provide us with important scale,” said Börje Ekholm, CEO of Ericsson. “The Chinese 5G contracts are expected to be profitable over the life cycle, but had a negative contribution to gross margin in Q2.

“Investments in R&D have established us as a leader in 5G, with proven performance and cost of ownership benefits for our customers. We have continued to increase our market share in several markets by leveraging our competitive product portfolio. Profitability in earlier awarded strategic contracts has improved according to plan.

“As we prepare to exit the crisis caused by Covid-19, there is a need to restart economies and make strategic, forward looking investments which we suggest must include the future digital infrastructure. We see many regions around the world increasing investments in this space and as a European company we are concerned that Europe will fall behind.

“As critical national infrastructure, 5G will be a key determinant for long-term competitiveness of the general economy, and act as a stimulant to accelerate economic growth, attract future investments and speed up technology innovation. I believe Europe must prioritize actions to incentivize investments in the digital infrastructure, to include lowering the cost and speeding up the availability of spectrum.

Jejdling kept his cards close to his chest when we suggested Huawei being banned from the UK is beneficial for Ericsson, sticking to the party line that the end of the uncertainty is good for the industry as a whole. But the removal of a primary competitor is bound to be helpful and maybe that context played a part in Ericsson’s shares jumping 9% after its quarterly numbers were published.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)