América Móvil is not planning to build on its presence in the US mobile market, despite its Tracfone business having built up a sizeable customer base.

September 15, 2020

América Móvil is not planning to build on its presence in the US mobile market, despite its Tracfone business having built up a sizeable customer base.

Quite the opposite, in fact. The Mexican operator has inked a deal to sell its US MVNO to Verizon for US$6.9 billion in cash and stock. The deal, which requires regulatory approval, removes a fairly large player from the market and one that many believed had the potential to expand to become a credible competitor for the big three.

Admittedly, América Móvil itself never actually detailed ambitions to plough significant investment – and we would have been talking big sums – or effort into growing Tracfone to that extent. But with a customer base of 20.9 million as of the end of June (13 million of whom use Verizon’s network), Tracfone has some traction.

Further, with the stronger competition and tighter regulation it has faced in its home market over the past half decade, it seemed a logical move for the Mexican incumbent to look north of the border for growth. The Mexican government has worked hard to level the competitive playing field in the telecoms market, both in fixed and mobile, leaving América Móvil bearing the brunt of a range of asymmetric regulations. And the arrival of AT&T into Mexico in 2015 started to blur the borders between Mexico and the US, from a telecoms point of view, at least.

Almost exactly five years ago América Móvil followed in then market newcomer AT&T’s footsteps and launched a new mobile plan that effectively merged the US and Mexican markets, allowing its Mexican customers to call the US at local rates, and so forth. In its Q2 report from 2015, América Móvil shared its intention to “lead the integration of the Mexico and U.S.A. telecoms market,” a statement that referred to the new tariff plans launched by itself and its new rival, but naturally led to speculation that the telco could seek to build up its presence in the US as well.

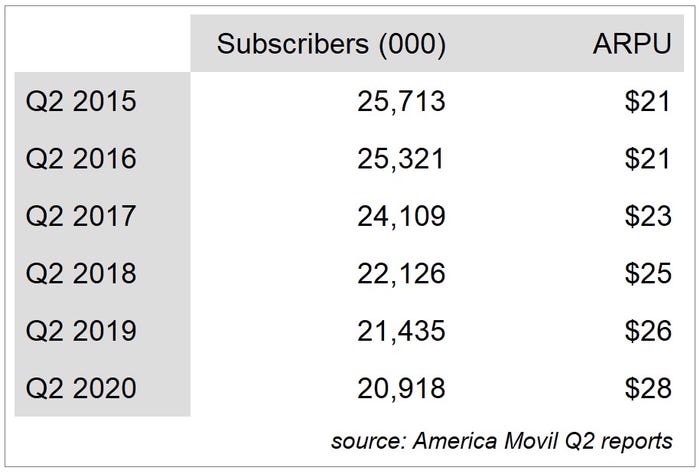

It did not. In fact, since that time Tracfone’s subscriber base has been in decline (see chart), dropping by close to 5 million connections over the same number of years. However, revenues and ARPU are on the up, making Tracfone look more like an established mobile operator than a low-cost option. It is a low-cost player though, which is part of the attraction for Verizon.

“Since its launch, Tracfone has developed strong consumer brands and has established itself as a clear leader in the value mobile segment. This transaction firmly establishes Verizon, through the Tracfone brands, as the provider of choice in the value segment, which complements our clear leadership in the premium segment,” noted Ronan Dunne, CEO of Verizon’s Consumer Group.

As Light Reading noted, the deal would make Verizon, the largest mobile operator by subscribers in the US, even larger, and would also make the market leader in prepaid, with one third of the market, according to New Street research. This could be a valuable tool for the telco as the prospect of recession looms. More from Light Reading on this story here.

Verizon said it expects to derive “significant benefits and network synergies” from the deal, which, incidentally, is made up of $3.125 billion in cash and $3.125 billion in Verizon common stock, plus an additional $650 million in cash payable based on certain performance measures. It is due to close next year, following receipt of the relevant regulatory approvals.

On completion of the deal, Verizon said it will make its 4G and 5G technologies available to Tracfone customers, further develop the MVNO’s distribution channels, and “expand Tracfone’s market opportunities.” Looks like Verizon is eyeing a turnaround of that shrinking Tracfone customer base.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)