As the EU faces fresh calls to investigate Google for abusing its market dominance, the internet giant flexes its muscles once more by starting to charge for Google Photos.

November 12, 2020

As the EU faces fresh calls to investigate Google for abusing its market dominance, the internet giant flexes its muscles once more by starting to charge for Google Photos.

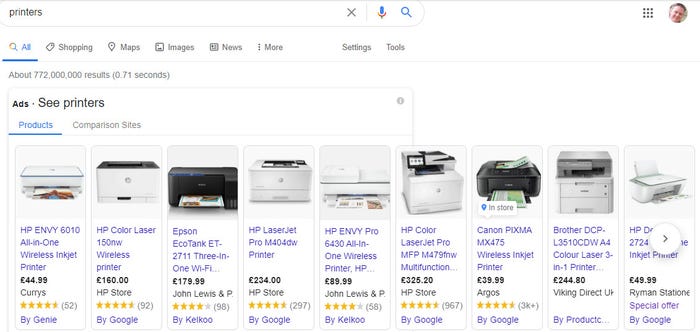

For some reason Reuters has the exclusive on a letter sent by 165 organisations – mostly European internet players – moaning about Google biasing its own services in search results. Specifically they identify a thing called the OneBox, through which Google can give certain search results extra prominence. They reckon Google biases its own stuff in those boxes and a quick Google search for printers yielded the results below.

As you can see, the majority of results are for Google rather than third party sellers and that proportion continued as we scrolled through them. This clearly gives Google’s ecommerce operations a massive advantage over all its competitors and, on the surface, appears to be a clear conflict of interest within Google.

The group may have timed its letter to come soon after the European Commission opened its investigation into Amazon for a very similar conflict of interest, as if to say ‘while you’re at it Margrethe, why not have another butcher’s at Google.’ There is, of course, plenty of precedent for the EC investigating Google’s anticompetitive behaviour, but if it’s still at it then that needs to be looked at.

If Europe does decide to act on this letter it will join the US department of Justice in investigating suspected anticompetitive practices regarding search and advertising. Partisan and transactional as it is (as indicated by California’s refusal to act against Google), there’s always a suspicion that moves like these are merely state shake-downs in the US, that will be settled out of court. The EC has a track record of (eventually) following through on this stuff, so Google should be concerned.

And it’s not helping itself by providing additional ammunition for these investigations. Google Photos was launched five years ago as free cloud storage for your photos, so long as you don’t mind them being compressed a bit. Now the company has announced that even the compressed photos will count against your 15 GB of cloud storage that Google gives you for free. You can increase that limit to 100 GB for £16 per year.

On the surface this is all fair enough – Google is certainly not obliged to keep offering stuff for free, you still have 15 GB and £16 per year isn’t that much money. But the very act of offering Google Photos for free in the first place cuts to the heart of the internet platform antitrust issue.

No specialist cloud photo storage services could afford to not charge for years in order to establish themselves, unless they too were underwritten by a mega-company, and ‘free’ us a very compelling differentiator. So Google is in a position where, if it wants to enter a market, it just needs to offer its service for free until all the competition is killed off, then start charging once it has established yet another monopoly.

This is why companies automatically come under antitrust scrutiny when they reach a certain size, because their activities necessarily alter the competitive dynamics of the market. Plenty of other commentators have made this observation, also noting that the only remaining competition in cases like this is often provided by other tech giants.

The US tech giant oligopoly is very real and the fact that they seldom sue each other would appear to support impressions of a rather too cosy relationship between them. The recent US general election put the social media oligopoly in the spotlight and left many people dissatisfied with the current arrangement. Whether the likely Biden administration will have the any appetite for taking on some of its biggest donors, however, remains to be seen.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)