AT&T has agreed to sell its Crunchyroll anime business to Sony for close to US$1.2 billion, and is reportedly in the latter stages of a sale process for DirecTV, which could be worth about $15 billion.

December 10, 2020

AT&T has agreed to sell its Crunchyroll anime business to Sony for close to US$1.2 billion, and is reportedly in the latter stages of a sale process for DirecTV, which could be worth about $15 billion.

Times change and telcos’ needs change, but nonetheless it would not be outlandish to suggest that AT&T had no great master-plan for many of the content assets it has ploughed billions of dollars into over the past half decade or so.

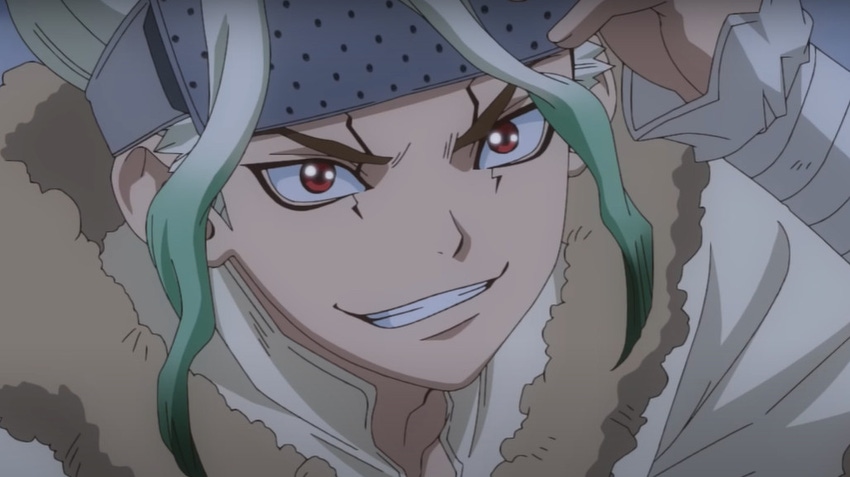

This is a particularly fair assumption when it comes to Crunchyroll, of which AT&T took sole control as recently as two years ago. The sale to Sony – or specifically, to Funimation, a joint venture between Sony Pictures Entertainment and Aniplex, a unit of Sony Music Entertainment (Japan) – makes a lot of sense for the purchaser, which is already an anime powerhouse. Crunchyroll brings 3 million SVOD subscribers and serves 90 million registered users around the world with advertising-based VOD, mobile games, manga, events merchandise and distribution.

“The combination of Crunchyroll and Funimation provides the opportunity to broaden distribution for their content partners and expand fan-centric offerings for consumers,” AT&T and Sony said, in a joint statement.

That’s a pretty clear rationale for a tie-up. The bigger question is what AT&T was doing with Crunchyroll in the first place, or rather what it planned to do.

It took full control of the company’s parent, Otter Media, in August 2018 when it bought out joint venture partner Chernin Group and wrapped the asset into WarnerMedia. AT&T and Chernin Group founded Otter Media in 2014 as a vehicle to, in its own words, “invest and develop platforms and properties that capitalized on the growth of direct-to-consumer subscription and advertising models, as well as the rise of new digital media brands.”

Is that statement not still a true reflection of AT&T’s content and media ambitions?

It seems likely that this is all about the money. The telco desperately needs to reduce debt, and is under pressure on that score from activist investor Elliott Management, which is pushing for a sale of media assets. AT&T’s long-term debt was $153 billion at the end of Q3, of which close to $6 billion is due to mature within a year.

Saying AT&T is making money from its content assets is misleading though; it’s purely a case of freeing up money.

We don’t exactly know what Crunchyroll has cost AT&T over the past couple of years. It did not disclose the price it paid to acquire the whole of Otter Media, although a New York Times report at the time said analysts had valued the deal at north of $1 billion. The paper also noted that Chernin Group had paid $75 million Crunchyroll, as a start-up. Presuming those figures are correct, selling for $1.175 billion to Sony is not about capitalising on a profit-taking opportunity.

We do know that AT&T paid significantly more for DirecTV than it is likely to recoup through a forthcoming sale that appears to be progressing by the day.

The latest sale reports came from the Wall Street Journal this week, whose sources claim that AT&T has received bids from a number of interested parties including Churchill Capital, TPG and Apollo Global Management. Once again, the figures being bandied about are around the $15 billion mark. According to the WSJ, Churchill and TPG have come out as the top bidders with offers north of that figure, while Apollo, once widely tipped as the most likely buyer, has submitted a lower offer.

AT&T paid $49 billion for DirecTV in 2015, or $67 billion including debt. No complex calculations needed to show that that is a lot more than $15 billion, presuming that figure is broadly accurate.

The Journal says the DirecTV auction is in a late stage and predicts AT&T could reach a deal with a buyer early next year.

We will also have to wait a little while for the closing of the Crunchyroll deal. It requires the usual closing conditions to be satisfied, including regulatory approvals.

Unfortunately, I’m not qualified to comment on whether regulators will be concerned about a concentration of power in the anime world…

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)