Finnish kit vendor Nokia reported flat sales in Q4 2020 and a decline for the full year, and its outlook indicates that trend is set to continue.

February 4, 2021

Finnish kit vendor Nokia reported flat sales in Q4 2020 and a decline for the full year, and its outlook indicates that trend is set to continue.

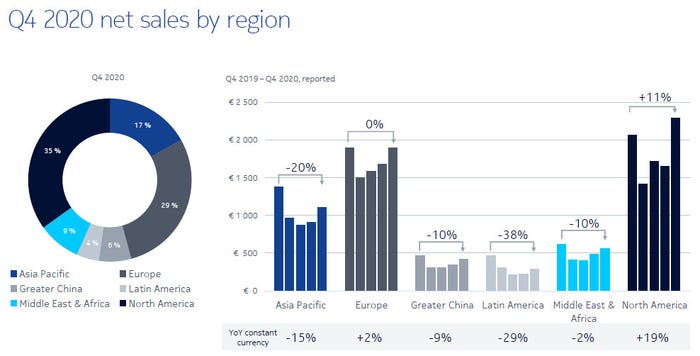

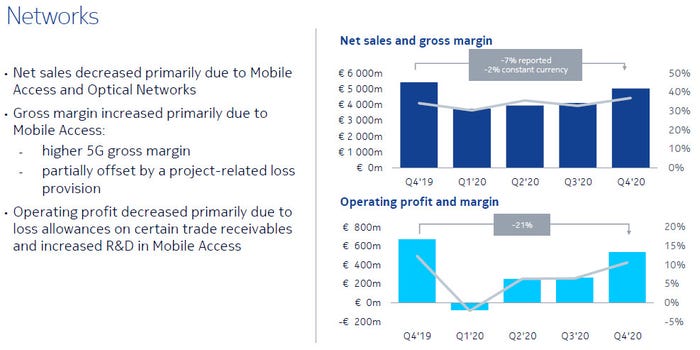

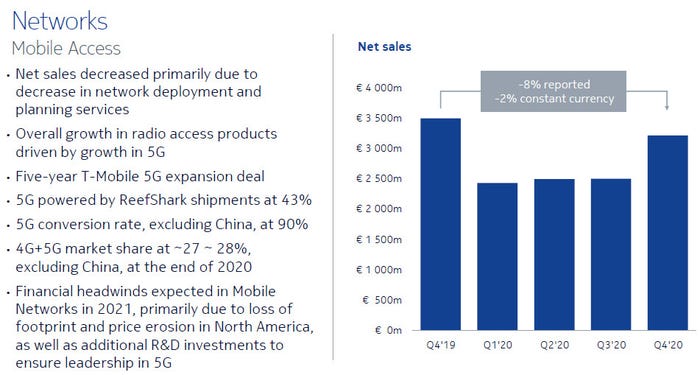

The numbers weren’t terrible but they weren’t great either. Considering the unique circumstances the world found itself in last year, a small drop in sales accompanied by increased profitability isn’t a bad effort. The problem is Nokia’s main rival, Ericsson, did significantly better than that. As you can see from the slides below, Nokia is still primarily a mobile networks company and it has been consistently losing ground to Ericsson in that market.

One of the main reasons for this was the strategic decision to go big on more expensive programmable chips in its kit, as opposed to cheaper fixed-function ones. Previous CEO Rajeev Suri paid the price for that and now it’s down to his successor, Pekka Lundmark, to steady the ship and chart a course for growth.

We took important steps in 2020 to accelerate roadmaps, improve execution and create a new way of working, which will enable Nokia to return to a sustainable long-term financial performance,” said Lundmark. “We know we have our work cut out for us in 2021, but the new Group Leadership Team has hit the ground running.”

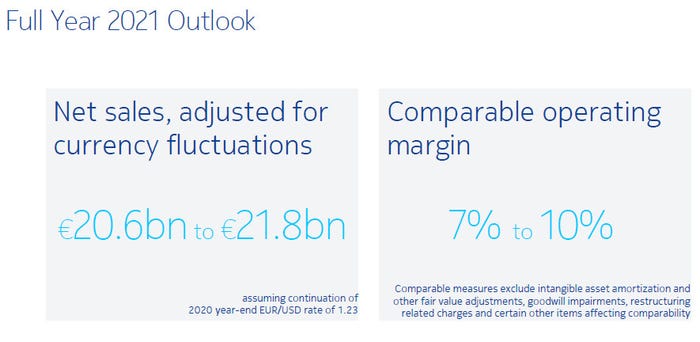

The ultimate indicator of how tough Nokia thinks this year will be is its outlook, which anticipates declining sales and margins unless things go surprisingly well. Light Reading spoke to Lundmark, who indicated that further cost savings will be the priority. That’s fair enough and mirrors Ericsson’s successful rebuilding strategy, but it can’t be done at the expense of R&D or Nokia risks falling even further behind in the 5G market.

For some reason Nokia was briefly the focus of all the investor mucking about last week, but these results and outlook are unlikely to please either short sellers or proper investors. If only because there are so few alternatives, Nokia should more or less maintain its share of the mobile kit market, but there’s little reason to anticipate much growth over the next 12 months.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)