The FCC has announced the winning bidders from the recent 3.7 GHz spectrum auction and Verizon is top of the list, accounting for more than half of the eye-watering spend.

February 25, 2021

The FCC has announced the winning bidders from the recent 3.7 GHz spectrum auction and Verizon is top of the list, accounting for more than half of the eye-watering spend.

The telco, which participated in the auction as Cellco Partnership, spent a staggering $45.5 billion on 3,511 spectrum licences across the US.

We knew Verizon was likely to emerge as one of the biggest spenders. It has rolled out a speedy 5G network, but needs mid-band spectrum to improve coverage. Furthermore, when T-Mobile US announced its intention to tap the bond market to fund spectrum acquisition shortly before the auction ended, financial analysts were able to deduce that its spend would likely be lower than previous estimates, leaving Verizon and AT&T to shoulder more of the financial burden.

But in excess of $45 billion? That’s a huge financial burden by anyone’s standards. If I were a Verizon customer I would be wondering how it might seek to recoup, or even just offset, that spend. Granted, there are getting on for 95 million of them, so the bill works out at under $500 each, but then add network spend on top…

Of course, it doesn’t quite work that way, but those numbers serve to illustrate the scale of the figures we are dealing with here.

There has been no formal comment from Verizon as yet. Presumably its PR people are busy crafting the equivalent of a “darling, I’m afraid I spent slightly more…” message.

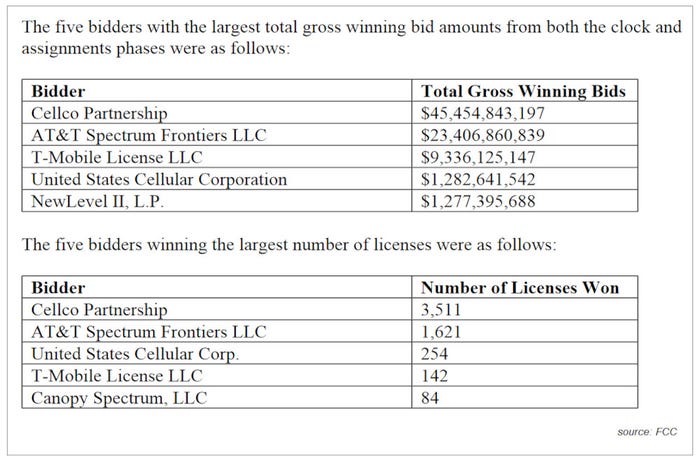

Verizon’s massive bill makes AT&T’s $23.4 billion spend look pretty reasonable. It won 1,621 licences. T-Mobile came in third in spending terms, committing $9.3 billion, but won fewer licences than US Cellular.

However, as BitPath COO Sasha Javid demonstrates in his analysis of the results, T-Mobile’s 142 licences cover a population of 207.7 million and nearly 68% of the contiguous US, while US Cellular’s population coverage is just 31 million. Verizon and AT&T both won licences in all 406 markets, with Verizon acquiring more spectrum in each.

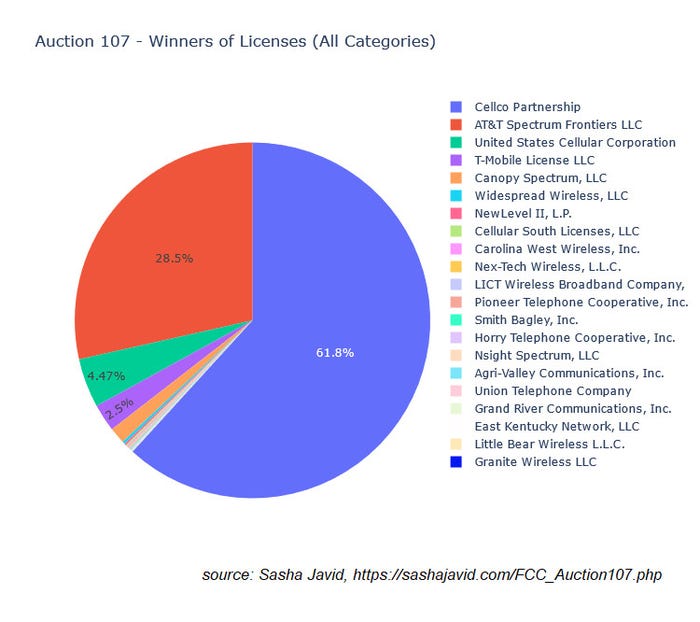

In total, there were 21 winning bidders, picking up all 5,684 of the available spectrum licences. The final auction spend came in at $81.17 billion following the completion of the assignment phase, although the net result is some $54 million lower, taking into account small business and rural service provider bidding credits. The winning bidders will also have to pay $13 billion in clearing costs to the satellite companies currently occupying the spectrum.

Verizon, AT&T and T-Mobile together accounted for $78.2 billion, or the vast majority of the total. As Javid’s chart neatly illustrates, Verizon was responsible for almost 62% of the overall spend. There is no doubt that Verizon needs the spectrum. But $45.5 billion is an enormous price to pay.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)