The UK Competition and Markets Authority has provisionally cleared the proposed merger of Virgin Media and O2 UK.

April 14, 2021

The UK Competition and Markets Authority has provisionally cleared the proposed merger of Virgin Media and O2 UK.

The main concern from a competition point of view was that, having merged with an MVNO (Virgin Mobile) O2 might increase prices to other MVNOs using its network, such as Giffgaff. In approving the merger, the CMA decided it wasn’t worried about competition in the wholesale market for the following reasons:

Backhaul costs are only a relatively small element of rival mobile companies’ overall costs, so it is unlikely that Virgin would be able to raise backhaul costs in a way that would lead to higher charges for consumers.

There are other players in the market offering the same leased-line services, including BT Openreach – which has a much greater geographical reach than Virgin – and other smaller providers. This means the merged company will still need to maintain the competitiveness of its service or risk losing wholesale custom.

As with leased-line services, there are a number of other companies that provide mobile networks for telecoms firms to use, meaning O2 will need to keep its service competitive with its wholesale rivals in order to maintain this business.

“Given the impact this deal could have in the UK, we needed to scrutinise this merger closely,” said Martin Coleman, CMA Panel Inquiry Chair. “A thorough analysis of the evidence gathered during our phase 2 investigation has shown that the deal is unlikely to lead to higher prices or a reduced quality of mobile services – meaning customers should continue to benefit from strong competition.”

Why it took five months of supposedly fast-tracked investigation to come to those fairly obvious conclusions is a mystery, but the CMA was still far quicker than the EU would have been if the matter hadn’t been pried from its clammy grip. The process still isn’t over, however, as VM and O2’s competitors still have a month to whinge at the CMA before it publishes its final decision. Hopefully, after all this time, that’s just a formality and we can finally get on with this.

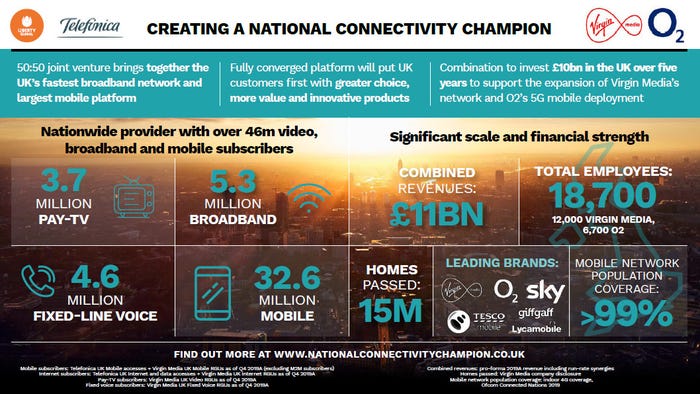

“Liberty Global and Telefónica note the CMA’s publication of its provisional findings as part of its review into the proposed merger of their UK businesses,” said the Liberty Global/ Telefónica hive mind. “We continue to work constructively with the CMA to achieve a positive outcome and continue to expect closing around the middle of this year.”

“The CMA’s provisional approval comes as no surprise given that the deal does not create a significantly stronger player in either the fixed-line or mobile markets,” said Kester Mann of CCS Insight. “The blockbuster merger will transform the UK telecoms landscape and create a powerful new converged provider to rival BT.

“For customers, the move marks the next step on the UK’s journey toward bundled telecom services. The new company will seek to sell fixed-line and mobile services across both the Virgin and O2 brands, hoping to lock-in customers and drive higher spend. The joint venture will need to dig deep to fund the costly expansion of cable and 5G services throughout the UK and make tough decisions over its future brand direction.”

At this stage the combined company feels a bit like a poor man’s BT, but it doesn’t have to stay that way. A lot will depend on how much more the parent companies are prepared to invest in it, but neither of them seem to be rolling in cash. The immediate strategy will presumably be to attack BT bundles on price, which can only benefit the UK consumer, so the CMA was right to clear this merger.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)