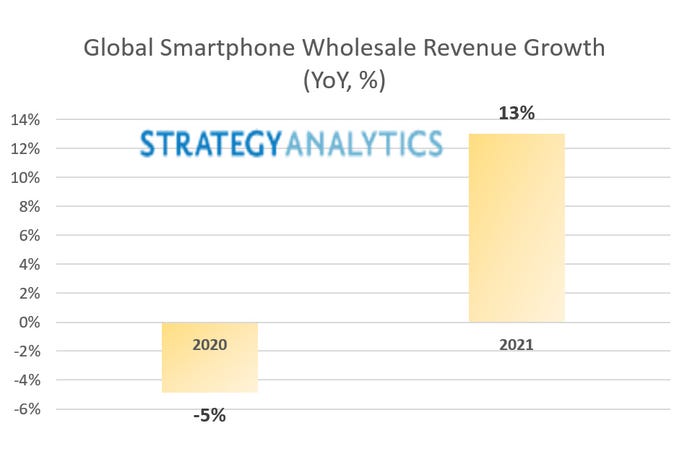

Strategy Analytics forecasts that the global smartphone wholesale revenues will increase by 13% in 2021, driven primarily by pent-up demand during the pandemic and increased device price.

April 16, 2021

Strategy Analytics forecasts that the global smartphone wholesale revenues will increase by 13% in 2021, driven primarily by pent-up demand during the pandemic and increased device price.

The research firm published a snapshot of its forecast of the global smartphone market for 2021. While the wholesale market value of smartphones went down by 5% globally last year, mainly due to the economic impact of COVID-19 and the closing down of retail outlets in many countries, analysts at the firm believed delayed replacement cycle, increased component prices, as well as migration to 5G devices should help the market bounce back this year. A projected 13% growth in wholesale value would represent the biggest increase in six years.

Source: Strategy Analytics, 15 April 2021

The increased price of components, presumably microchips in particular, will drive up average selling price across the board. Meanwhile, leading products like the iPhone 12 series will also support the projection that the market value will grow faster than the total volumes shipped.

“We expect global smartphone sales volume will grow + 7% YoY at 1.4 billion units, and global smartphone wholesale average selling price (ASP) will grow +6% to US$294 in 2021, resulting in smartphone wholesale revenue exceeding US$400 billion,” said Linda Sui, Senior Director at Strategy Analytics. “We expect the ultra-premium segment (US$600 wholesale and above) to perform particularly well due to iPhone 12’s super cycle, and to contribute to almost half of the overall wholesale revenues this year,” Sui added.

Similar to the distribution of values across price segments, geographical concentration is also prominent. Over half of the global smartphone wholesale value will be accounted for in the four largest markets: China, the US, India, and Japan, according to David Kerr, Senior VP at Strategy Analytics. Such high level of concentration also carries risks. “A downside risk remains in terms of volumes and value in India and Brazil which are suffering through significant surges in COVID-19 currently. However, in general we remain modestly optimistic about both replacement sales and new customers,” said Kerr.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)