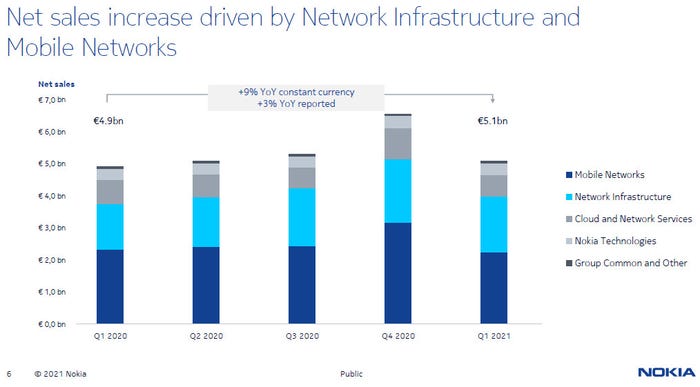

Finnish kit vendor Nokia started 2021 with a bang, driven by a 28% increase in revenues from its network infrastructure business.

April 29, 2021

Finnish kit vendor Nokia started 2021 with a bang, driven by a 28% increase in revenues from its network infrastructure business.

Mobile networks did alright, which is something considering how well Ericsson is performing in that area. Cloud and network services remains a work in progress, as the equivalent group is for Ericsson, and the intellectual property operation experienced stead growth. But the real story was the fixed line bit, which was what the Alcatel Lucent acquisition was all about, but which has only just started providing a strong contribution. Nokia’s shares were up 15% at time of writing.

“We have delivered a robust start to the year with strong net sales, operating margin and cash flow,” said Nokia CEO Pekka Lundmark. “Today’s results demonstrate that we are on track to deliver on our three-phased plan to achieve sustainable, profitable growth and technology leadership as announced at our recent Capital Markets Day.

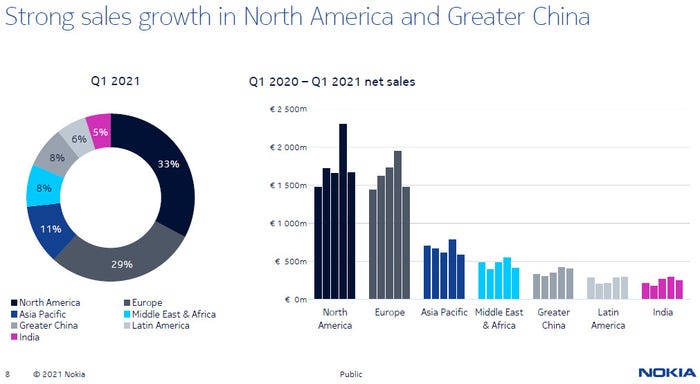

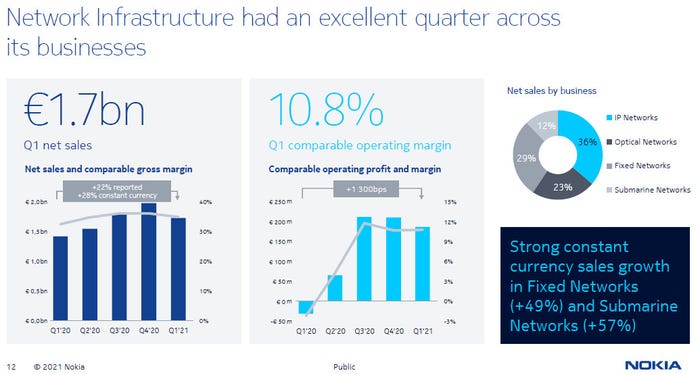

“I was particularly pleased by strong sales growth across our Network Infrastructure business group driven by increasing demand for next generation connectivity; good progress in Mobile Networks in securing full portfolio competitiveness; continued double-digit sales growth with our Enterprise customers; double-digit sales growth in North America; and good net sales development for Nokia Technologies.

“At this point we are maintaining our Outlook for the full year, as we want to see how 2021 continues to develop. The solid first quarter provides a good foundation for achieving the higher end of the 7 to 10% comparable operating margin range. We expect our typical quarterly earnings seasonality to be less pronounced in 2021, and we continue to monitor overall market developments including visibility for semiconductor availability. I am proud of how we have continued to successfully deliver to our customers during the global semiconductor shortage.”

As you can see below, Network Infrastructure also delivers healthy margins (fixed refers to access networks, while optical is transport and IP is routers, switches, etc), while Technologies tends to serve up 80% margin. If Nokia can keep this kind of performance, it can use the extra cash to start raising its R&D game and experience the kind of virtuous cycle Ericsson has shown. No pressure, then.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)