A common theme in analyst calls this earnings season has been cautious pessimism about the knock-on effects of the global chip shortage.

May 6, 2021

A common theme in analyst calls this earnings season has been cautious pessimism about the knock-on effects of the global chip shortage.

Most recently Nintendo followed its fellow games console maker Sony in warning it would flog fewer units because of reduced supply, rather than demand. Car companies have been ringing alarm bells since the start of the year and none of the sudden political attention on the matter seems to have done any good so far.

Light Reading took a look at some of the stuff tech companies are coming out with and, while there are no signs of panic among the big operators, the chip shortage seems to have been the elephant in the room during many of their recent calls. The more directly reliant on the semiconductor industry a company is, the more severely it seems to be affected, with Apple and Qualcomm recently forecasting fairly substantial hits to their numbers.

While the crisis seemed to be catalysed by the US government unilaterally cutting companies like Huawei out of the chip ecosystem, forcing them to stockpile while they had the chance, its enduring severity is probably more down to the pandemic. A once in a generation global crisis such as this throws supply chains, demand patterns and general planning out of the window, so it’s hardly surprising to see things like this.

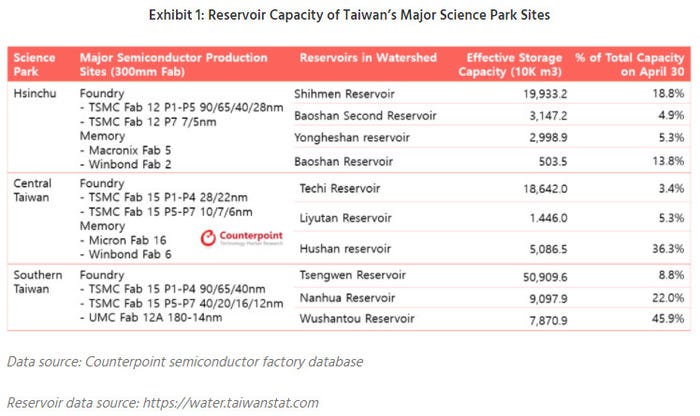

Much of the world’s semiconductor supply relies on the small island of Taiwan, which is enduring its worst drought for 56 years. Counterpoint has had a look at what this might mean for chip production, for which water is a necessary resource. The report includes this handy table, summarising the dire water situation as it concerns the major chip fabs.

“The water level in the northern reservoirs has reached a multi-year low, though still sufficient for the continued use by Hsinchu Science Park (HSP),” wrote Counterpoint’s Brady Wang. “However, the average effective water storage of the reservoirs supplying the Central Taiwan Science Park (CTSP) and Southern Taiwan Science Park (STSP) on April 30 was only 8.9% and 14.3% respectively.

“According to Counterpoint estimates, if there is no heavy rainfall or the rainfall does not fall in the catchment area, CTSP will face a water outage in July and STSP around August. Given that the current capacity utilization rate of most semiconductor fabs is close to 100%, this is bound to worsen the ongoing semiconductor shortage.”

The chip crisis illustrates the nature of the global economy well. No rain in Taiwan equals no iPhones in your local phone shop. Given how totally interconnected everything is, and how India shows there’s still plenty to come from this blight, there will presumably be many more such supply issues before we’re done with shutting things down.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)