Operating loss incurred at Japan’s challenger operator increased by 85% in Q2 to reach $900 million, which the company attributed to aggressive investment in network rollout and rising roaming cost.

August 11, 2021

Operating loss incurred at Japan’s challenger operator increased by 85% in Q2 to reach $900 million, which the company attributed to aggressive investment in network rollout and rising roaming cost.

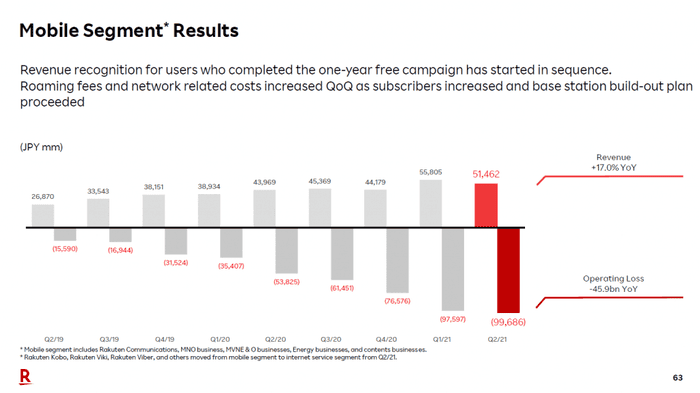

Rakuten announced its Q2 financial results today, which saw the whole group having generated the “highest revenue in the second quarter of a fiscal year”. Meanwhile, Rakuten Mobile, Japan’s newest and greenfield mobile operator, reported an 85% expansion over the JPY 53,825 million ($485.9 million) operating loss reported in the same quarter last year, despite growing revenue by 17%. The total operating loss reached JPY 99,686 million ($899.8 million). Once again, the loss from Rakuten Mobile more than wiped out the operating profit generated by other business units and took the whole group to an operating loss of JPY59,539 million ($537.4 million).

Source: Rakuten Group Inc.

The company attributed the enlarged loss to continued aggressive investment in network rollout and increased roaming cost, thanks to the growing subscriber base. On the other hand, due to the global semiconductor shortage, its target to cover 96% of the population by summer is extended to the end of the year. In financial terms this means Rakuten Mobile would need to extend the roaming payment (to KDDI) for its customers in areas its own network does not yet serve. Rakuten foresaw come October and March next year as the main milestones to reduce roaming fees in big measures.

Total number of subscribers reached 4.42 million by the end of the reporting period, but the net adds were only 6,400 between May and the end of June. A major reason is the “first year free” campaign started in 2020 came to an end. Yoshihisa Yamada, Rakuten Mobile’s President, believed subscriber growth will rebound from September, without elaborating the reason. On the other hand, Rakuten believed it is a net beneficiary from churns from competitors, and there are more MNP (mobile number portability) churns than new number creations. The former group typically generate higher ARPU.

Rakuten Mobile is implementing a three-prone, or “triangle” strategy as the company calls it. It should first be able to stand alone as a business. The company reiterated its target to turn profitable by 2023, relying on fast subscriber acquisition, aggressive tariff, and operating efficiency. Rakuten Mobile claimed its engineer to customer ratio stands at 1:20,000, which is 20 times superior than its competitors, indicating that there are about 200 engineers working in the operator. Its second prone is to be a gateway and a ramp for the overall Rakuten ecosystem, and the final angle is global expansion.

Understandably plenty of hope has been banked on global expansion, carried by the newly created Rakuten Symphony which includes RCP. Hiroshi Mikitani, Rakuten Group CEO, said that the company believed there is a JPY15 trillion ($135 billion) business opportunity in the telco solution market over the next five years, and Rakuten is well positioned to assume a leading position in that market.

The company also believed it should be a profitable business for the role it aims to play. Tareq Amin, Rakuten Symphony’s CEO and the Group CTO (promoted and role expanded from his position as Rakuten Mobile CTO), said Rakuten will only be dealing with software and platform business, for example network virtualisation on RCP, in its newly signed 10-year partnership with 1&1, while leaving hardware integration to its partners (including Tech Mahindra and Accenture, among others). It will aim to adopt the same business model in future cases. Rakuten said it is in discussion with potential telco customers in North America, Europe, and the Middle East. Mikitani foresaw RCP and Symphony outpacing business from other sectors in five to ten years’ time.

But before the potential can translate financial upside, Rakuten needs to manage the capital market expectations. At the end of July Rakuten’s credit rating was downgraded by S&P to BB+, on its “souring finances and negative outlook”.

Another interesting piece of information came out of a recorded interview on the CEO by Citi Group, when it was disclosed that Rakuten has spent in total more than JPY40 billion ($360 million) to acquire Altiostar. The recent acquisition announcement valued Altiostar at over $1 billion, which would represent an impressive gain in value on Rakuten��’s investment.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)