The lion's share of new 5G spectrum in Brazil has gone to the big three, as expected, but half a dozen small players also won frequencies, with one picking up a national licence.

November 8, 2021

The lion’s share of new 5G spectrum in Brazil has gone to the big three, as expected, but half a dozen small players also won frequencies, with one picking up a national licence.

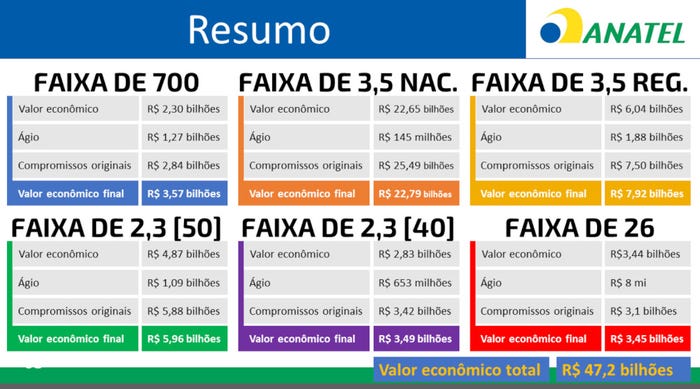

The country launched the sale process late last week, almost two years later than it originally intended. Despite the delays, the auction was done and dusted in a couple of days, enabling regulator Anatel to announce that it had raised 47.2 billion reais (US$8.5 billion), which is roughly what industry watchers expected.

Most of the operator spend – which comprises bids for the licences as well as projected capital investment for 5G rollout – came on day one, with the 3.5 GHz band attracting by far the most interest (see chart). The big three – America Movil’s Claro, TIM and Telefonica – picked up national licences.

In all, the regulator had frequencies in the 700 MHz, 2.3 GHz, 3.5 GHz and 26 GHz bands up for sale. Much of the available spectrum sold, but Reuters reported that the government is considering a follow-up auction to offload some unsold airwaves, particularly in the 26 GHz band.

The newswire also quoted Communications Minister Fabio Faria as saying that, as a result of the sale, Brazil now has six new telecom operators to compete with the bigger players. But that is perhaps something of a stretch.

A presentation shared by the regulator shows that five companies – Sercomtel, Brisanet, Consórcio 5G Sul, Cloud2u, and Algar Telecom – acquired regional frequencies at 3.5 GHz. Some of those names will be well-known to those familiar with the Brazilian fixed and mobile markets. Algar Telecom, for example, is set to become Brazil’s fourth-largest mobile provider following the break-up of Oi. However, at present its influence is limited, its market share coming in at just 1.2% as of July, according to Anatel’s figures.

Brisanet and Algar Telecom were among the winners in the 2.3 GHz band, but in the 26 GHz segment only the big three won spectrum.

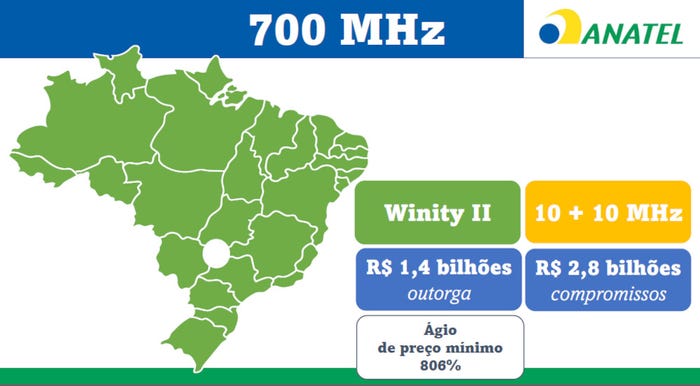

The 700 MHz frequencies went to a sixth small player – Winity II.

Much of the interest in this auction is focused on Winity II, which is the only company outside of the big three to have acquired a nationwide licence. There have already been a number of headlines around the arrival of a new fourth national mobile operator in Brazil next year, with media outlets bigging up Winity II as a replacement for Oi, whose assets are currently being split between the other three.

But there’s a bit of creative licence going on here. While Winity II does indeed have a nationwide licence, complete with various coverage obligations, there is no indication that it will operate as a retail mobile provider. The firm, backed by Latin American investment manager Patria Investimentos, currently pitches itself as a wireless infrastructure platform geared towards helping businesses solve connectivity bottlenecks. As Brazilian media outlet Globo points out, all spectrum lots included in the auction allow the winners to operate as a neutral network – a wholesaler, essentially – and the 700 MHz block is no exception.

The smart money is on Winity II launching an open access network, rather than setting itself up as a competitor to one of the big guns at a retail level. The smallest of the big three, TIM, has north of 50 million mobile customers, and that’s without factoring in the connections it will pick up from the Oi break-up. That would be heck of a lot of ground for a new player to make up in a business in which scale still matters.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)