Five of Europe’s biggest operators sent out a rallying cry for the continent to win leadership in Open RAN, with plenty of hyperbole and some fundamental flaws.

November 18, 2021

Five of Europe’s biggest operators sent out a rallying cry for the continent to win leadership in Open RAN, with plenty of hyperbole and some fundamental flaws.

A report titled “Building an Open RAN ecosystem for Europe” has been jointly released and published simultaneously by Deutsche Telekom, Orange, TIM, Telefónica, and Vodafone. As the title suggests, the paper aims to drive the telecoms community in Europe, from regulators and governments to businesses and research labs, to embark on a full-on campaign to win the leadership in Open RAN.

Despite not opening with a more memorable line, like “A spectre is haunting Europe — the spectre of Open RAN”, the report does provide many quotable sentences. “Open RAN is coming regardless of what Europe decides; it is a matter of when, not if”, “Europe needs to make Open RAN a strategic priority”, and “There is still time for Europe to ensure its current global leadership position in the RAN value chain is translated into a future global leadership in Open RAN, but this will only happen if the EU acts now” are but a few examples that serve the purpose to shake Europe into action.

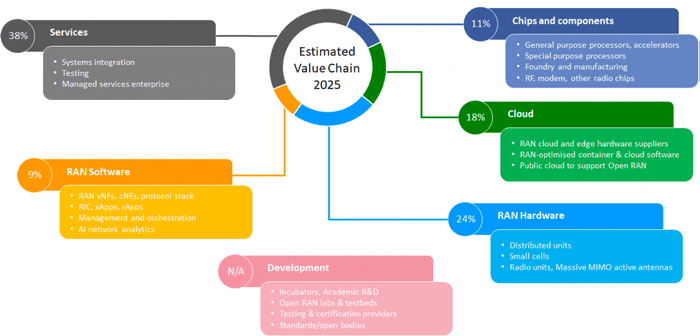

The report, which relies heavily on research done by Analysys Mason, a consulting firm, which forecast in April that the total global Open RAN supplier revenues could reach EUR36.1 billion by 2026 (p.10). It breaks down the Open RAN ecosystem into six major categories: semiconductors (including chips and related components), RAN software, RAN hardware, cloud, service, and development. It then measures the competitiveness Europe’s major companies, small- and medium-sized enterprises (SMEs), and potential players up against the major non-European players.

The result is mixed. Europe is strong in certain domains, like RAN hardware, moderate in some, like RAN software, and weak in others, like cloud and semiconductors including foundry.

If the weaknesses are not properly addressed and overcome they could lead to Europe looking elsewhere for Open RAN solutions in the coming years. Such a scenario “could put EUR 15.6bn of industry revenues, and (Europe’s) global influence, at risk,” the operators claim, citing Analysys Mason forecast done in June this year. (p.20)

For Europe to overhaul its weak Open RAN ecosystem and to assume global leadership, the operators put forward five policy recommendation:

Ensure high-level political support for Open RAN, including designating “the development of Open RAN as a strategic priority for the EU’s Digital Decade”, as well as recommending a joint declaration by the EU Commission, EU member states, and industry stakeholders in support of Open RAN. “Europe needs to talk with “a common voice” related to Open RAN”, the paper says.

Create a European roadmap for network innovation, including encouraging the European Commission “to create a European Alliance on Next Generation Communication Infrastructures”, in similar shape as earlier alliances the Commission has created for Cloud and Semiconductors sectors. The Alliance should develop a network technology roadmap for Europe, starting with embracing Open RAN.

Incentivise and support EU Open RAN development, including setting out specific priority domains for investment, public funding, tax incentive, as well as policy support. It also highlights the importance of closer scrutiny by the European Commission over any “strategic take-overs of European companies, including start-ups, by large non-European companies”.

Promote European leadership in O-RAN standardisation, including establishing “pan-European certification for Open RAN interoperability and quality to build deployer and ecosystem confidence” and adopting “O-RAN specifications as voluntary standards by ETSI, in complement to existing 3GPP specifications.”

Engage in international partnerships, including setting up a multilateral fund with allies and partners, in particular the US and Japan, “for the adoption of secure, open and interoperable network equipment in third countries”.

There are multiple flaws in both the report’s analysis and its policy recommendations.

To start with, the arguments of the report are built on the premise that “Open RAN will become the technology of choice in the deployment and modernisation of networks” without explaining why. It is almost as if the industry’s crave for Open RAN is both universal and assumed a priori. The leading concerns for Open RAN are either downplayed (interoperability challenges, system integration complexity) or ignored (security, specs lagging 3GPP releases, missing support for 2G by most Open RAN vendors).

The claim of Open RAN’s capability to reduce operator TCO has long been called into question. Although in theory a modular architecture with standardised components can lower CAPEX, the cost of increased system integration and interoperability testing will drive OPEX up. If anything, the findings in this report confirm instead of dispelling the doubt.

The category that will receive the biggest operator spending on Open RAN will be “Services” among Analysys Mason’s forecast, accounting for 38% of the total revenues on the value chain. This category includes system integration, testing, and managed services for enterprises. Though the report does not break the category further down to how much each of the three segments would take up, it is may be safe to assume that managed services for enterprises, which care first and foremost for security and minimising network failure, may not be the largest market segment for Open RAN.

Another datapoint shared by the report probably illustrates the issue even better. Analysys Mason forecasts that “by 2026, it is expected that Open RAN will account for a substantial portion of the total 5G SI market globally – EUR 13.3 billion in a total segment worth EUR 27.7 billion.” That is 48% of the total 5G SI revenues. This is against the background that there is almost a consensus among both industry practitioners (for example GlobalFoundries) and industry observers (for example Omdia) that Open RAN will have about 10% of RAN market by 2025. This means spending on integrating Open RAN will be substantially higher in proportion to its RAN footprint.

Source: “Building an Open RAN ecosystem for Europe”, p.10

Some of the report’s claims defy economics logic and look to be made by sheer willpower. It argues that the current network supply chain in Europe isn’t resilient enough, despite playing host to two of the world’s three biggest network equipment vendors. Meanwhile, it argues “Open RAN can play a key part by increasing the number of potential suppliers, reducing dependencies and stabilising supply chains.” (p.7) The current global supply chain constraint comes down to semiconductor shortage. The report seems to believe that when weighing demand from Nokia and Ericsson against demand from SMEs engaged in Open RAN, the TSMCs and Samsungs of the world would prioritise the second group.

The report claims that Europe is lagging North America and Japan in rolling out 5G networks, while highlighting those two countries are more committed to Open RAN (not the least by putting public funding in it). On top of the jump in logic to conclude the two things have a causal relationship, the report chooses not to compare with China, by far the world’s largest 5G market where Open RAN play no role.

One of the most puzzling recommendations the report puts forward is suggesting ETSI, one of 3GPP’s Organization Partners, should endorse O-RAN specifications as “voluntary standards”. O-RAN Alliance does not set standards. Instead, it develops Open RAN specifications on top of standards published by standardisation bodies like the 3GPP, which makes the request for “reverse standardisation” look bizarre, not to mention the opacity of O-RAN Alliance’s operation.

And there is the minor issue of what “Europe” means. It seems the report often treats Europe and the European Union as interchangeable. For example, it lists the UK’s £30 million Future RAN Competition as an example of competition pressure on Europe to act likewise. The UK is also said in the same breath as the US, Japan, and India as countries “supporting their industries in building new ecosystems ready to compete in future network technology”, while the report repeatedly calls on “member states” to up their efforts. This could puzzle some readers, including those of this publication. (It is surprising not to see Norway or Switzerland being listed as examples one way or another.) It’s made all the more interesting by the fact that Vodafone is one of the signatories.

There are gems in the report’s conclusions and recommendations, in particular the recommendation to establish a certification system for Open RAN interoperability and quality, and to examine more closely acquisition of European companies. In general, however, what the report proposes is largely self-serving, probably none more obvious than its suggestion to accept O-RAN specs as voluntary standards. All five operators are O-RAN Alliance members, including two founding members (Deutsche Telekom and Orange).

A cynical reading of it could see the operators aiming to commoditise RAN products through Open RAN to drive down CAPEX while demanding subsidies and funding for system integration and testing to compensate OPEX.

A more charitable reading could have us believe the operators are “taking back control” from the leading vendors, as they believe “more cost-effective RANs, built on the basis of operators’ requirements rather than vendors’ roadmaps, could lead to over USD285 billion in additional GDP globally over the next ten years, and over USD90 billion annually from 2030” (p.8, footnote), numbers cited from Telecom Infra Project (TIP), which is now in partnership with O-RAN Alliance.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)