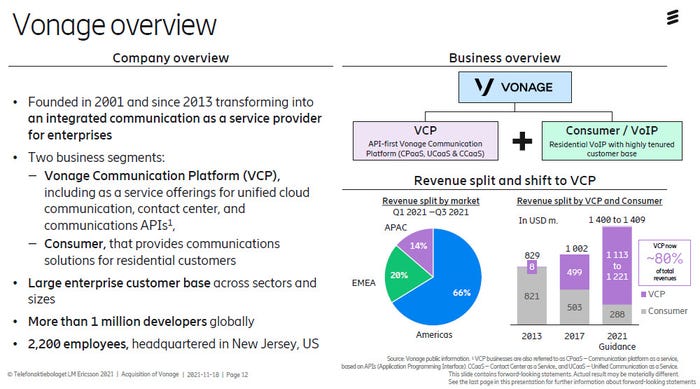

Swedish kit vendor Ericsson has made its biggest ever acquisition in the form of cloud unified communications provider Vonage.

November 22, 2021

Swedish kit vendor Ericsson has made its biggest ever acquisition in the form of cloud unified communications provider Vonage.

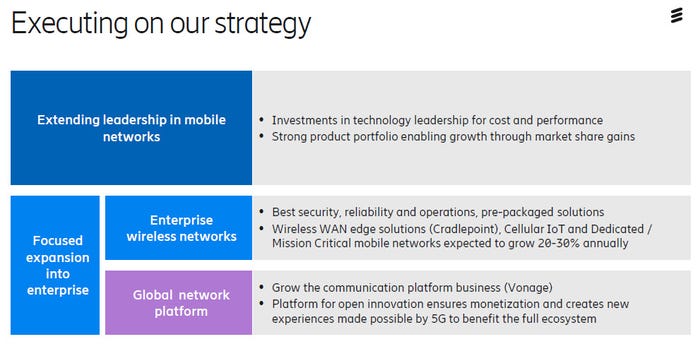

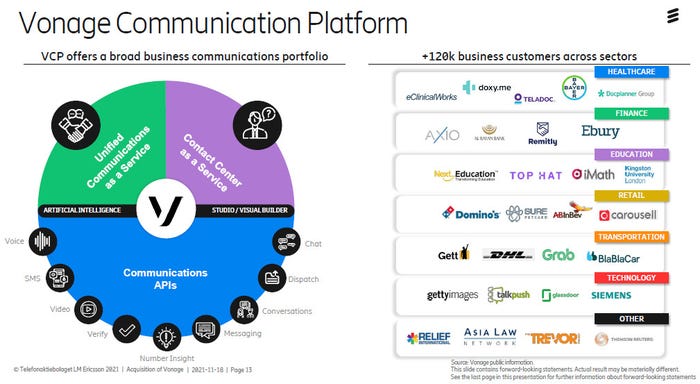

This one is a bit of a head-scratcher since its not obvious why unified communications as a service (UCaaS) should be a matter of such strategic importance to a company that sells radios to mobile operators. Having said that, Ericsson reckons 5G is all about offering novel services to all kinds of different industries, so this move does at least complement last year’s acquisition of Cradlepoint in pursuit of that strategy.

“The core of our strategy is to build leading mobile networks through technology leadership,” said Ericsson CEO Börje Ekholm. “This provides the foundation to build an enterprise business. The acquisition of Vonage is the next step in delivering on that strategic priority.

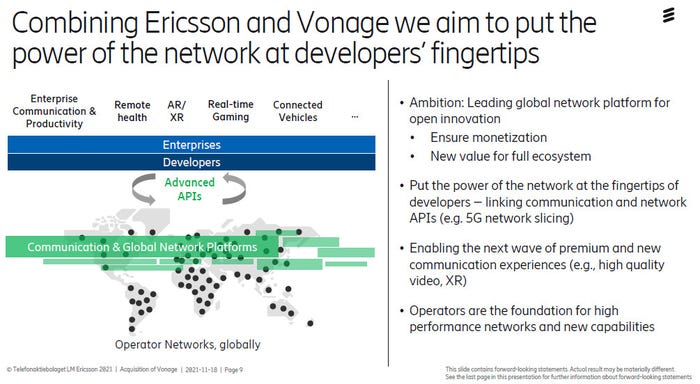

“Vonage gives us a platform to help our customers monetize the investments in the network, benefitting developers and businesses. Imagine putting the power and capabilities of 5G, the biggest global innovation platform, at the fingertips of developers. Then back it with Vonage’s advanced capabilities, in a world of 8 billion connected devices. Today we are making that possible.”

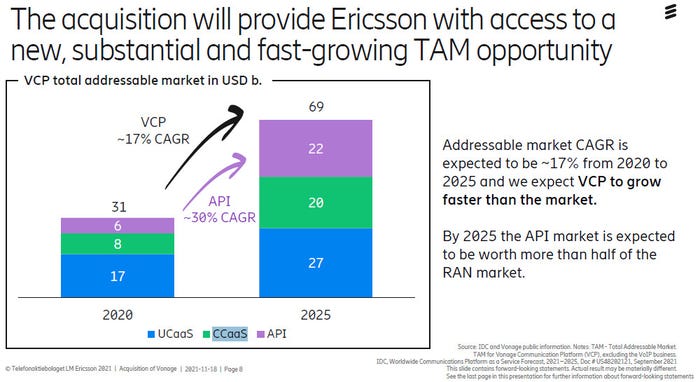

“Today Network APIs are an established market for messaging, voice and video, but with a significant potential to capitalise on new 4G and 5G capabilities. Vonage’s strong developer ecosystem will get access to 4G and 5G network APIs, exposed in a simple and globally unified way. This will allow them to develop new innovative global offerings.

“Communication Service Providers will be able to better monetize their investments in network infrastructure by creating new API driven revenues. Finally, businesses will benefit from the 5G performance, impacting operational performance, and share in new value coming from applications on top of the network.”

There’s a fair bit to unpack in Ekholm’s statement, the length of which appears to acknowledge this move requires some explaining. The core message seems to be that monetising 5G will be a lot more complicated than with previous generations. Whether it’s going direct to enterprise or giving its operator customers more B2B tools, Ekholm seems to think one of the keys to Ericsson’s 5G success will be helping the business world do more clever things with communications technology.

The acquisition of network APIs and a big developer community seems to be at least as important as the core Vonage tech in Ericsson’s M&A calculations. The idea seems to be to help companies tap into the 5G network and thus find some of those clever things for themselves. That all makes sense, to an extent, but this still feels like an incongruously speculative way for the previously restrained Ekholm to splash such a lot of cash. The analyst reaction we’ve seen so far indicates we’re not the only people who still need convincing.

But, of course, you should make your own mind up. We’ve selected some key slides from the analyst presentation below to help you. The $6.2 billion represents a 28% premium on the previous price and will be paid with cash Ericsson already has in the bank. Ericsson’s shares were down 3% on the news, implying investors are no more convinced about the wisdom of this move than the rest of us.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)