UK operator group Vodafone indicated it was pleased with how things are going in its latest trading update and might even be tempted to splash the cash before long.

February 2, 2022

UK operator group Vodafone indicated it was pleased with how things are going in its latest trading update and might even be tempted to splash the cash before long.

Operator quarterlies tend to be somewhat dull affairs as the prospects of wild swings in any direction are remote. On the surface Vodafone’s latest numbers are no exception, with organic revenue growth of 3.7%. However, investors are clearly more excited than we are, with Vodafone’s shares up 14% this year. Sometimes slow and steady progress is all people are looking for.

“Our team has delivered another solid quarter, demonstrating the sustainability of our growth strategy and medium-term ambition,” said Vodafone CEO Nick Read. “This performance keeps us firmly on track to deliver FY22 results in line with the higher guidance we set out in November.

“We remain focused on our operational priorities to strengthen commercial momentum in Germany, accelerate our transformation in Spain and position Vodafone Business to maximise EU recovery funding opportunities. We are also committed to creating value for our shareholders through proactive portfolio actions and continuing to improve returns at pace.”

That last comment is intriguing as ‘proactive portfolio actions’ seems like a euphemism for buying stuff. Vodafone’s track record in M&A is mixed, but investors will be hoping future examples are targeted and complimentary to the parts of the business that are already doing well, as opposed to some of the more speculative punts of the past.

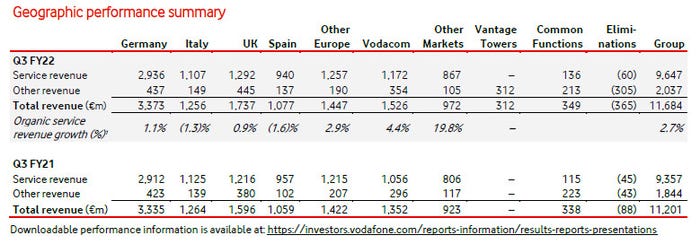

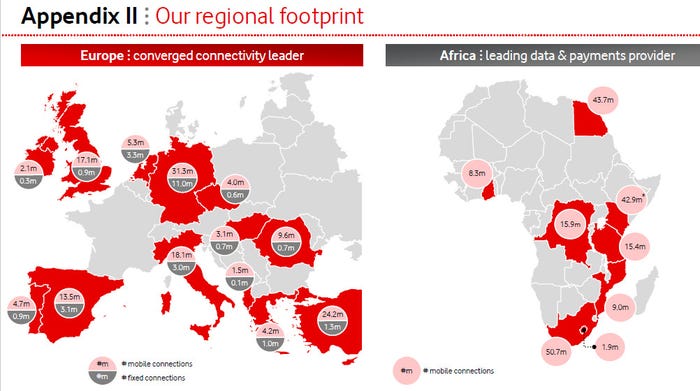

The company was keen to bring attention to is German business and you can see why in the graphics below. Germany accounts for 29% of total group revenues, almost twice as much as the next biggest market, the UK. Africa is a major growth contributor, but ARPU is significantly lower there. ‘Other revenue’ includes connection fees, equipment revenue, interest income and lease revenue.

Despite all this steady progress it seems some investors want more, with the FT reporting that Cevian Capital is making activist noises in Vodafone’s direction. Maybe that’s why Read felt compelled to say what he did about ‘improving returns at pace’. The likes of Cevian need to be careful what they wish for, however, as things seem to already be moving in the right direction and bad M&A is a great way of upsetting the apple cart.

Get the latest news straight to your inbox. Register for the newsletter now

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)