AT&T and Discovery have closed the transaction to merge Warner Business Media with Discovery to create a new entertainment entity leveraging all the properties owned by both firms.

April 11, 2022

AT&T and Discovery have closed the transaction to merge Warner Business Media with Discovery to create a new entertainment entity leveraging all the properties owned by both firms.

The new company is called Warner Bros Discovery and begins trading on the Nasdaq today. AT&T, which owned WarnerMedia, received $40.4 billion in cash and AT&T shareholders received 1.7 billion shares of the new firm, representing 71% of its shares on a fully diluted basis. Discovery’s existing shareholders own the remainder of the new company.

The properties owned by the Warner and Discovery will all be now under one umbrella, including Discovery Channel, discovery+, Warner Bros. Entertainment, CNN, CNN+, DC, Eurosport, HBO, HBO Max, HGTV, Food Network, Investigation Discovery, TLC, TNT, TBS, truTV, Travel Channel, MotorTrend, Animal Planet, Science Channel, New Line Cinema, Cartoon Network, Adult Swim, and Turner Classic Movies. Warner Bros mission statement is apparently to ‘create and distribute the world’s most differentiated and complete portfolio of content, brands and franchises across television, film and streaming.’

“Today’s announcement marks an exciting milestone not just for Warner Bros. Discovery but for our shareholders, our distributors, our advertisers, our creative partners and, most importantly, consumers globally,” said David Zaslav, Warner Bros. Discovery CEO. “With our collective assets and diversified business model, Warner Bros. Discovery offers the most differentiated and complete portfolio of content across film, television and streaming. We are confident that we can bring more choice to consumers around the globe while fostering creativity and creating value for shareholders. I can’t wait for both teams to come together to make Warner Bros. Discovery the best place for impactful storytelling.”

John Stankey, AT&T CEO, added: “We are at the dawn of a new age of connectivity, and today marks the beginning of a new era for AT&T. With the close of this transaction, we expect to invest at record levels in our growth areas of 5G and fibre, where we have strong momentum, while we work to become America’s best broadband company. At the same time, we’ll sharpen our focus on returns to shareholders. We expect to invest for growth, strengthen our balance sheet and reduce our debt, all while continuing to pay an attractive dividend that puts us among the top dividend paying stocks in America.”

The desire to create a more substantial creative and distribution operation for film and TV seems like a logical one. Since AT&T bought Time Warner in 2017 the landscape of streaming media has become more competitive – entertainment monolith Disney and tech giant Apple have since got into the game and have been busy leveraging their not inconsiderable resources to build up reams of content, while Netflix and Amazon continue to invest in new programming.

For AT&T’s part the commentary in the release seems to be around pumping the cash it is receiving as part of the deal into its core business of 5G and fibre infrastructure, which makes it all seem like something of a turnaround. Indeed the question of whether it was a good idea for a telecoms firm to shell out huge sums of money for a content firm will have been asked at the time of Time Warner’s initial purchase in the first place, and the answer for many now will be ‘it wasn’t’.

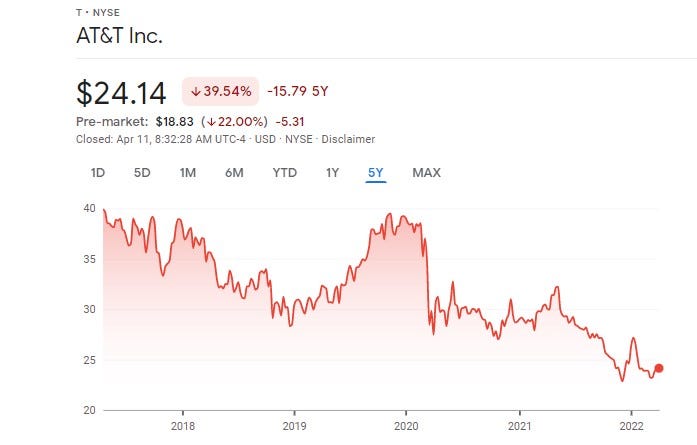

AT&T reached a deal to buy Time Warner for $85 billion five years ago and it has received $40 billion in cash as a result of today’s deal. It does also own 71% of the new entity Warner Bros Discovery – but that appears to have a market cap of $12 billion. In that time AT&T’s share price has fallen by around 40% as you can see from the graph below. So the move certainly doesn’t seem to have been a great one for investors, and the firm appears to have ended up around $45 billion lighter as a result of the initial purchase and subsequent merging of assets with Discovery, leaving aside from whatever it end up making from Warner Bros Discovery.

It can be debated then whether this deal then represents a good move in terms of reversing a questionable one – AT&T could have sat on the assets for another five years and not received the $40 billion cash injection, which it can now use for more core business purposes. But it certainly feels like a tactical retreat from the content business, and perhaps the whole situation will serve as a relevant talking point whenever telcos look to extend themselves far beyond anything that could be considered core to their business in the future, as many have in the past.

Image: Google Finance

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)