Global smartphone shipments fell 11% in Q1 2022 amid ‘unfavourable economic conditions and sluggish seasonal demand’.

April 19, 2022

Global smartphone shipments dropped by 11% in Q1 2022 amid ‘unfavourable economic conditions and sluggish seasonal demand’, according to analyst firm Canalys.

The Canalys report reckons the market was held back by an ‘unsettled business environment’ in Q1 – namely spikes in covid cases due to the Omicron variant, vendor uncertainty due to the Russia-Ukraine war, China’s resurgent lockdown policy and the implications of inflation around the world.

On the upside, it reckons the component shortage situation might improve ‘sooner than expected’, which would alleviate things somewhat.

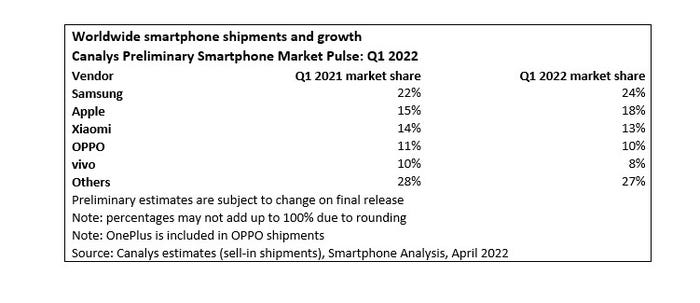

In terms of market share for the top five smartphone vendors, Samsung tops the list with a 24% share (up from 19% in Q4 2021) Apple came second with 18% (up from 15%), Xiaomi had 13% (down from 14%), Oppo 10% (down from 11%) and Vivo 8% (down from 10%).

“Despite the looming uncertainty in global markets, the leading vendors accelerated their growth by broadening device portfolios for 2022,” said Canalys Analyst Sanyam Chaurasia. “While the iPhone 13 series continues to capture consumer demand, the new iPhone SE launched in March is becoming an important mid-range volume driver for Apple. At a similar price point to its predecessor, it offers an upgraded chipset and improved battery performance and adds the 5G connectivity that operator channels are demanding.

“At the same time, Samsung ramped up production of its popular A series to compete aggressively in the mid-to-low-end segment while refreshing its 2022 portfolio, including its flagship Galaxy S22 series. While Chinese vendors are still suffering supply constraints at the low end, their global expansion is being hampered by a slowdown in their home market.”

While impacts on businesses and markets are the least of concerns when looking at the cost to human life caused by the Russian invasion of Ukraine or the ongoing pandemic, events of such magnitudes can of course disrupt entire industries. The secondary effects, such as energy getting much more expensive or rising inflation, are now becoming very noticeable to many around the world, which in turn seem likely to have tertiary effects such as a slowing demand for all sorts of consumer goods – whether that’s smartphones as described here, or streaming subscriptions, a fall in which was also reported on today.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)