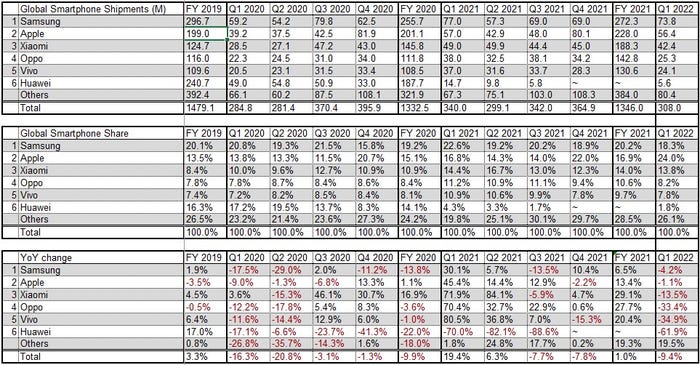

Global smartphone shipments fell by 12.9% in Q1 2022 to 308 million units, representing the third consecutive quarter that figure has gone down, according to analyst firm Omdia.

April 29, 2022

Global smartphone shipments fell by 12.9% in Q1 2022 to 308 million units, representing the third consecutive quarter that figure has gone down, according to analyst firm Omdia.

Much of the drop can be attributed to s sharp fall in shipments by Chinese manufacturers due to a slowdown in the regional market, according to Omdia. Resurgent waves of Covid there has played havoc with supply chain, as major cities like Shenzhen and Shanghai have seen new and characteristically brutal lockdowns. The related economic slowdown has seen consumer demand reduce as well, which also plays into the drop in numbers.

Samsung shipped the most phones in the period, 73.8 million to be precise – an decrease of 2.9 per cent YoY, but a 6.8% increase on the previous quarter. Its overall market share increased to 24%, which is attributed to its relative lack of exposure to China, which seems to be the main drag factor in global shipments.

In second place was Apple which shipped 56.4 million units, and saw its market share increased to 18.3%. Shipment volume increased by 2.5% YoY, making it one of the three main phone manufacturers that recorded an increase in the quarter.

In third place was Xiaomi which shipped 42.4 million units in the period, though this is 7.1 million less than last year. Heightened competition with other Chinese companies in its main markets of India and Southeast Asia are blamed in particular for the drop.

At the other end of the scale In 9th and 10th places were Motorola and Huawei who shipped 12 million units and 5.6 million units respectively. Motorola has apparently been enjoying demand for its mid-end models, while Huawei is experiencing difficulties in market expansion in China – as you’d expect following the US led sanctions against it. Huawei’s market share fell by a decent chunk from 4.2% last year to 1.8% this year.

For this article we are using Omdia’s numbers. We use whoever offers numbers first so previous quarter, and thus full-year, tallies in the table we present below may differ from Omdia’s. It doesn’t really matter, though, since all analyst numbers are educated guesses anyway, and the variation isn’t that great between them.

In terms of the outlook going forwards, the data from Omdia is grim. It doesn’t see the covid induced slowdown of the Chinese market going anywhere for the next quarter, and the Russian invasion of Ukraine is also creating heavy market disruption not only in those countries but around the world. All in all, the report suggests this will negatively effect overall demand this year, which might take an expected post covid recovery off the table for 2022.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

Read more about:

OmdiaAbout the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)