The 5G device market is showing signs of maturity, with much broader support for standalone (SA) and fewer non-5G versions of handsets.

July 7, 2022

The 5G device market is showing signs of maturity, with much broader support for standalone (SA) and fewer non-5G versions of handsets.

This is according to the latest Mobile Device Trends report, published this week by the Global Certification Forum (GCF). GCF is a non-profit group that verifies mobile products to ensure they are of sufficiently high quality, secure, reliable and interoperable. 150 OEMs from 25 countries participate in its certification programmes, giving it a good bird’s eye view of how the device market is evolving.

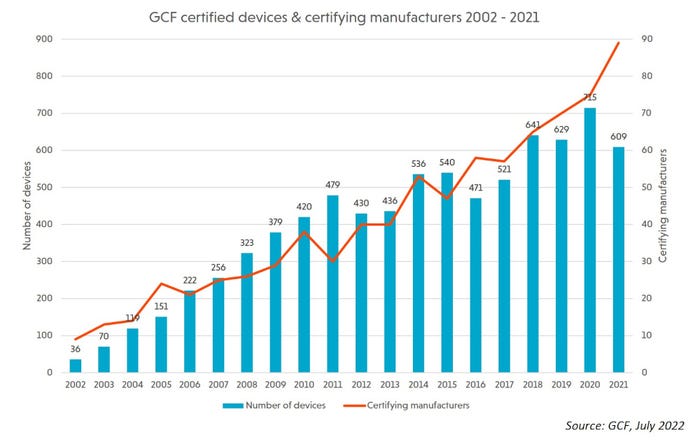

In its latest report, GCF said in 2021 it certified 609 new device models from 89 manufacturers. Of that total, 31 percent supported 5G, up from 21 percent in 2020. The proportion of those 5G devices with standalone support surged to 65 percent from 34 percent.

“This rate continues to grow and, in 2022 year-to-date, the proportion of 5G devices supporting 5G SA is 88 percent,” GCF said.

GCF also noted that the overall number of devices certified last year was down from 715 in 2020. While continuing chip shortages are partly to blame, GCF said it is also indicative of maturity in the 5G market. Reason being, in 2020 it was more common for manufacturers to offer separate 4G and 5G variants of the same device, whereas this year more OEMs are going with a single 5G version.

In terms of device types, smartphones remained the largest category in 2021, accounting for 43 percent of models certified, ahead of modules on nearly 30 percent. Perhaps most interestingly, the third-largest device category was WLAN routers, which made up 8 percent of devices certified.

“This was a considerable jump from 2020 and was largely due to operators supporting fixed 5G wireless access (FWA) on their 5G networks, which drove up the demand for WLAN routers,” GCF said. ��“In 2022 so far, the top three device categories remain the same but the proportion of WLAN routers has declined, possibly because their longer lifecycle means that fewer new models need to be certified.”

FWA has proved a surprisingly popular early use case for 5G. As Ericsson noted in its most recent Mobility Report, FWA accounts for 20 percent of global mobile data traffic, and the number of connections is expected to reach 100 million by the end of this year. And while most FWA connections currently don’t use 5G, that’s expected to change. By 2027, Ericsson predicts FWA connections will climb to approximately 275 million, and the split between 5G and other technologies is expected to be much closer to 50:50.

The GCF report also serves to highlight just how little progress has been made with integrating cellular technology into other consumer device segments. Tablets, for example, are still predominantly Wi-Fi only, accounting for 4.8 percent of cellular devices certified last year. Laptops don’t even merit a mention, and are lumped into the ‘other’ category, which includes USB dongles, feature phones, and other ‘non-smartphone communications devices’.

A full copy of the report is available here.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)