TIM has outlined more detailed plans to split its network operations from its services business, confirming recent reports that around half of its debt will go with the NetCo unit.

July 7, 2022

TIM has outlined more detailed plans to split its network operations from its services business, confirming recent reports that around half of its debt will go with the NetCo unit.

But the financial picture at NetCo could change pretty quickly. TIM also noted that M&A is still an option, specifically the merger of the networks business with that of rival Open Fiber or the sale of the unit to other investors. Only if the financials stack up though, of course.

There are no big surprises in TIM’s separation plan, which was presented at its capital markets day on Thursday; there had already been reports in the newswires of a 50:50 split.

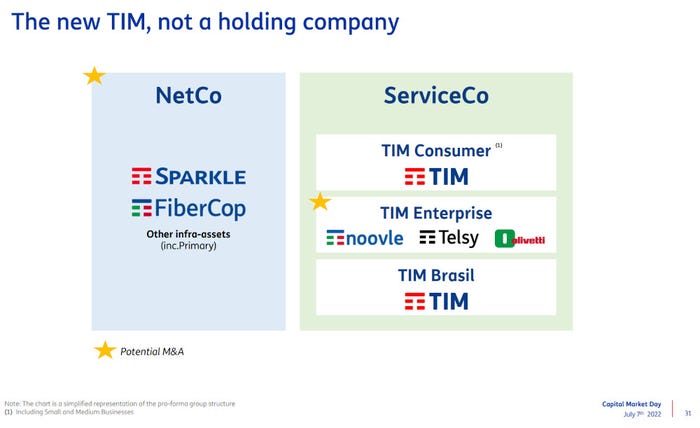

Some of that leaked information is in the telco’s presentation. NetCo will take with it up to around €11 billion in debt, which represents approximately half of its adjusted financial net debt of €22.6 billion as of the end of Q1. As expected, NetCo comprises TIM’s core fixed-line business, its FiberCop fibre-to-the-home (FTTH) unit, and international wholesale operator Sparkle.

The entire restructuring is designed with the aim of deleveraging across the board. The NetCo transaction itself will help with that, TIM said, as well as highlighting its intention to sell a minority stake in its Enterprise business – one of the three pillars of the ServiceCo business; more on that below – and the possible sale of other assets.

And, of course, the future ownership of the NetCo business itself is still very much undecided, and any transaction would affect its financial position.

“‘Combination’ with Open Fiber remains the priority / preferred option in order to unlock sizeable synergies and allow full valorization of TIM’s infrastructure network…but only if executed at attractive terms to both equity / debt holders,” the telco said in its presentation. In a footnote, it added that the word ‘combination’ could mean any number of things, including a full sale of NetCo to Open Fiber. That’s an option that hasn’t seemed particularly palatable to the telco to date, but now it appears that anything is possible.

Should it fail to finalise a deal with Open Fiber there are other options on the table, including, but not limited to, a sale to investors; TIM notes that there remains a strong appetite for telecoms assets among the investment community. Structural separation remains a possibility too.

Whatever the outcome, it’s pretty clear that TIM sees its future as a services company, a future it is looking to fund by cashing in on the value of its networks.

ServiceCo, as that side of the business is currently dubbed, will comprise TIM Enterprise, TIM Consumer, and TIM Brasil. We’re looking at business as usual for the last, with TIM focusing on revenue growth in mobile and fixed, accompanied by a fibre push, and tapping into new growth markets like IoT and consumer services beyond IoT.

Change is afoot at TIM Enterprise, which comprises amongst other things the Noovle cloud business, security unit Telsy, and Olivetti. The telco is looking to drive stronger integration between those units and is looking to shift the revenue-generation balance away from connectivity towards cloud services. It didn’t have much to say on the subject of a stake sale, so we continue to watch and wait on that one.

As has been well documented, TIM Consumer is operating in a competitively challenging market; its 34% revenue slide over the past decade came alongside a 30% increase in capex, TIM noted. This imbalance has been a trend across Europe, but TIM is feeling the pinch more than many; ARPUs remain low in the mobile market, while the fixed market is still very competitive. The operator is looking to infrastructure-sharing and the possibility of in-market consolidation to shore things up a bit.

There’s no easy way forward on that last point. While there are ongoing network rollout partnerships between various operators in Italy, full consolidation is often discussed but rarely happens; there was talk of a deal between Iliad and Vodafone earlier this year, for example, that came to nothing. And even if the telcos could agree, they might have a tricky time getting the regulators onside.

But that’s something of a digression, although it does demonstrate the backdrop against which the new TIM – as well as the current TIM, of course – will operate, once its network assets have gone to a new home.

This separation plan will be some time in the making though. For now, the company is working on the carve-out of the financials and finalising the capital structure of the two businesses. There’s nothing in today’s announcement about the company’s employees, but doubtless headcount is a big factor in the calculations.

Essentially, TIM has told what we already knew, or at least suspected; that it aims to split in two, reduce debt, and monetise those network assets one way or another. There’s still a way to go in this restructure.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)