Analyst firm Canalys has published its preliminary numbers for the global smartphone market in Q2 2022 and once more they paint a challenging picture.

July 19, 2022

Analyst firm Canalys has published its preliminary numbers for the global smartphone market in Q2 2022 and once more they paint a challenging picture.

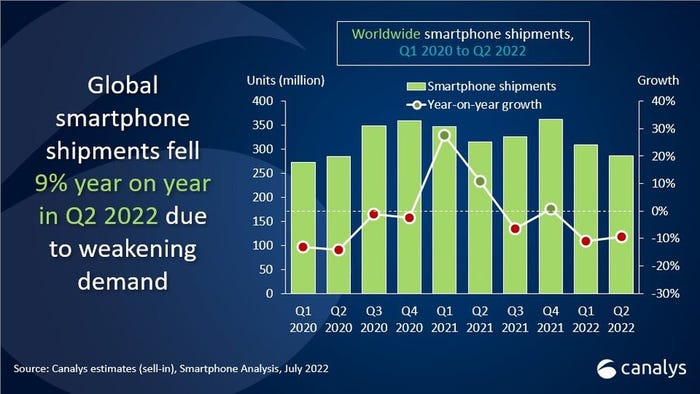

The top line is that the overall market declined by 9% year-on-year, according to Canalys, having sunk by 11% in the previous quarter. The press release talks of ‘economic headwinds’ and there certainly seem to be a lot of them right now. On the supply side, the component shortage shows little sign of abating, while on the demand side, rampant inflation is making consumers understandably reluctant to spend on anything other than essentials.

“Vendors were forced to review their tactics in Q2 as the outlook for the smartphone market became more cautious,” said Runar Bjørhovde of Canalys. “Economic headwinds, sluggish demand and inventory pileup have resulted in vendors rapidly reassessing their portfolio strategies for the rest of 2022. The oversupplied mid-range is an exposed segment for vendors to focus on adjusting new launches, as budget-constrained consumers shift their device purchases toward the lower end.”

“Falling demand is causing great concern for the entire smartphone supply chain,” said Toby Zhu of Canalys. “While component supplies and cost pressures are easing, a few concerns remain within logistics and production, such as some emerging markets’ tightening import laws and customs procedures delaying shipments.

“In the near term, vendors will look to accelerate sell-through using promotions and offers ahead of new launches during the holiday season to alleviate the channel’s liquidity pressure. But in contrast to last year’s pent-up demand, consumers’ disposable income has been affected by soaring inflation this year. Deep collaboration with channels to monitor the state of inventory and supply will be vital for vendors to identify short-term opportunities while maintaining healthy channel partnerships in the long run.”

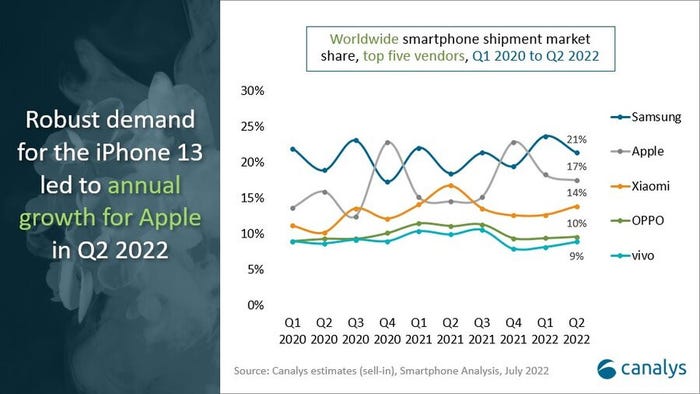

For all the talk of everyone being too skint to buy smartphones, Apple still managed to grow its market share year-on-year, as did Samsung, largely at the expense of Xiaomi, it seems. Compared to other Chinese vendors Xiaomi relies a lot more on non-domestic markets such as Europe, so weakness there won’t have helped. But there’s little reason to assume the broader smartphone market slump won’t continue with the headwinds showing no sign of abating.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)