Reliance Jio Infocomm accounted for well over half of the US$19 billion pledged by India's telecoms operators in the country's just concluded 5G spectrum sale.

August 2, 2022

Reliance Jio Infocomm accounted for well over half of the US$19 billion pledged by India’s telecoms operators in the country’s just concluded 5G spectrum sale.

There had been concerns over the level of telco participation in the multi-band frequency auction that took place – after what feels like years of debate – over the past week. The operators themselves had warned of lukewarm interest in the sale, disgruntled about private 5G network rules, amongst other things. But ultimately the lure of 5G was too great to resist: the telcos agreed to part with their cash and the government saw its coffers boosted to the tune of just over 1.5 trillion rupees ($19 billion).

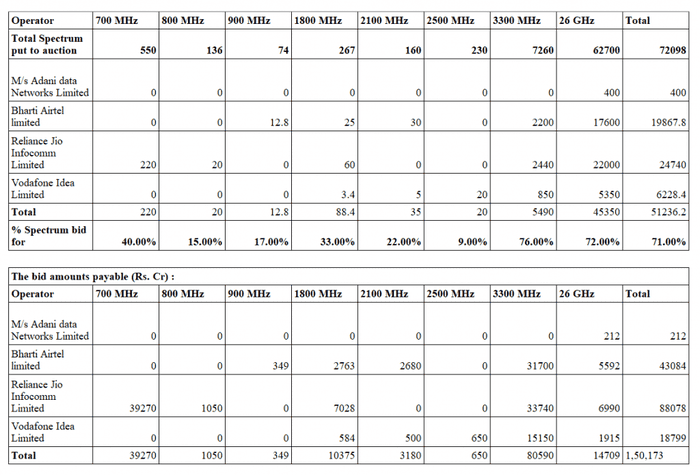

Reliance Jio was the most aggressive participant by some margin, paying out a total of INR881 billion (just over $11 billion) for frequencies in the 700 MHz, 800 MHz, 1800 MHz, 3.3 GHz, and 26 GHz bands.

That’s a massive sum of money, even considering the growth opportunity afforded by 5G. There’s the still the cost of network rollout to consider, after all. But as Jio points out, it is payable over 20 years at a 7.2% interest rate. The telco estimates it will pay out INR78.77 billion ($1 billion) per year, subject to the approval of the Department of Telecommunications (DoT).

All in all, the operator seems pretty pleased with its performance.

“The acquisition of the right to use this spectrum will enable Jio to build the world’s most advanced 5G network and further strengthen India’s global leadership in wireless broadband connectivity,” the company said, in a statement. “Jio’s 5G network will enable the next generation of digital solutions that will accelerate India’s AI-driven march towards becoming a US$5+ trillion economy.”

Not too much hyperbole there, then. Jio chairman Akash Ambani added that “Jio is set to lead India’s march into the 5G era,” an ambition that was echoed by the country’s second-largest operator – and the auction’s second biggest spender – Bharti Airtel, which insisted that it is “set to lead India’s 5G revolution.”

Bharti Airtel pledged INR431 billion ($5.5 billion) for frequencies in five bands (see table for full results).

“This spectrum acquisition at the latest auction has been a part of a deliberate strategy to buy the best spectrum assets at a substantially lower relative cost compared to our competition,” said Bharti Airtel chief executive Gopal Vittal.

No hint of a lukewarm approach to 5G spectrum acquisition from either of the big two, but a strong hint that competition to roll out 5G networks and services will be fierce. There has been no official statement from Vodafone Idea yet, which accounted for around an eighth of the total auction spend. But it too will doubtless be keen to keep pace with its major rivals in the race to 5G.

Adani Group, which made headlines a month ago when it announced its participation in the auction with a view to getting into private 5G, picked up 400 MHz of spectrum in the 26 GHz band, leaving itself with a INR2.12 billion ($27 million) bill. That’s a drop in the ocean compared with the overall auction spend, but a fair amount for a non-telco to part with. The operators will be keeping a close eye on the private 5G space in the coming months and years; they can’t afford to lose too much business there.

All in all, the government successfully offloaded 71% of the 72,098 MHz of spectrum it put up for sale. There were no bidders for the 600 MHz band, but the state is keen to point out that the device ecosystem for that band is still not developed. “In a few years this band may become important,” it predicted.

Crucially, the government has pledged to push on with the actual allocation of the spectrum auctioned in a timely fashion.

“5G services are likely to be rolled out by September/October,” it said. It’s safe to say that we will hear more from the telcos on that just as soon as the first site goes live.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)