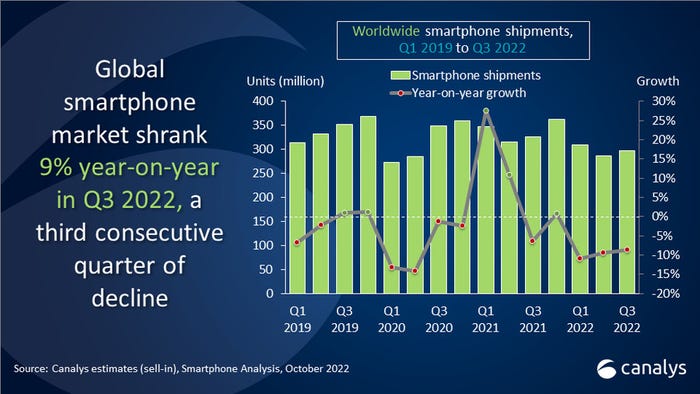

The worldwide smartphone market has declined for the third consecutive quarter, falling 9% year-on-year, according to analyst firm Canalys, which marks the worst Q3 since 2014.

October 18, 2022

The worldwide smartphone market has declined for the third consecutive quarter, falling 9% year-on-year, according to analyst firm Canalys, which marks the worst Q3 since 2014.

Canalys attributes the decline in sales to – unsurprisingly – the general economic gloominess and expects this to continue to have a dampening effect on sales for the next six to nine months.

In terms of the market leaders, Samsung retained its leading position with a 22% market share apparently spurred on by heavy promotions to reduce channel inventory. Apple with its every loyal iPhone fanbase was the only vendor from the list of the top five to record positive growth, increasing its market share to 18%. While Xiaomi, OPPO and vivo took away 14%, 10% and 9% of the global market share respectively.

“The smartphone market is highly reactive to consumer demand and vendors are adjusting quickly to the harsh business conditions,” said Canalys Analyst Amber Liu. “For most vendors, the priority is to reduce the risk of inventory building up given deteriorating demand. Vendors had significant stockpiles going into July, but sell-through gradually improved from September owing to aggressive discounting and promotions. The pricing strategy of new products is cautiously crafted, even for Apple, to avoid significant pushback from consumers who now tend to be very sensitive to any price hike.”

Canalys Analyst Sanyam Chaurasia added: “As demand shows no signs of improvement moving into Q4 and H1 2023, vendors have to work on a prudent production forecast with the supply chain while working closely with the channel to stabilize market share. Going into the sales season, consumers who have been delaying purchases will expect steep discounts and bundling promotions as well as significant price reductions on older generation devices. Compared to the strong demand period of the previous year, a slow but steady festive sale is anticipated in Q4 2022. However, it will be too soon to see the upcoming Q4 as the real turning point of market recovery.”

As we approach winter with an ongoing uncertainty as to what turbulence in the energy sector is going to do to heating bills, anyone not rolling in cash has surely at least been having an extra long think about any purchases recently. Many seem to have concluded that they can eek out an extra year or so for their current handsets in that light, and until the general economic outlook improves it seems the global market is set for continued decline.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)