The company formerly known as Facebook took another big hit to its share price as the cost of its pivot to the metaverse hit home.

October 27, 2022

The company formerly known as Facebook took another big hit to its share price as the cost of its pivot to the metaverse hit home.

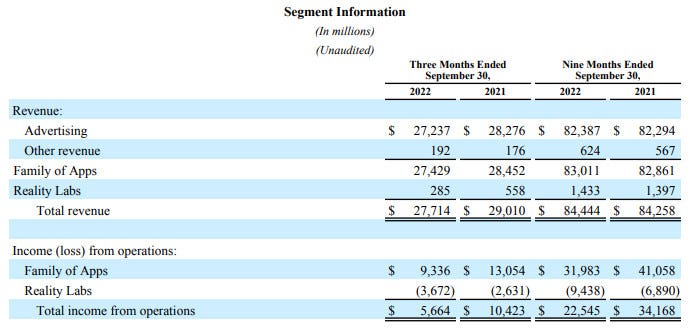

Total revenues were down 4% to $27.7 billion in Q3 2022, which isn’t catastrophic, considering the known slowdown in digital ad spending, a sector Meta dominates along with fellow US internet giant Google. But net income halved year-on-year to $4.4 billion, thanks mainly to the obscene amounts of cash the company is ploughing into its strategic bet on the metaverse. As a result of those numbers and a stated determination to double down on that strategy, Meta shares were down 22% at time of writing.

“Our community continues to grow and I’m pleased with the strong engagement we’re seeing driven by progress on our discovery engine and products like Reels,” said Mark Zuckerberg, Meta founder and CEO. “While we face near-term challenges on revenue, the fundamentals are there for a return to stronger revenue growth. We��’re approaching 2023 with a focus on prioritization and efficiency that will help us navigate the current environment and emerge an even stronger company.”

Obviously investors are unconvinced. Meta refers to its main business as the ‘family of apps’ – principally Facebook, WhatsApp and Instagram. They still seems to be ticking along OK, with active user counts up a bit year-on-year and the revenue decline explained by a lower price per ad. But overheads were up 19% on the year-ago quarter leading to significantly profitability at a time when losses at the ‘Reality Labs’ division devoted to the Metaverse bet are mounting.

Meta’s outlook added to the gloom. While 2022 total expenses are expected to remain within previous guidance of around $86 billion, they are forecast to be in the range of $96-$101 billion in 2023. “We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year,” said the CFO outlook commentary. “Beyond 2023, we expect to pace Reality Labs investments such that we can achieve our goal of growing overall company operating income in the long run.”

Zuckerberg attempted to placate investors in the subsequent analyst call. “I appreciate the patience and I think that those who are patient and invest with us will end up being rewarded,” the FT reports him saying. The same piece quotes Jefferies analyst Brent Thill as saying ““Summing up how investors are feeling right now is that there are just too many experimental bets versus proven bets on the core.”

While Thill might want to reflect on the phenomenon of ‘proven bets’, he probably accurately represented up broader sentiment. Zuck’s latest attempt to sell his metaverse obsession may have been done with these numbers in mind, but he’s apparently no closer to convincing the market than he was at the start of the year. Meta’s share price is down over 60% since then, which would test the patience of any investor.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)