Vodafone has agreed a co-control deal for its Vantage Towers business with Global Infrastructure Partners (GIP) and KKR that could bring in cash proceeds of up to €7.1 billion.

November 9, 2022

Vodafone has agreed a co-control deal for its Vantage Towers business with Global Infrastructure Partners (GIP) and KKR that could bring in cash proceeds of up to €7.1 billion.

A new joint venture between Vodafone and the GIP/KKR partnership will take control of Vodafone’s existing 81.7% stake in Vantage Towers. At the same time, the JV will make a voluntary takeover offer for the outstanding Vantage Towers shares, with one minority holder – RRJ Capital – having already agreed to cede its 2.4% stake.

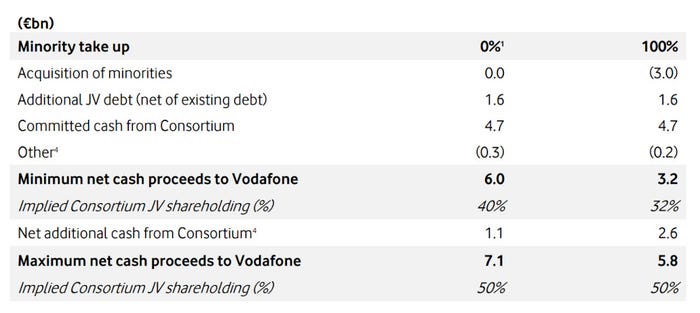

It’s a complex transaction, but the important point is that, depending on the take-up of the VTO and the size of stake GIP/KKR ends up holding, Vodafone’s cash proceeds will range between €3.2 billion and €7.1 billion (see chart).

That’s not a sum to be sneezed at. To put the deal into a more relatable context, it gives Vodafone and the minority holders a valuation of €32 per share for Vantage Towers, which is a 19% premium on its most recent three-month average and an increase of 33 percent on its March 2021 IPO price of €24 per share. It confers an equity value of €16.2 billion on Vantage Towers, or an adjusted EBITDA multiple of 26x, which is roughly what we have seen in most towers deals of late. It’s a decent result.

But as well as being about money, this transaction is also about control, as we suspected.

Vodafone has been evaluating its options for the business for the past few weeks, and it was pretty clear that retaining some level of control would be high on its agenda. Indeed, last week Bloomberg reported that GIP and KKR were leading the race to buy into Vantage, despite a rival bid from passive infrastructure specialist Cellnex. It was a fairly safe bet that the latter’s desire for operational control would freeze it out, as was the case with its aborted attempt to buy into Deutsche Telekom’s GD Towers unit back in July.

Like Deutsche Telekom, Vodafone clearly wants to keep some skin in the towers game.

“This transaction successfully delivers on Vodafone’s stated aims of retaining co-control over a strategically important asset, deconsolidating Vantage Towers from our balance sheet to ensure we can optimise its capital structure and generate substantial upfront cash proceeds for the Group to support our priority of deleveraging,” said Vodafone chief executive Nick Read.

Further, the telco made it clear that it and the GIP/KKR consortium will have balanced governance rights in the JV and equal voting rights. Vantage Tower’s current leadership team will remain as is.

The deal is about Vantage Tower’s growth prospects as much as it is about Vodafone’s desire to bring in some cash.

As chief executive Vivek Badrinath made clear when the towers business was spun out of Vodafone two years ago, Vantage Towers has plenty of headroom for increasing its tenancy ratio, as well as its footprint. It has made some progress on that score, inking a deal with Germany’s 1&1 at the back end of last year being a prime example, but there is more growth to be captured in the European towers space.

“We’re delighted to join forces with Vodafone and KKR to invest in Vantage Towers, a high-quality European tower portfolio with strong upside potential,” said Will Brilliant, Partner and Head of Digital Infrastructure at GIP. “We are looking forward to capturing the exciting value-creating opportunities in the European telecoms infrastructure sector by advancing Vantage Towers’ strategy and supporting its capacity to build new sites.”

Meanwhile, Vincent Policard, Partner and co-Head of European Infrastructure at KKR, made similar remarks, as well as addressing the question of inorganic growth.

“At KKR we are long-term conviction investors in Europe’s digital infrastructure and at Vantage Towers we intend to pursue value-creating investments to capitalise on the growth in this sector and to help drive consolidation in a fragmented market,” he said.

That sounds like a strong hint at future M&A.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)