At its capital markets day, Swedish kit vendor Ericsson said it’s aiming for the lower end of its margin target amid a networking market that is unlikely to grow for the foreseeable future.

December 16, 2022

At its capital markets day, Swedish kit vendor Ericsson said it’s aiming for the lower end of its margin target amid a networking market that is unlikely to grow for the foreseeable future.

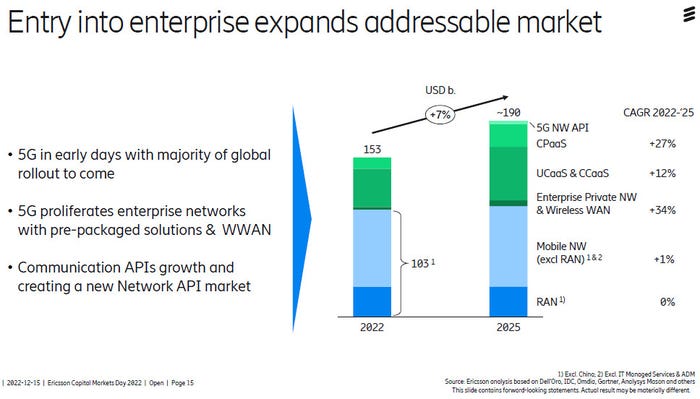

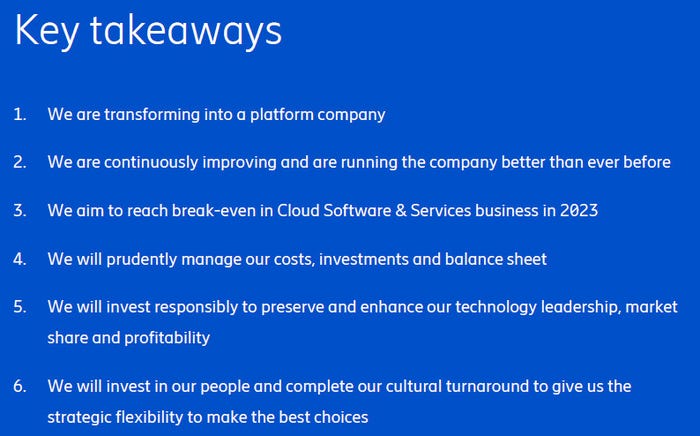

Amid continued awkwardness around its relationship with US authorities, Ericsson sought to focus on the positives during its annual strategy update. Much of the presentation addressed on the rationale behind the acquisition of Vonage, which is Ericsson’s biggest. The point of it is to transform Ericsson into a ‘platform company’, but that transformation is going to take a while and is far from certain to deliver the hoped-for return.

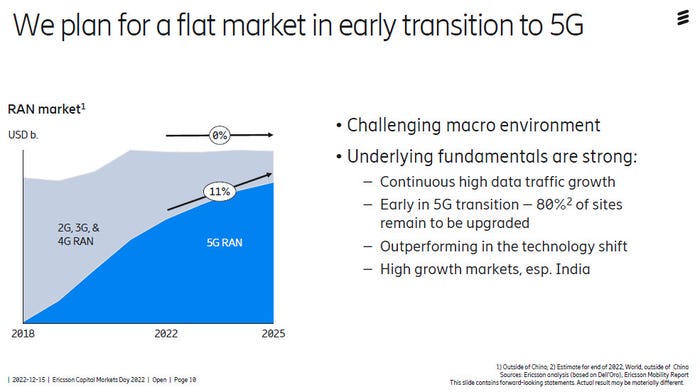

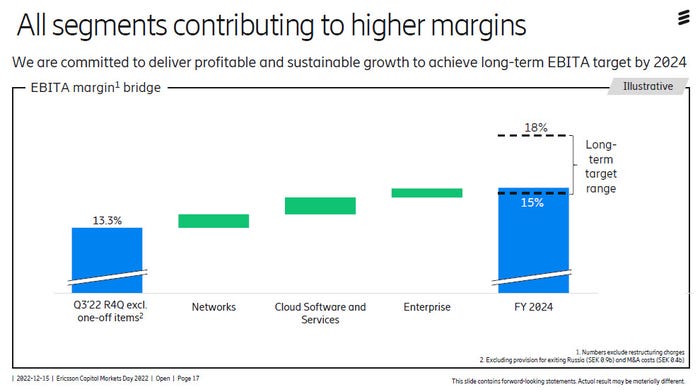

So the underlying message to investors and analysts seemed to be a plea for patience. Ericsson was keen to stress that the overall direction of travel is positive when it comes to key metrics such as profitability, but that future growth will rely largely on its diversification into non-telecoms enterprise markets. A big reason for that is that the mobile networks market, from which Ericsson currently derives the majority of its revenues, is expected to be flat for the next few years.

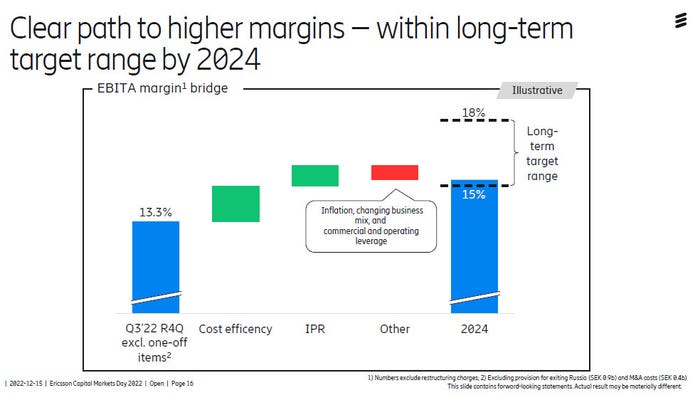

That challenging macro environment is presumably a major reason why Ericsson had to advise that it only expects to his the very lower end of its EBITDA margin target range by 2024. Even that will only happen after it has increased cost cutting initiatives by almost a billion dollars more over the course of next year.

“Over the last years, our strategy execution has been visible in the financial results and the strengthened financial position with strong free cash flow generation and return on invested capital,” said Ericsson CFO Carl Mellander. “Our expected continued strong business performance, in combination with measures to offset external headwind, puts Ericsson on track to reach the lower end of our long-term EBITA margin target range by 2024.”

“With 5G, everything that can go wireless, will go wireless,” said Ericsson CEO Börje Ekholm. “Long-term, the industry is moving towards the network as a platform for innovation where 5G and future 6G capabilities will be monetized in new ways. Our strategy and industry leadership puts us in an advantageous position to capitalize on this development and thereby create new revenue streams for our operator customers that complement subscription revenues.”

The network as a platform vision makes sense and is aligned with much of the current commercial activity around 5G. It is still difficult to map such aspirations to substantial new revenue streams, however, which maybe why Ericsson’s shares have declined by around 7% or so in the past 24 hours and are down almost 40% this year. Investor patience seems to be wearing thin.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)