Consumer revenues were down 6% and revenues for BT Group as a whole were down 3% in the last quarter of 2022 but the incumbent says it is building out fibre ‘like fury.’

February 2, 2023

Consumer revenues were down 6% and revenues for BT Group as a whole were down 3% in the last quarter of 2022 but the incumbent says it is building out fibre ‘like fury.’

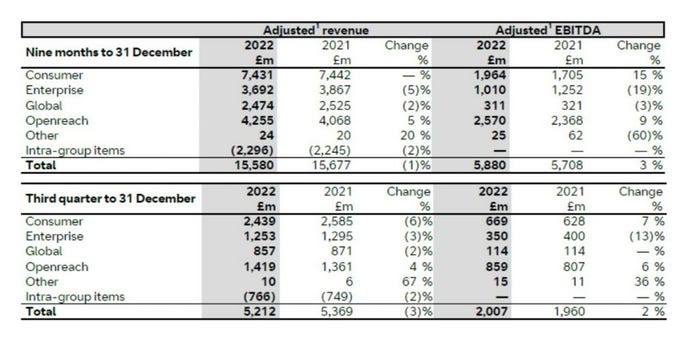

BT’s consumer revenues dropped 6% in the last three months of 2022 to £2.4 billion, though earnings, or EBITA, were up 7% to £669 million, in what CEO Phillip Jansen described as a ‘challenging economic backdrop.’

For the group as a whole there was a revenue drop of 3% to £5.2 billion for the quarter, though similarly earnings were up 2% to £200 million. BT has opted to publish figures for the last nine months of 2022 alongside the quarter’s results, which paints a relatively flat picture of 1% drop in adjusted revenue and 3% hike in earnings.

“We’ve grown revenue and EBITDA on a pro forma, like-for-like basis, despite a challenging economic backdrop, and we’re transforming BT Group for the benefit of our customers,” said Philip Jansen, Chief Executive. “We continue to accelerate our investments in the UK’s leading next generation networks; we’re combining our Enterprise and Global operations to create BT Business, a single, strengthened B2B unit; and we’re going further on cutting costs to deliver £3 billion in annualised savings by the end of FY25.”

In terms of wins for the quarter, BT highlights that it has increased its 5G customer base to 8.5 million, and points to a ‘record’ FTTP build of 810k premises passed at an average build rate of 62k per week, which apparently means 38% of its targeted 25 million FTTP build has been completed. “On full fibre, we’re building – and now connecting – like fury: 9.6 million premises reached to date, with 29% already connected, and our 5G mobile network now reaches 60% of the UK population,” said Jensen.

BT had a famously rough year in 2022, and regularly highlighted the affect rising energy costs were having on its large footprint of infrastructure while it was battling with the CWU over a staff pay dispute. The situation got quite nasty with the union describing a ‘culture of fear’ at the telco group.

Nodding to the fact it did eventually agree to mass pay rises, Jansen added: “In December we awarded a cost-of-living pay rise to 85% of our UK colleagues, reaching an agreement with our union partners that we will all lean into our ongoing transformation plans. Despite extraordinary energy costs and other inflationary headwinds, we are reaffirming our outlook for the year.”

The telco recently revealed many of its broadband customers will face price hikes of 14.4% as of the end of March. By way of explanation, and to remind us of its woes once again, Nick Lane, MD Customer Services at BT Consumer said at the time: “We continue to invest when, as a business, many of the costs we are facing are rising way above inflation. Take our energy costs, for example, which have increased approximately 80% over the past year. Component prices for the hardware we provide for our customers are going up. We also have additional costs imposed on us with the requirement to remove high-risk vendors from our core network – a cost we expect to reach around £500m.”

Meanwhile BT released a separate announcement today, revealing there has been some recent reshuffling at the board level. Maggie Chan Jones and Ruth Cairnie will be taking up seats at the top table as independent non-executive directors, while Iain Conn will step down from as a non-executive director in July after serving on the Board for 9 years, to be succeeded by Cairnie Senior Independent Director.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)