Three of Silicon Valley’s juggernauts posted some less than celebratory Q4 2022 results, revealing a gear shift from the boom times many aspects of Big Tech experienced during the pandemic.

February 3, 2023

Three of Silicon Valley’s juggernauts posted some less than celebratory Q4 2022 results, revealing a gear shift from the boom times many aspects of Big Tech experienced during the pandemic.

The last quarter of 2022 proved to be a tough one for three of tech’s top dogs, for varying reasons. Apple’s Q4 revenue was down 5% year on year, Amazon’s golden goose AWS growth slowed significantly, and Google owner Alphabet’s revenues were shy of expectations.

Apple’s quarterly revenue clocked in at $117.2 billion, down 5% compared to Q4 2021. Net sales in key categories were down – Apple doesn’t post it by percentages but by our calculations Macs were down about 29%, wearables and accessories 8%, and iPhones 8%.

“As we all continue to navigate a challenging environment, we are proud to have our best line up of products and services ever, and as always, we remain focused on the long term and are leading with our values in everything we do,” said Tim Cook, Apple’s CEO. “During the December quarter, we achieved a major milestone and are excited to report that we now have more than 2 billion active devices as part of our growing installed base.”

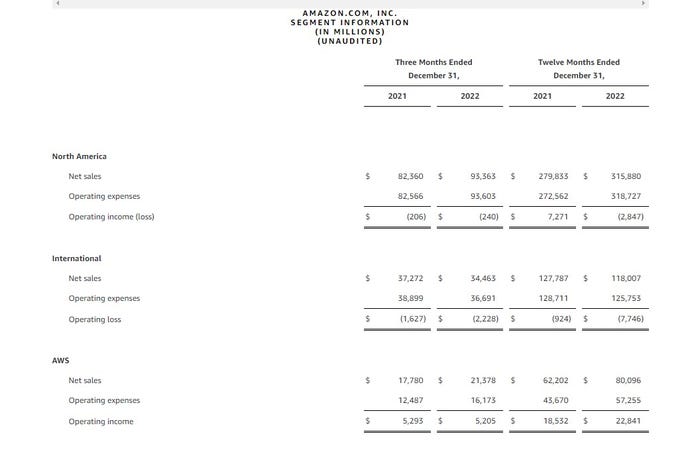

Amazon clocked $142.2 billion in revenue for Q4 up 9% from 2021– nothing wrong with that of course – however its cloud computing division AWS has had its meteoric growth halved in the quarter from 40% to 20%. This is significant because recently it has looked as though the division is almost propping up the rest of the firm, with its staple ecommerce business struggling to make a profit. To keep that in perspective, it still made £21.4 billion in revenue the last three months of the year and operating income of $5.2 billion.

It’s international (anything outside the US) operations seemed to stutter somewhat in the quarter as well – sales decreased 8% year-over-year to $34.5 billion, and operating loss was $2.2 billion, compared to $1.6 billion in Q4 2021.

“In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon,” said Andy Jassy, Amazon CEO. “The vast majority of total market segment share in both Global Retail and IT still reside in physical stores and on-premises datacenters; and as this equation steadily flips, we believe our leading customer experiences in these areas along with the results of our continued hard work and invention to improve every day, will lead to significant growth in the coming years.”

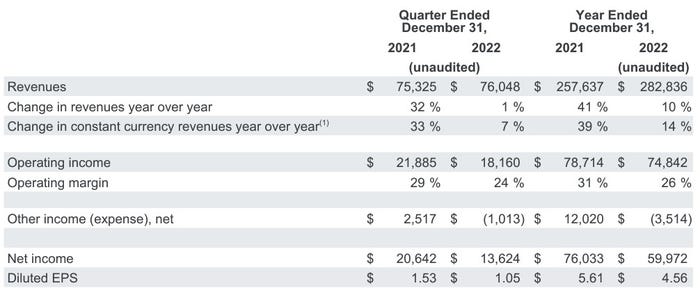

Google owner Alphabet posted a 1% hike in revenue for Q4 2023, which is less than it’s used to and adjusted profit of $1.05 per share fell short of an expected $1.18 per share, reports Reuters.

Revenues for the Google Services division, which includes ads on search and YouTube, was down what looks like around 2%.

“Our long-term investments in deep computer science make us extremely well-positioned as AI reaches an inflection point, and I’m excited by the AI-driven leaps we’re about to unveil in Search and beyond,” said Sundar Pichai, CEO of Alphabet and Google. “There’s also great momentum in Cloud, YouTube subscriptions, and our Pixel devices. We’re on an important journey to re-engineer our cost structure in a durable way and to build financially sustainable, vibrant, growing businesses across Alphabet.”

The results are all different but probably what unites them is a sense that even at one time bullet proof businesses such as Amazon’s cloud computing division, Apple’s iPhone, and Google search advertising are not immune from the economic uncertainty effecting the rest of the mortal economy. This trend is further exemplified by the recent spate of job cuts many big tech firms have been engaged in.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)