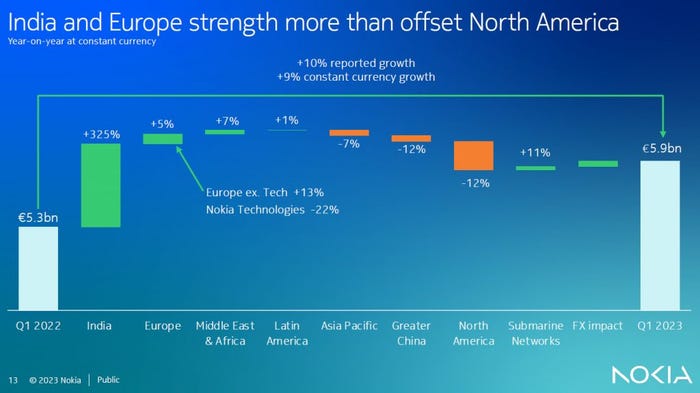

Finnish kit vendor Nokia shared its main competitor’s reliance on India in the first quarter of this year but its risks are more spread out.

April 20, 2023

Finnish kit vendor Nokia shared its main competitor’s reliance on India in the first quarter of this year but its risks are more spread out.

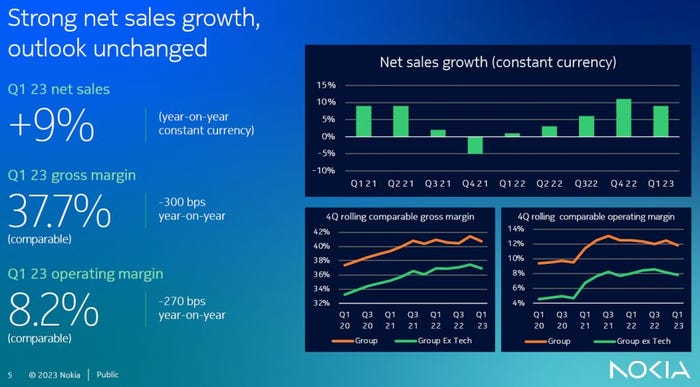

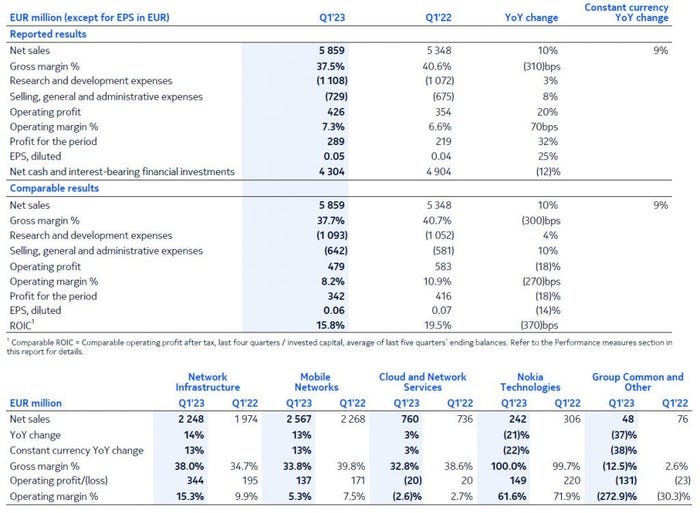

Nokia’s net sales were up 9% year-on-year in Q1 2023, which compares favourably to Ericsson’s flat numbers, reported earlier this week. In common with its competitor, Nokia relied heavily on India’s 5G roll out to offset declines in North America. But Nokia seems less exposed to the US market and has a more diversified portfolio thanks mainly to its fixed-line (Network Infrastructure) business.

“Network Infrastructure had another great quarter with 13% constant currency net sales growth and continued operating margin expansion,” said Nokia CEO Pekka Lundmark. “We saw particular strength in Optical Networks and good growth in both IP Networks and Submarine Networks. Mobile Networks net sales grew 13% as 5G deployments in India ramped up, more than offsetting a slowdown in North America spending.”

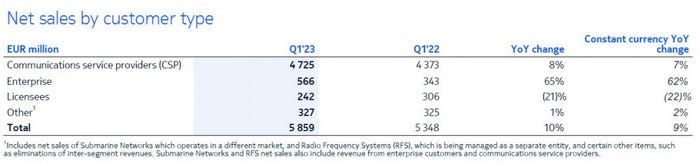

As we saw from Ericsson, the margins from flogging 5G kit to Indian operators are much lower then for American ones, so Nokia’s gross margin was also significantly down year-on-year. The company was keen to flag up 62% growth from its enterprise sales, which is also a core strategic focus for Ericsson. Enterprise still only accounts for less than ten percent of Nokia’s total sales, but it’s clearly headed in the right direction.

“Looking forward, we are starting to see some signs of the economic environment impacting customer spending,” concluded Lundmark. “Given the ongoing need to invest in 5G and fibre, we see this primarily as a question of timing; nevertheless we will maintain our cost discipline to ensure we can successfully navigate this uncertainty. We remain on track to deliver another year of growth in 2023 so our outlook is unchanged with the expectation that profitability in the second half of the year will be stronger than the first half.”

It looks like Nokia’s sales beat expectations but it missed on profits, which is consistent with the India narrative. Sales were a bit higher than Ericsson’s, which were around €5.5 billion in Q1, but Nokia seems to have taken a similar share price hit – down 8% at time of writing. It’s interesting to note that Nokia’s current market cap of €22 billion is significantly higher then Ericsson’s €16 billion. The common narrative from their respective outlooks is that things are expected to pick up in the second half of this year. Let’s see.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)