ChatGPT hype is channelling even more money into public cloud than Gartner initially expected.

April 20, 2023

ChatGPT hype is channelling even more money into public cloud than Gartner initially expected.

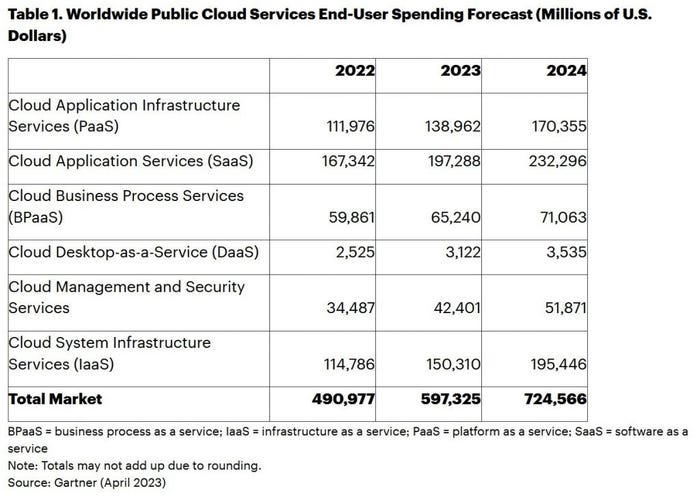

The analyst firm on Wednesday raised its 2023 forecast for global end user spending on public cloud to $597.3 billion from $591.8 billion.

Before anyone says that’s not a massive hike, it is still an extra $5.5 billion, which is not exactly pocket change. What’s more, this predicted increase in spending will take place against a backdrop of ongoing economic turbulence, which is forcing many sectors – including Big Tech – to be careful with their money.

Spending growth is expected to continue into next year too, with Gartner predicting it will reach $724.6 billion (see table). By 2026, 75 percent of organisations worldwide will have adopted a digital transformation model predicated on cloud as the fundamental underlying platform.

It seems that generative AI, along with Web3 and metaverse, are encouraging enterprises to loosen their purse strings. It is understandable, given the purported benefits of these technologies, such as improving and automating business processes, and reaching out to customers in new and exciting ways.

These emerging technologies, as Gartner calls them, lend themselves well to public cloud architecture and, in particular, hyperscalers.

“For example, generative AI is supported by large language models (LLMs), which require powerful and highly scalable computing capabilities to process data in real-time,” said Sid Nag, VP analyst at Gartner, in a research note. “Cloud offers the perfect solution and platform. It is no coincidence that the key players in the generative AI race are cloud hyperscalers.”

In fact, some hyperscalers seem to be doing a little too well.

As Telecoms.com reported earlier this month, telco watchdog Ofcom referred Microsoft and Amazon to the Competition and Markets Authority (CMA). It is concerned that some of the features and practices of Amazon Web Services (AWS) and Microsoft Azure make it harder or discourage businesses from switching provider.

It is a difficult one because an SME might be fine with a smaller public cloud provider that doesn’t own a data centre in every corner of the globe. That is until it wants to do something compute-hungry and/or in real-time, like rolling out a virtual chatbot for customer interaction, deploying a digital twin, or offering a metaverse experience. Having hyperscale compute and storage power on tap suddenly holds great appeal.

“The next phase of IaaS (infrastructure-as-a-service) growth will be driven by customer experience, digital and business outcomes and the virtual-first world,” predicted Nag. “Emerging technologies that help businesses interact more closely and in real time with their customers, such as chatbots and digital twins, are reliant upon cloud infrastructure and platform services to meet growing demands for compute and storage power.”

That said, software-as-a-service (SaaS) will still be the single biggest public cloud spending category this year, accounting for $197.3 billion of the total. It is here that smaller players can compete more effectively against the big guns.

“The technology substrate of cloud computing is firmly dominated by the hyperscalers, but leadership of the business application layer is more fragmented,” said Nag. “Providers are facing demands to redesign SaaS offerings for increased productivity, leveraging cloud-native capabilities, embedded AI and composability – particularly as budgets are increasingly driven and owned by business technologists. This change will ignite a wave of innovation and replacement in the cloud platform and application markets.”

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)