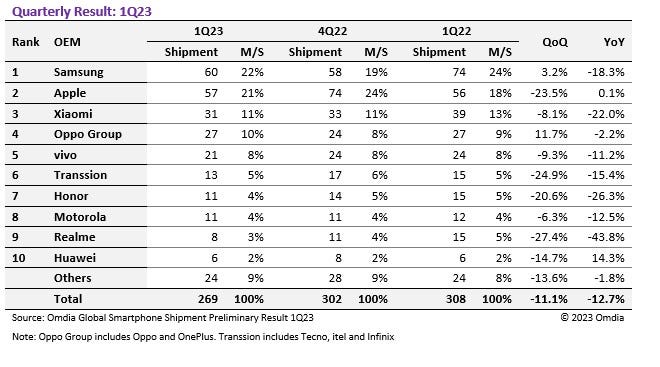

Global smartphone shipments totalled 268.5 million units in Q1 2023 according to the latest Omdia figures – down 12.7% year-on-year and down 11.1% from the previous quarter.

May 5, 2023

Global smartphone shipments totalled 268.5 million units in Q1 2023 according to the latest Omdia figures – down 12.7% year-on-year and down 11.1% from the previous quarter.

Despite the general drop in shipments Apple managed to remain flat for the quarter with 57 million shipments recorded – a 0.1% increase from the same period in Q1 2022, but a 23.5% drop from the past quarter following the traditional end of year bump.

Apple’s market share increased year-on-year as a result of all other OEMs seeing falls in shipments, rising from 18% in Q1 2022 to 21% this year. Omdia notes that Apple is ‘weathering the economic storm better than other OEMs’ and is recovering from a temporary blip in its eight-quarter/two-year streak of growth.

Samsung meanwhile suffered 18.3% drop YoY, but registered a 3.2% bump on the previous quarter. Its annual Galaxy S-series upgrade apparently didn’t perform as well as previous updates. It still flogged the most phones of all the manufacturers with 60 million units shipped – however Its lead on Apple has shrunk from 18 million more in Q1 2022 to 3 million more this year, and its market share tumbled from 24% to 22%

“Due to production disruptions at Foxconn’s Zhengzhou plant in December of last year, Apple was unable to supply the necessary quantities for the most important sales season, Christmas, and the end of the year,” said Jusy Hong, Senior Research Manager at Omdia. “As a result, some of Apple’s production was carried over to the first quarter of this year. In order to clear inventory in major markets such as China, early this year, the company conducted a promotion to lower the selling price of the new iPhone.

“This resulted in year-on-year growth rate of shipments in 1Q to perform relatively better compared to other OEMs. Apple’s price promotion of the new iPhone in the first quarter is very unusual. This seems to be a strategy to lower inventory to prepare for the sluggish smartphone market expected in the first half of this year. Among the newly released iPhone 14 series, the Pro Max sales volume was the highest, followed by the Pro model. This seems to be the effect of the Dynamic Island display applied to both models and the steady replacement demand from the high-income class, which is relatively less affected by the economic recession.”

The other thing to note from the report is that Chinese OEMs appear to have been particularly hard hit. Zaker Li, Principal Analyst at Omdia added: “The correlation that Chinese OEMs are experiencing worse market conditions than others is no coincidence. This larger decline is happening within the context of a shrinking domestic market and India. Realme, in particular, may be hit harder by this due to its product range being primarily in the low-end price tier – and therefore demand being more elastic than OEMs occupying the higher-end of the smartphone market.”

While global economic strife may be causing many to delay upgrading handsets, Apple fans as ever appear more willing than most to run out and get the latest hardware as soon as it drops.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

Read more about:

OmdiaAbout the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)