An IDC report says spend in telecoms is up due to tariff hikes but value is down in real terms due to high inflation, and operators are looking to new pastures for growth.

May 9, 2023

An IDC report says spend in telecoms is up due to tariff hikes but value is down in real terms due to high inflation, and operators are looking to new pastures for growth.

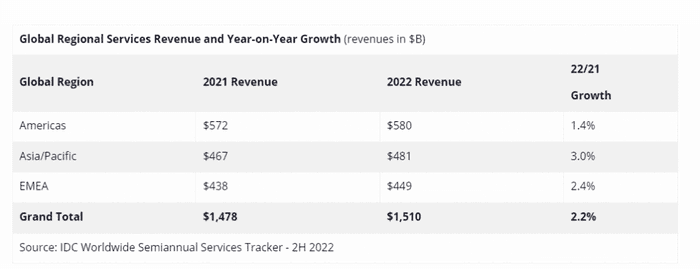

Worldwide spending on telecom and pay TV services reached $1,478 billion in 2022, a 2.2% year over year bump, according to the latest IDC Worldwide Semiannual Telecom Services Tracker. It’s not intuitively obvious why pay TV is lumped in there, but regardless IDC also expects worldwide spend to jump 2.0% next year and reach a total of $1,541 billion. This is a slightly more optimistic projection to one it published last in November, and it believes this acceleration is ‘a consequence of the increase in tariffs of telecommunication services fuelled by inflation.’

We’re told this is the second time in the last six months the analyst has increased its forecast for the telecom services market, and positive adjustments have been made for all regions. IDC says this is because inflation is happening worldwide and operators ‘are all behaving in similar way when their profitability is threatened by the inflationary pressures’ – referring to tariff hikes.

The analyst cites IMF forecasts that claim inflation will continue for the next three years, and therefore asserts that operators will continue to raise prices. “This is the explanation for why we increased our forecast not only for 2023, but for the entire first half of the forecast period,” explains the release.

However it says its forecasted growth rates are much lower than the annual inflation rates published by monetary statisticians, which means that ‘the market is witnessing a decline in value in real terms.’

The report states that as a consequence of this operators continue to heavily invest into ‘advanced telco technologies’, are ramping up digitalization and ‘software-ization’ of their operations, and are looking to move more into IoT, data centres, cloud, AR/VR, IT services, VoD, enterprise vertical solutions, financial solutions, cyber security, digital media, and e-commerce.

“Telecom operators are completely transforming – from providers of traditional commodity-style services they are becoming modern all-round full-stack technology suppliers,” said Kresimir Alic, Research Director, Worldwide Telecom Services. “In that way they become leaders of the digital transformation revolution and rightly hope they can acquire one of the central positions in the new digitalized world.”

So in a nutshell, telecoms spend is on the up due to tariff hikes, but value is down in real terms due to inflation. In terms of operators looking to move to pastures new, there certainly has been some diversification, or attempted diversification, by many of them into adjacent areas. But some of that – especially anything involving media – hasn’t always looked mega-successful.

The quote above seems to imply it’s almost a given that operators will become ‘modern all-round full-stack technology suppliers’ – but it remains to be seen the extent to which operators manage to shift from the core business of selling connectivity into something new. One of the hurdles in this journey is the breadth of competition from the wider tech market, much of which also has its eyes on, or is already established in, things like VR, cloud, IoT, data centres, and the rest.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)