All of Three UK's numbers are moving in the right direction, but CEO Robert Finnegan still isn't satisfied.

May 10, 2023

All of Three UK’s numbers are moving in the right direction, but CEO Robert Finnegan still isn’t satisfied.

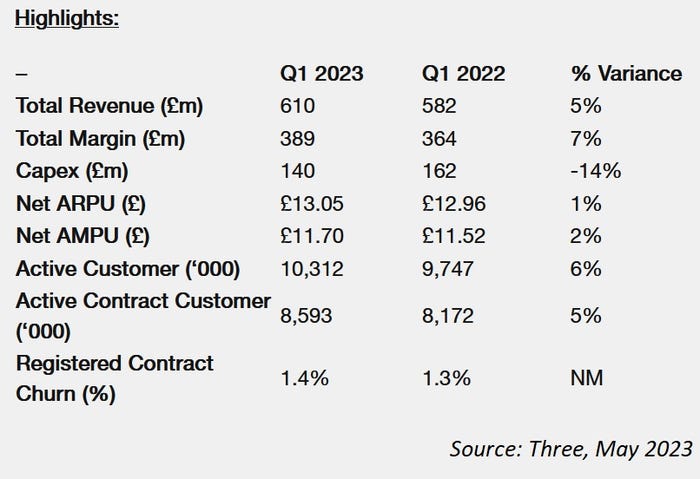

The mobile operator’s revenue for the first three months of the year totalled £610 million, a 5% increase on last year. Margin increased 7% to £389 million, and capex was down 14% to £140 million. Monthly ARPU inched up to £13.05 from £12.96, and average margin per user (AMPU) grew 2% to £11.70.

Things are looking good on the customer front too. Three’s active customer base increased 6% year-on-year to 10.3 million. Of that base, 8.5 million are contract customers, up from 8.2 million in Q1 2022.

“We have continued to see growth this quarter with a strong year-on-year performance reflected in a 6% increase in our active customer base, 5% in revenue and 7% in margin. We also delivered our new IT systems, which will transform our customer offering and give customers flexibility to choose their plan,” said Finnegan in a statement accompanying the publication of Three’s first quarter results on Tuesday.

“However, our returns remain below the cost of capital,” he said. “Connectivity is crucial to how we live and work; for the industry to continue investing in the UK’s digital infrastructure, market structural change is needed.”

Rolling out 5G is undoubtedly expensive, even more so given the rise in borrowing costs. It is little wonder then that Three’s returns are below the cost of capital, and it would be wholly unsurprising to discover that other telcos are in the same boat.

It also doesn’t help that it is taking the industry so long to deploy 5G standalone (SA), given this technology apparently holds the key to unlocking efficiencies and fresh sources of revenue over and above enhanced mobile broadband (eMBB).

Furthermore, Three originally planned to launch 5G using Huawei equipment, and had earmarked at least £2 billion for the rollout. However, that plan – and presumably the budget – had to be adjusted after the UK government banned Huawei from 5G networks.

It would be remiss then of Finnegan not to remind the government of his company’s travails. Particularly when there’s a potential merger with Vodafone on the line, a merger that will attract intense scrutiny from competition watchdogs and other vested interests.

A Financial Times report last week gave the impression that a deal worth £15 billion is imminent, and could be announced this month. Recent rumblings from the government suggest it is ambivalent about the number of mobile operators.

However, on Tuesday, Frank John Sixt, CFO of Three parent CK Hutchison, appeared to strike a more cautious tone. According to Reuters, he told investors that “it is probable as has been speculated that we will reach an understanding with our friends at Vodafone.”

“Although I would say they (Vodafone) are extremely difficult to draw a conclusion with on the one hand, but on the other hand they are, in the end, very good partners,” he continued. “So the first part makes me a little bit more sceptical but the second part makes me a little bit more optimistic.” Additionally, the Telegraph reports that national security concerns are an additional complicating factor.

As has been previously reported, the merger would see Vodafone take a 51% stake in the combined entity, and – according to the FT – would pave the way for CK Hutchison to sell its 49% holding to Vodafone.

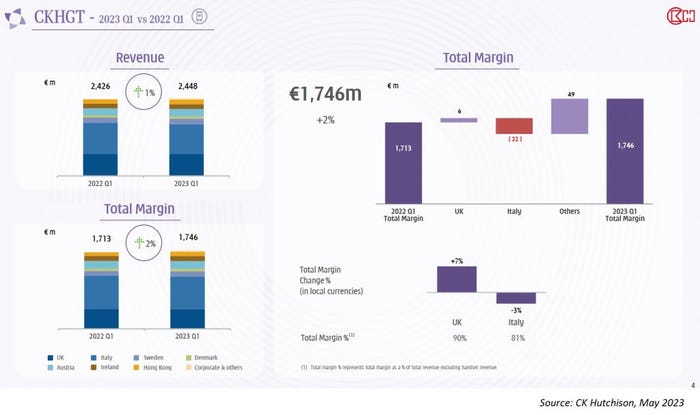

Should it do so, CK Hutchison would be giving up one of the jewels in its crown. According to the financials it published on Tuesday, the UK is Hutch’s second-biggest telecoms market behind Italy, accounting for nearly 30% of Q1 group revenue, which came in at €2.45 billion. Its opcos in Sweden, Denmark, Austria, Ireland, and its domestic operation in Hong Kong, together account for around third of total revenue, with the remainder – some €941 million – generated by Italian arm Wind Tre.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)