September 12, 2018

By Ian Martin Ravenscroft, Vice President Of BSS Solutions, Huawei

The explosive growth in the use of Smartphones worldwide has led to more and more innovation in how people access and pay for services via these devices. In Asia and Africa where the more traditional banking and payment services were less developed this has led to a significant amount of local innovation and divergence in how services are offered and payment received. In China, with the dominant of Alipay and Wechat there is almost no service that you cannot access or purchase using these platforms – meeting the needs of large numbers of banked individuals to access universally available and accepted electronic payment mechanisms. Recent report released by Accuray Research predicts that the mobile money market is expected to grow from $21B in 2016 to over $400B by 2025 with a CAGR of almost 40% [1].

New Opportunities in Emerging Markets

Although Mobile Money networks in worldwide are on an uptrend, due to lacking of existing financial infrastructure, these networks in the emerging markets are still in their infancy with significant opportunity for the growth and development. World Bank Open Data show that around 2 billion people remain unbanked globally, with less than 30% bank penetration, less than 10 ATMs per 100,000 adults, and over 60% live far from banks[2]. Without access to financial services, these people have to keep their hard-earned savings in a mattress or travel to exchange funds in person, bringing inconvenience to their daily lives. Therefore, a way that enables the conversion between e-money and cash is quite necessary for these people.

So while mobile money networks always rely on national banking infrastructure, a key part of many mobile money networks is to extend the financial infrastructure of the country through the support and creation of agent networks to enable the conversion between e-money and cash. It is the support for these agent networks in terms of organization, liquidity and commissions that enables mobile money networks to be so successful. The developing mobile money ecosystems are by their nature, operating on a peer to peer basis with other mobile money networks and international remittance networks enabling mobile money to be sent between networks in the same or different countries in a matter of minutes. Moreover, these ecosystems also encourage small businesses and developers to innovate and expand the range of services available to users, enabling mobile money services to be successful in emerging markets.

Huawei Mobile Money: Improving Lives and Accelerating Economic Growth for 19 Countries People, Promoting Inclusive Finance

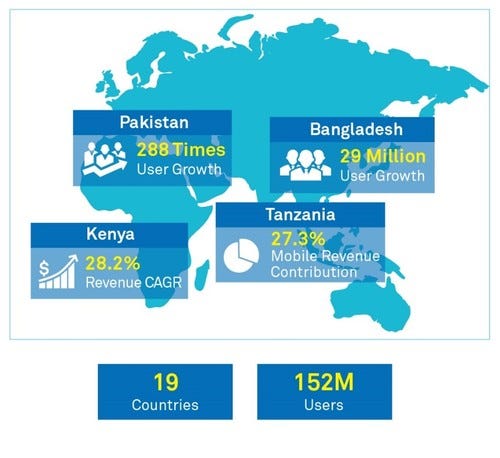

Figure 1: Mainstream Mobile Money providers in Emerging Markets, including highlight for business impact of Mobile Money service

Figure 1: Mainstream Mobile Money providers in Emerging Markets, including highlight for business impact of Mobile Money service

Huawei Mobile Money has been deployed in 19 countries of these emerging markets, serving more than 193 million users. The main stream mobile money operators(figure 1) across these emerging markets such as Kenya, Tanzania, Bangladesh, and Pakistan have chosen Huawei as their mobile money partner. Today Huawei Mobile Money powers over 35% of the global mobile money transactions of this vital ecosystem for the traditionally unbanked. The mobile money ecosystems co-exist alongside more traditional banking networks extending the availability of e-money and financial services, enabling vital access to charitable distribution, savings, loans, health, education, electricity & water as well as providing low cost easy access to life enriching services such entertainment and media services.

Huawei Mobile Money, with its Secured, Reliable and Open Platform, Helps Operators Achieve Business Success

Figure 2: Huawei Mobile Money Business Assessment Program (BAP)

Figure 2: Huawei Mobile Money Business Assessment Program (BAP)

The success of Huawei Mobile Money relies on its secured, reliable and open platform. Huawei Mobile Money success is built with security, reliability, openness and flexibility as its core, enables 99.9% transaction success (identified by PCI-DASS), 35 million+ transactions per day, and help quickly integrate agents and merchants. Apart from the platform, Huawei also develops a successful mobile money business rests on 5 key foundation based on its wide expertise in these foundations. Huawei has developed a Business Assessment ProgramFigure 2 which uses in engagements to help focus activities and maximize Mobile Money program investments, enabling customers’ business success.

Huawei Mobile Money is designed to support the advanced ecosystem of services needed to support the community of merchants, service providers and developers at the heart of any developing digital ecosystem. Evidence is that once a Huawei mobile money platform becomes established, the increased population with access to digital financial services rapidly increases demand for other digital services and overall economic activity. Huawei has the ability to synchronize network infrastructure to ensure the mobile money service can reliably reach the remotest areas and thereby ensuring universal access to mobile money powered digital economy.

In summary, there is massive untapped mobile money potential globally that will be developed in the next decade, evidence [3] shows that the opportunity is now and early adopters will become the most successful. Unlike 10 years ago when Kenya first launched the availability of reliable smart phones, widespread 4G networks and advanced, scalable and open mobile money platforms such as Huawei’s make the development of a successful mobile money service much likely to deliver successful outcomes for the operator, the economy and most importantly the unbanked who can join the rest of the world in the digital economy. Huawei with its extensive experience in helping customers achieve success in mobile money is ideally positioned to help operators establish profitably grow their mobile money businesses. If you would like to know more about Huawei Mobile Money please visit our Mobile Money site at http://carrier.huawei.com/minisite/software/mobile-money

[1] GLOBAL MOBILE MONEY MARKET ANALYSIS & TRENDS – INDUSTRY FORECAST TO 2025 -Accuray Research MRC Pvt Ltd

[2] World Bank Open Data: https://data.worldbank.org.cn/

[3] 2017 State of the Industry Report on Mobile Money, GSMA

Read more about:

Vendor SpotlightsYou May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)