O2 UK was conspicuous by its absence from the list of carriers offering Nokia's next flagship device - the N97. Could this be because of its exclusive relationship with Apple?

June 29, 2009

O2 UK was conspicuous by its absence from the list of carriers offering Nokia’s next flagship device – the N97. Could this be because of its exclusive relationship with Apple?

Exclusive deals between handset vendors and network operators have become increasingly popular since the launch of the first Apple iPhone with US carrier AT&T. Apple selected individual operators for each country that was included in its early launch phase and, in some of those countries, exclusive distribution rights remain in place. Subsequently

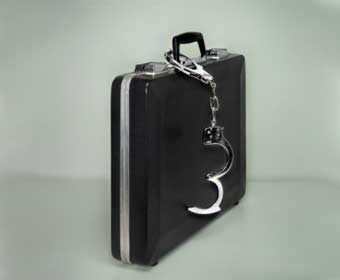

case-excliusive

The Cost Of Exclusivity

the first two Android phones to be taken to market by Google (manufactured by HTC) were only available from T-Mobile and Vodafone. Apple’s marketing strategy is a benchmark in this industry and it was able to paint its operator partners as lucky recipients with consummate ease, despite the substantial kickbacks it was understood those operators were obliged to give the vendor for the privilege of offering its handset.

But it has been suggested that exclusivity deals are not without risks and, early in June, it was announced by Nokia that its flagship N97 product will be available through all carriers in the UK apart from O2, which is Apple’s UK partner.

While UK retailer Carphone Warehouse will be selling the handset with contracts on O2’s network, the N97 will not be available in O2’s stores, or from its online shop. Existing O2 customers who are desperate to get hold of an N97 will not be able to get one as an upgrade from Carphone Warehouse so the only option for these people would be to buy one SIM-free from the Nokia store for £499. At first glance the arrangement seems potentially detrimental to both Nokia and O2. The carrier is the largest in the UK market, so the doors of almost 30 per cent of UK users are initially closed to the N97. Nokia, meanwhile, is the most popular handset brand in the world so O2 risks upping churn among the Nokia die hards on its network. O2 does not reveal breakdowns of its customer base by handset brand. But it is reasonable to assume that, with a customer base of more than 22 million-and with Nokia’s UK market share reflecting its global stake of around 40 per cent-there are very many such loyalists on O2’s books.

And yet an O2 UK spokesperson ruled out any chance that the firm would sell the handset at any point. “We have no plans to sell the Nokia N97 through our direct channels,”

she said, adding: “We offer a range of handsets through our product portfolio, which is regularly reviewed to meet the demands of our customers.”

Nokia, meanwhile, refused to comment on why the largest carrier in the UK will not be stocking what is arguably its most important new product since the iPhone shook up the high end handset market two years ago. So what factors might be at play? The most obvious connection is Apple, of course, which Nokia views as a dangerous, if at the moment niche, competitor. Analysts have speculated that it is the iPhone – and specifically O2 UK’s exclusive distributor status for the Apple product – which has led to the carrier’s absence from the N97 launch. David McQueen, principal analyst at Informa Telecoms & Media, said it was believed that O2 had exhausted its subsidy budget with the costly iPhone and had been unable to offer the N96, when that first launched, as a result. (O2 does now offer the N96, but not heavily subsidised. To get it for free, consumers must sign up to a 24-month tariff of almost £75/month.)

The current situation could simply be a continuation of that problem, said McQueen, given O2’s ongoing commitment to the iPhone and the carrier’s reliance on the product for driving its consumer data traffic. iPhone users are renowned as far more data-hungry than users of other handsets. “In addition, it is very likely that O2 can’t commit to marketing budget for the N97 as it is likely to have to co-market the iPhone in June / July, most probably when a new iPhone comes out,” McQueen said.

There has also been speculation that O2 is planning to market the Palm Pre, placing further strain on its budgets. Alternatively O2 may have been excluded, rather than opting out. This latest development could be a decision taken by a disgruntled Nokia based on O2’s initial vote not to offer the N96.

Tony Cripps, a handset market analyst at Ovum suggested that Nokia might be concerned at how much fanfare O2 would be able to give the N97 in its marketing strategy. “Perhaps Nokia thinks that going through O2 with what will be its flagship handset for some time may not get it the attention it thinks the phone deserves,” he said. He added that a good deal of the prospective market for a high end smartphone like the N97 among O2 users would already be iPhone users.

Speaking to telecoms.com recently, Vimpelcom CEO Boris Nemsic decried the kind of exclusivity deals that O2 has with Apple, writing them off as dangerous for carriers. “I think that the operators who are making these exclusive deals are weakening their position severely,” he said. “It is a very single minded [strategy] and it doesn’t work. In our society and life, exclusivity doesn’t work. You see in Russia that all three operators have the iPhone. Why should a vendor say I will take just 30 per cent of the market when I can have 100 per cent. It doesn’t make sense.”

O2 will only be able to make a call on that when the N97’s sales performance has become clear.

Read more about:

DiscussionAbout the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)