Major OTT players like WhatsApp, Facebook Messenger and Viber have become choice messaging services for consumers wanting low cost, global communication; creating an ecosystem where operators need to seriously consider which type of partnership or OTT integration models will enable them to drive revenue and sustain their business long term.

August 5, 2014

Telecoms.com periodically invites expert third-party contributors to submit analysis on a key topic affecting the telco industry. In this piece Thorsten Trapp, Co-Founder and CTO of tyntec, looks at the threat to operators from OTT players and suggests that cooperation may be the best way forward for all concerned.

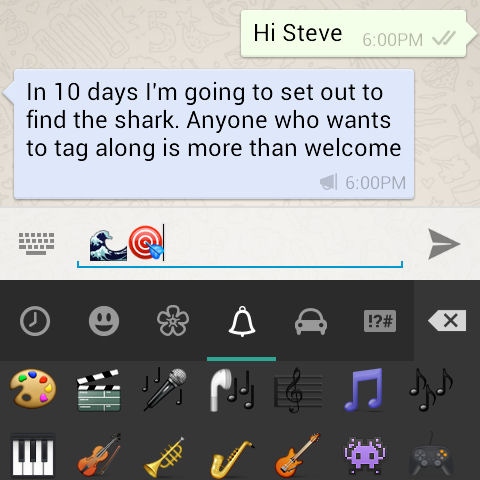

There are over 2 billion OTT voice and messaging apps installed around the world and for the first time, more messages are being sent via these applications than traditional SMS. In 2013, the total number of messages sent and received from WhatsApp was more than double the global total of SMS traffic for the same year, despite both services being as readily available.

According to research by analyst house mobilesquared, by 2017, over two thirds of smartphone users will be communicating through OTT services and the OTT communications market is expected to be worth an estimated $53.7 billion. Major OTT players like WhatsApp, Facebook Messenger and Viber have become choice messaging services for consumers wanting low cost, global communication; creating an ecosystem where operators need to seriously consider which type of partnership or OTT integration models will enable them to drive revenue and sustain their business long term.

No operator is an island

Some mobile operators have attempted to compete with OTTs by offering their own “OTT-like” services. For example, Telefonica’s TU Go app debits subscribers’ existing minutes to make / receive calls as well as use SMS and voicemail features. But services like this are isolated only to their subscribers and do little to connect them with the greater would-be customer pool of OTTs.

The same research shows that this self-generated OTT option is losing its appeal for operators, simply because of the complexities involved to successfully integrate or launch such a service. By example, the Joyn initiative was proposed as a collective method to combat OTT services, but its extended-time-to-market and integration complexities have caused operator interests to wane.

Strength in partnership

Instead of a competitive approach, we are now seeing a renewed interest in partnerships as operators recognise that it offers the best chance of further growth. Partnerships such as the E-Plus and WhatsApp bundled SIM or Deutsche Telecom and Dropbox Android preloaded file sharing and storing give us a glimpse of what more partnerships might look like in the near future.

Ultimately, partnerships which close the disparate worlds of telecom and web will yield the greatest benefits for both operators and OTT players. Partnership extends their respective reach and gives them access to a larger group of potential customers—as well as the possibility to generate additional income from data, voice and messaging revenues.

As an example, using existing telecom elements partnerships can benefit both operators and OTTs potential to generate revenues from off-net access by:

Renting virtual mobile numbers.

Terminating additional SMS or voice traffic into the operator network.

Offering branded app services to their subscribers.

A clear direction?

Each side brings their strengths: OTT players bring their brand recognition and MNOs/MVNOs bring their network connectivity.

Only time will tell if operators will be compelled to enter into dialogues with OTT players and embrace innovation. In doing so, they will certainly play a role in the new, modern telecommunications ecosystem. However, their inability to act puts them at greater risk to experience tumbling revenues, customer loss and lowered position in the marketplace.

About Thorsten Trapp

About Thorsten Trapp

Serial entrepreneur Thorsten Trapp co-founded tyntec in 2002. His deep knowledge of the technical side of telecommunications combined with his ability to spot emerging trends and develop products and services to meet industry demand mean he is a highly regarded industry expert who is a regular feature in the global trade press. Thorsten developed the company’s Mobile Messaging platform architecture which powers tyntec’s core business and is chiefly responsible for the company’s technical innovations and intellectual property. Amongst others, he is the inventor of tyntec’s dynamic SS7 platform, its Mobile Number Portability System and disruptive tt.One product.

Read more about:

DiscussionAbout the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)