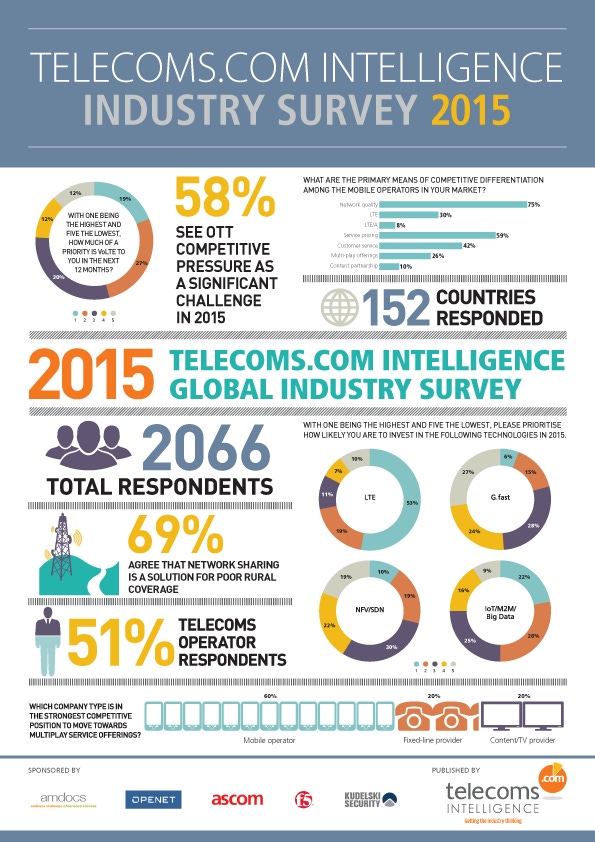

75% of operators looking to video for LTE revenue – exclusive report

Operators see video content streaming as one of the most lucrative LTE services, according to the Telecoms.com Intelligence Annual Industry Survey 2015. However, the report results also showed telcos still see OTT service providers as a significant competitive concern.

February 27, 2015

Operators see video content streaming as one of the most lucrative LTE services, according to the Telecoms.com Intelligence Annual Industry Survey 2015. However, the report results also showed telcos still see OTT service providers as a significant competitive concern.

The annual report, which had over 2,000 respondents, showed 75% of respondents identified video as one of the services enabled by LTE with the most revenue-generating potential. Additionally 58% of respondents said they see OTT competitive pressure as a significant challenge facing them in 2015. This indicates respondents are concerned the potential offered by video content being reduced by OTTs such as Netflix or Amazon Prime Instant Video.

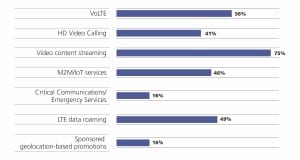

In terms of other LTE offerings, VoLTE (voice-over-LTE) was seen as the second most lucrative with 56% respondents selecting it, followed by LTE data roaming (49%) and HD video calling (41%).

Which Of The Following Do You Think Are The Most Lucrative Services Enabled By Lte? (Select Three)

Overall, 72% of operators said they are prioritising LTE investment in 2015. But at the same time the survey revealed operators don’t expect LTE to reach even the majority of their subscribers within this year. “LTE is, of course, a key technology for demonstrating value and differentiation to the market, but the survey revealed most respondents still expect the minority of their subscribers to be covered by LTE this year,” Scott Bicheno, Editor of Telecoms.com Intelligence said.

“Another major LTE-related question facing the industry is the move to VoLTE. While it’s generally considered inevitable, there is understandable reluctance to do so prematurely and the survey revealed distinct anxieties about ensuring continuity when they eventually do.”

Looking at what makes telcos stand out in more detail, network quality and coverage was seen as the most important means of competitive differentiation with 75% of operators choosing this as the primary feature. At 59% service pricing came second and customer service third at 42%.

On the contrary, device pricing, content partnerships, LTE-Advanced and carrier billing didn’t seem very important in terms of competitive advantage, with 15%, 10%, 8% and 6% of responses respectively.

Vincent Rousslet, VP Market Insight and Strategy at Amdocs, one of the survey sponsors, said: “Telecoms.com Intelligence Annual Survey bears out the emergence of this new world of customer experience in a striking manner: competitive pressure is mounting between operators (a top priority for 64% of respondents) and from internet companies (59%).

“Lower prices and the cost of technology (60%) – both rolling out the new and servicing the old – create a challenging scissor effect, with revenue losing ground to costs. In order to succeed, a common thread has to be woven across the operator: competitive customer experience is that thread.”

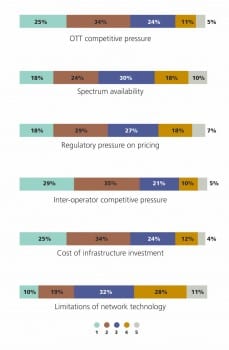

With One Being The Most And Five Being The Least, How Much Of A Challenge Do You Consider The Following To Be In The Next 12 Months?

The full report is available as a free download here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)