Global smartphone market suffers first ever shipment decline

A day after Apple revealed its first revenue decline for 13 years preliminary global smartphone shipment numbers reveal the first ever decline in that category.

April 28, 2016

A day after Apple revealed its first revenue decline for 13 years preliminary global smartphone shipment numbers reveal the first ever decline in that category.

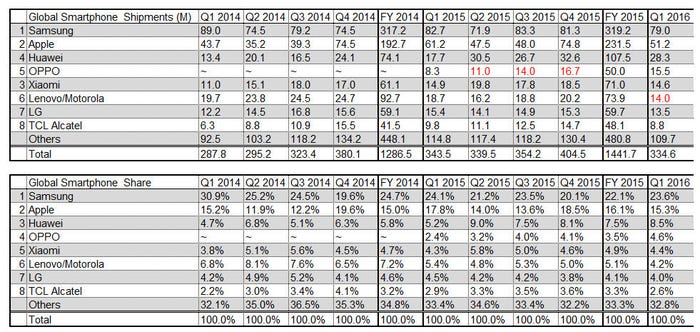

Telecoms.com collates global smartphone shipment data from a combination of public announcements, such as Apple’s, and numbers from analyst firm Strategy Analytics. Where neither is available we indicate our estimates with a red font colour. IDC also publishes smartphone shipment data at the same time as SA but they often differ considerably and, in our experience, SA’s are more accurate. IDC doesn’t think the market declined this quarter.

“Global smartphone shipments fell 3 percent annually from 345.0 million units in Q1 2015 to 334.6 million in Q1 2016,” said Linda Sui of SA. “It is the first time ever since the modern smartphone market began in 1996 that global shipments have shrunk on an annualized basis. Smartphone growth is slowing due to increasing penetration maturity in major markets like China and consumer caution about the future of the world economy.”

The smartphone business can be broadly subdivided into the pre and post Apple/Android eras (BA and PA?). The very first devices marketed as smartphones wouldn’t even qualify as feature phones now. Blackberry was an early trailblazer and then Nokia took over, using the Symbian platform. As is well documented the arrival of Apple and Android had a catastrophic impact on these complacent market leaders and, for once, the term ‘disruptive’ was fully justified.

The PA era experienced incredible growth in its first few years as consumers quickly understood the power of having a connected mini computer in their pocket. Additionally the licence-free nature of Android enabled anyone with a contact in Shenzhen to get into the smartphone game so, while Apple dominated the premium end, volume was driven by Android.

Initially that volume was derived from western consumers upgrading from feature phones or BA smartphones then, as the cost of producing smartphones decreased, developing markets such as China became the main growth drivers. That source has now dried up and countries like India are not growing their smartphone shipments sufficiently to compensate.

In spite of this the only smartphone vendors currently experiencing growth are Chinese challenger brands such as OPPO and Vivo. “OPPO has been well known in the smartphone industry for several years, but it is finally breaking into the wider public consciousness with its popular range of 4G models like the R9 across Asia and elsewhere,” said Sui. “Xiaomi remains under pressure from OPPO, Vivo and others across Asia, while it is still very weak in North America and Western Europe and the vendor will need to target these regions more aggressively if it wants to catch Huawei and others in the future.”

SA didn’t offer Vivo numbers in its release, but IDC reckons they shipped 14.3 million smartphones in Q1 2016, up from 6.4 million a year ago. OPPO and Vivo have been around for a while, along with other Chinese brands like Xiaomi, Meizu, Tianyu, etc. It’s not immediately obvious what they’ve done to improve their fortunes so dramatically in the past year but the traditional Chinese manufacturing virtues of scale and efficiency are likely to have played a major part.

It’s hard to see what can be done to reverse this declining trend. There is still growth to be had from developing markets, but coming from the sale of cheap, low-margin devices, from which the main beneficiary will be Google. In developed markets pretty much everyone already owns a smartphone and operates on a well-established two-year upgrade cycle, so they will remain flat.

Any deviation from the rectangular touchscreen form-factor will rightly be dismissed as gimmicky and there’s no obvious new functionality that might be introduced to get people running to the shops. The smartphone market has matured very quickly and made some companies a lot of money. It has now peaked and companies like Apple and Samsung are desperately looking for new product categories to replace it. The answer is unlikely to be smart watches, shipments of which SA says halved sequentially in Q1.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)