Apple revenue jumps in spite of declining volume thanks to the iPhone X

US gadget giant Apple delivered another obscene set of quarterly numbers, which indicate the high price point of the iPhone X has not put loyalists off.

February 2, 2018

US gadget giant Apple delivered another obscene set of quarterly numbers, which indicate the high price point of the iPhone X has not put loyalists off.

Q4 2017 iPhone shipments were down 1% year-on-year, despite one of the most significant Apple product launches in years taking place just before the start of the quarter. Under normal circumstances this would be a minor setback for Apple, but at the same time its iPhone revenues were up 13%.

Apple is all about margin. It has dominated the premium end of the consumer tech market for years and has never had any difficulty persuading its customers to pay a significant premium for technology with debatable superiority. But when the iPhone X was launched a lot of people thought the four-figure price point might just be a step too far, even for its notoriously profligate punters.

Apparently not. Quarterly revenue of $88.3 billion yielding net income of $20.1 billion, up from $17.9 billion a year ago is not a bad performance at all. To put that in perspective Google and Amazon both had great quarters, but Google’s net income (if you ignore the one-off tax charge) was around a third of Apple’s and even with a one off tax boost only managed net income of $1.9 billion. In other words Apple increased its profit by more than Amazon’s entire profit.

For Apple to increase its revenues while selling fewer units it must have significantly increased the iPhone average selling price (ASP), which must surely be down to the iPhone X. This is consistent with some early data on the global smartphone market.

“We’re thrilled to report the biggest quarter in Apple’s history, with broad-based growth that included the highest revenue ever from a new iPhone lineup. iPhone X surpassed our expectations and has been our top-selling iPhone every week since it shipped in November,” said Tim Cook, Apple’s CEO. “We’ve also achieved a significant milestone with our active installed base of devices reaching 1.3 billion in January. That’s an increase of 30 percent in just two years, which is a testament to the popularity of our products and the loyalty and satisfaction of our customers.”

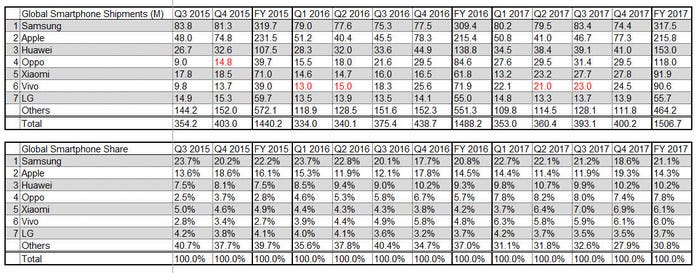

Apple also managed to take the number one global smartphone shipment spot back from Samsung, which isn’t unprecedented for Q4. You can see our latest vendor summary below, which also reveals a significant global drop-off in smartphone shipments. If anything this makes Apple’s performance even more impressive since it suffered less of a volume fall than its main competitors.

“Global smartphone shipments declined 9 percent annually from 438.7 million units in Q4 2016 to 400.2 million in Q4 2017,” said Linda Sui, analyst at Strategy Analytics. “It was the biggest annual fall in smartphone history. The shrinkage in global smartphone shipments was caused by a collapse in the huge China market, where demand fell 16 percent annually due to longer replacement rates, fewer operator subsidies and a general lack of wow models.”

“Despite robust iPhone X demand and an iPhone average selling price approaching an incredible US$800, we note global iPhone volumes have actually declined on an annual basis for 5 of the past 8 quarters,” said Neil Mawston, Analyst at SA. “If Apple wants to expand shipment volumes in the future, it will need to launch a new wave of cheaper iPhones and start to push down, not up, the pricing curve.”

It doesn’t look like Apple is bothered about volume – certainly not at the expense of margin, anyway. Android ASPs are a fraction of Apple’s and there will be nothing in its latest numbers to persuade Apple it needs to play in the lower tiers. Furthermore there has always been significant danger of damage to Apple’s premium brand in it offers budget products and the potential returns just don’t seem good enough to justify that risk.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)