Iliad Italy hits 2.2 million subscribers in Q3 2018

French telecoms group Iliad has released its Q3 2018 numbers and they reveal continued strong subscriber growth from its new Italian business.

November 14, 2018

French telecoms group Iliad has released its Q3 2018 numbers and they reveal continued strong subscriber growth from its new Italian business.

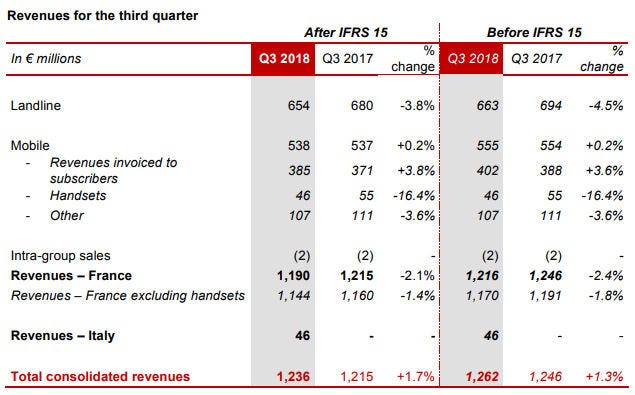

By the end of September Iliad Italy had 2.23 million subscribers, up from a million in mid July. This means the subscriber growth rate slowed a bit, but not much, and there was still plenty of momentum. On top of that Iliad Italy contributed €46 million to group revenues in Q3, having chipped in less than ten prior to that, so Iliad seems to be doing a decent job of monetising those subscribers already.

Here’s what Iliad had to say in its quarterly report about its Italian performance:

Outstanding commercial success: The Group had over 2.23 million subscribers7 in Italy at end-September 2018, just four months after launching its Italian mobile business. By way of comparison, the Group signed up 2.6 million subscribers in three months when it launched Free Mobile in France.

A successful upscaling strategy: The Group successfully introduced two consecutive price increases and enriched its offerings, while pursuing its strong pace of net adds. At September 30, 2018, Iliad’s original offer in Italy was invoiced at €7.99/month, including unlimited calls and texts, as well as 50 GB of 4G/4G+ and 4GB roaming allowance.

A recognized brand, with the Iliad brand now widely recognized in Italy: At end-September, four out of five Italians knew the Iliad brand, compared with one out of ten before the launch.

Third-quarter 2018 revenues generated by Iliad’s Italian operations totaling €46 million, already representing almost 4% of the Group’s total revenues: This amount comprises (i) the subscription cost (€5.99/month, €6.99/month or €7.99/month depending on the offer) and (ii) SIM card activations carried out during the period, at a price of €9.99 per SIM card.

Over in France revenues declined by 2%, with landline operations and sales of mobile handsets cancelling out growth in mobile subscriber revenues. Iliad just blamed competition for the landline situation and lauded an improvement in subscriber mix (i.e. more postpaid) for the mobile improvement. The main reason for the handset revenue decline was a ‘stricter commercial strategy for rental offers’.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)