Netflix share price slumps 11% as Q2 falls short of expectations

Netflix blames price increases and an under-performing content slate for poor performance in the second quarter of 2019.

July 18, 2019

Netflix blames price increases and an under-performing content slate for poor performance in the second quarter of 2019.

Revenues and profits might be up, but these are two metrics which have never seemingly bothered Netflix shareholders that much. What seems to be bothering the twitchy investors is tepid subscriber growth and increased competition in the streaming segment; ultimately these will both lead to the revenue and profitability metrics, but the point is to cast an eye on the horizon not today.

And it appears some investors do not share the same optimism as the Netflix management team as share price slumps 11% in overnight trading.

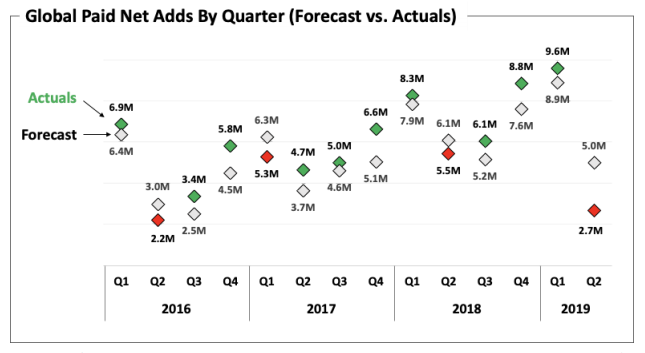

“… as you can see over the past 3 years, sometimes we’re forecast high,” CEO Reed Hastings said during the earnings call. “Sometimes we forecast low. This is one where we forecasted high. There was no one thing.

“And if I think about three years ago, we were also light, and we never really were confident of the explanation. Then, we were $2 billion in quarterly revenue. Now, we’re going $5 billion. And so, it’s easy to over-interpret the quarter membership adds, which are a bit noisy. So, for the most part, we’re just executing forward and trying to do the best forecast we can.”

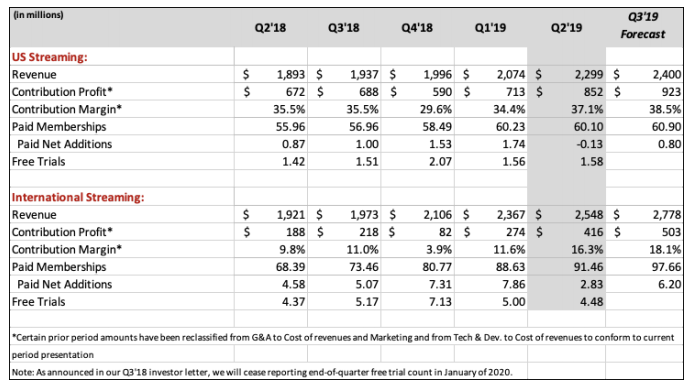

Subscription numbers are of course all important for what effectively is a single revenue stream business model, and the numbers aren’t the most flattering. 2.7 million net additions compared to the 5 million which were forecast at the beginning of the quarter, including a net loss of 130,000 in the US. When you consider the US currently accounts for roughly 48% of total revenues, this becomes an issue.

Hastings is playing his hand exactly as you would expect. In the early years, Netflix told investors not to worry about the money as subscriber gains are going through the roof; the money would come eventually. Now, Hastings and co. are telling investors not to worry about subscribers because the money is rolling in.

What is worth noting is that one bad forecast, one dip in subscribers, does not engulf Netflix in flames. Its not ideal, but as long as it doesn’t become a trend there shouldn’t be much to worry about.

Understanding why is of course critical however should Netflix want to rebound to the 7 million subscription gains it is promising over the next three months.

Firstly, price increases have not landed well with the subscribers according to CFO Spencer Neumann. The biggest churn rates across the world were in the markets where Netflix had announced price increases, the US for example, though strong performance in Q1 and a poor content slate over Q2 were also factors which contributed to the numbers.

Neumann suggests the first quarter of 2019 was particularly strong, perhaps pulling forward subscriptions and emptying the sales funnel for the second quarter, while the team has suggested the content slate was not as attractive as previous periods. This should change in the future however as the business moves from a licensing model to one which is more governed by original content.

Over the next couple of years, certain companies are going to start pulling back content from the Netflix catalogue, Disney and WarnerMedia/AT&T are prime examples. Not only will this decrease the variety of content on the platform, removing some fan favourites as well, but it will also strengthen the opposition.

Netflix has not blamed competition for the poor performance this quarter, suggesting there has been not material change to the competitive landscape just yet, though some shareholders might be getting a bit worried. Netflix is facing some difficulties at the moment, while bigger disruptions are on the horizon with Disney and AT&T readying their own streaming services.

What is also worth noting is content; Netflix is the market leader in the streaming market and is in the strongest position to deal with increased competition. There of course will be some difficult conversations to be had in the future, but this is still a business heading in the right direction.

Total revenue for the quarter was $4.9 billion, up 26% year-on-year, while the management team is forecasting $5.2 billion for the next three months, a 31% year-on-year jump. Globally, paid memberships increased to 151.5 million, while there were more than 7 million free trials across the second quarter.

On the pricing front, although this might have a slight negative impact on churn and subscription gains in the short-term, collecting additional revenue each month is only going to be a positive in the long-term. Netflix is still very affordable for the majority.

Looking forward, the team has suggested the first couple of weeks of the current quarter has demonstrated an acceleration in subscriptions, while churn is returning the levels experienced prior to the price increase. And while it might seem internet TV is taking over the world, there is still plenty of room for growth according to the team, both in terms of the linear/streaming dynamic and the opportunity on mobile.

Another factor to consider is the spend which is being allocated to original and localised content; few in the industry can compete with the Netflix numbers in this column. And as content becomes more fragmented through the various streaming platforms, the more original content Netflix produces, the more attractive is becomes as a service to consumers.

Netflix is still in a very strong position, but it is not going to have the same free-reigning dominance as it has experienced over the last few years. A diluted content library, price hikes and increased fragmentation will have a say in the fate of the business, but it is still in the strongest position of this increasingly competitive segment.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)