Deutsche Telekom raises guidance yet again after strong Q3

The good times continue to roll at Deutsche Telekom, which has reported solid Q3 earnings growth across all its operations.

November 9, 2023

The good times continue to roll at Deutsche Telekom, which has reported solid Q3 earnings growth across all its operations.

The performance led the German incumbent to raise its guidance for the third time this year.

Net profit is the most eye-catching figure – it jumped 21.9% on Q3 last year to €1.9 billion. This was attributed to an expected reduction in integration costs related to US arm T-Mobile’s merger with Sprint. Adjusted for this, net profit was actually down 5.9%.

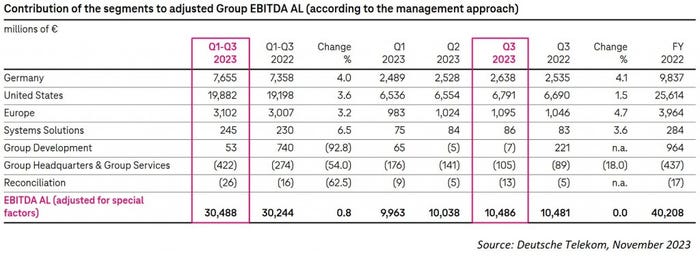

Adjusted EBITDAaL (EBITDA after leases) is arguably the more impressive line on the balance sheet. While it was flat at group level, inching up to €10.49 billion from €10.48 billion, all of its major operating segments reported growth EBITDAaL for one reason or another.

In Germany, the increase was due to high-value revenue growth and cost efficiency, while earnings at T-Mobile US benefited mainly from lower costs. Solid margins at its Europe business offset higher indirect costs, resulting in a 4.7% improvement in EBITDAaL. Finally, growth at its enterprise IT arm, Systems Solutions, was attributed to lower costs resulting from its transformation programme, combined with revenue growth at its road-toll business, which offset declining earnings from its cloud business.

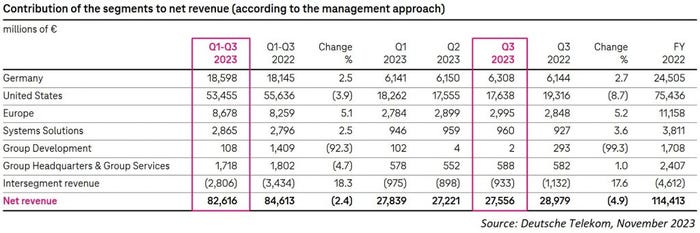

Meanwhile, group revenue fell 4.9% to €27.56 billion due to currency fluctuations – on an organic basis revenue inched up by 0.7%. Similarly, reported service revenue fell 1.4% to €23.26 billion, but was up organically by 4.1%.

At its closely-watched T-Mobile US arm, service revenue increased 4.7% on an organic basis to €15.9 billion. Postpaid phone subscriber additions were flat year-on-year at 850,000; however, Deutsche Telekom claimed it still outperformed its rivals in this regard.

After raising its full-year guidance in May and then again in August, Deutsche Telekom has raised it once more – it’s in danger of becoming a tradition.

Now it expects group adjusted EBITDAaL to come in at €41.1 billion, up from its previous guidance of €41 billion, which was itself an upgrade from €40.9 billion at the end of Q1. It also expects free cash flow of €16.1 billion, up from €16 billion.

“In these uncertain times, Deutsche Telekom continues to grow unabated on both sides of the Atlantic,” said Tim Höttges, CEO of Deutsche Telekom, in a statement. “We want our shareholders to participate in this positive development by way of a higher dividend.”

Indeed, as an early bit of good news for investors ahead of its Q3 report, Deutsche Telekom announced last week that is has increased its annual dividend to €0.77 per share, up from the €0.70 it paid out in 2022. Not only that, but it also plans to carry out a €2 billion share buyback in 2024, which won’t do investor confidence any harm either.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)