Ericsson and Nokia shares plunge after gloomy updates

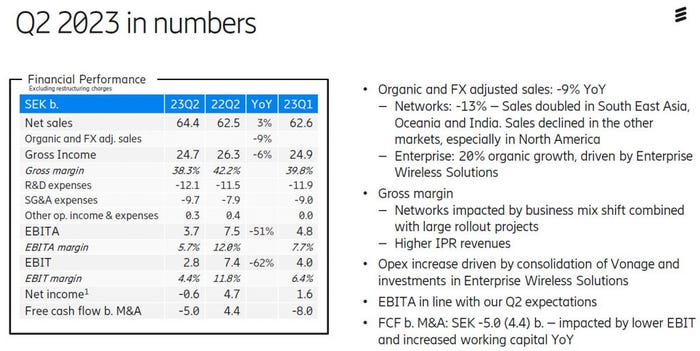

Ericsson’s Q2 23 numbers were in line with expectations but its share price fell after competitor Nokia lowered its outlook for the year.

July 14, 2023

Ericsson’s Q2 23 numbers were in line with expectations but its share price fell after competitor Nokia lowered its outlook for the year.

A sales decline of 9% year-on-year for Ericsson was what it had anticipated and even exceeded some analyst expectations so, in the absence of any significant change in its own outlook, it would be reasonable to expect its share price to be unmoved by its latest earnings. But major competitor Nokia chose today to announce a downgrade of its outlook for the year, which seems to be the main reason both companies’ shares fell by around 8% at time of writing.

“Building on our strong position and despite challenging market conditions we delivered a solid quarter – meeting expectations,” said Ericsson CEO Börje Ekholm. “In Networks, we saw strong execution with record build-out speed in India, where we now have a leading market share. Sales growth in India partly offset the expected softening we saw in other markets, notably in North America, where build-out pace moderated and customer inventory levels were reduced.

“As we look ahead, a fundamental driver of network capex is the continued rapid data traffic growth. Average smartphone usage is expected to exceed 20 GB/month in 2023 with strong growth… Traffic growth and operators’ desire to meet expectations for network quality with cost and energy efficiency, will stimulate investments.

“We are confident that the market will recover as a consequence of these factors, and Ericsson is well positioned to benefit from increased investments. The exact timing of these increased network investments is, of course, in the hands of our customers, but we expect that the market will see a gradual recovery in late 2023 and improve in 2024.”

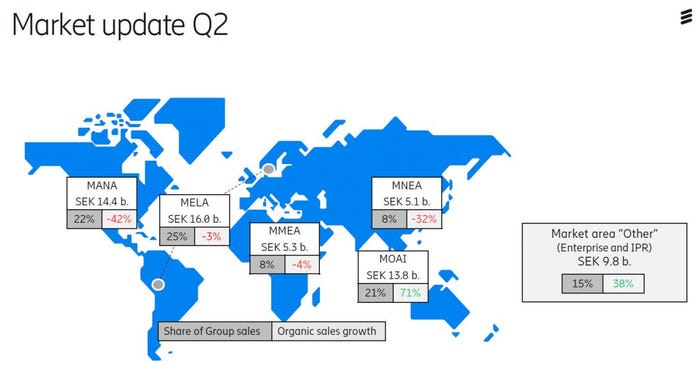

Ekholm’s regional commentary is illustrated by the first slide below, with APAC excluding NE Asia (principally India) now close to overtaking North America as a contributor to Ericsson’s sales. A lot of this is cyclical, with the US further along in its 5G rollout than India, but those challenging market conditions have been annoyingly persistent and seem to be hitting US telco capex especially hard.

Ahead of its quarterly earnings announcement next week, Nokia thought it necessary to alert the market to a lowering of its outlook for this year. It now expects 2023 sales to be in the range of €23.2 billion to €24.6 billion, down from its previous hope of €24.6 billion to €26.2 billion – a roughly 6% downgrade.

“The weaker demand outlook in the second half is due to both the macro-economic environment and customers’ inventory digestion,��” explained the Nokia announcement. “Customer spending plans are increasingly impacted by high inflation and rising interest rates along with some projects now slipping to 2024 – notably in North America. There is also inventory normalization happening at customers after the supply chain challenges of the past two years.”

The exceptional monetary loosening by many countries in response to the Covid pandemic has inevitably resulted in persistently high inflation and thus significant macroeconomic uncertainty. Both companies seem to think this negative pressure will ease towards the end of this year, at least in the US, but that’s far from guaranteed.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)