Huawei profits plunge as former CFO takes top job

Chinese telecoms vendor Huawei has revealed a 69% fall in profit for 2022, which it blames largely on ‘non-market factors’.

March 31, 2023

Chinese telecoms vendor Huawei has revealed a 69% fall in profit for 2022, which it blames largely on ‘non-market factors’.

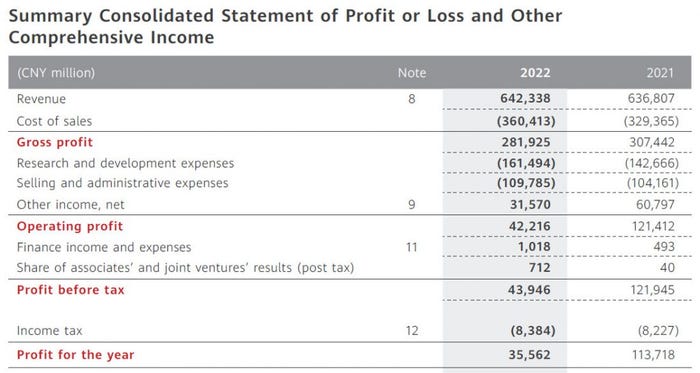

It should be stressed that the previous year’s profit figure was inflated by some one-off disposals, including a server and a smartphone business. But profits of CNY 35.6 billion 2022 still represented just over half of the total from two years ago. A more positive datapoint for Huawei was it managed to slightly increase revenue, which had fallen dramatically last year.

“In 2022, a challenging external environment and non-market factors continued to take a toll on Huawei’s operations”, said Eric Xu, Huawei’s Rotating Chairman, at the company’s annual report press conference. “In the midst of this storm, we kept racing ahead, doing everything in our power to maintain business continuity and serve our customers. We also went to great lengths to grow the harvest – generating a steady stream of revenue to sustain our survival and lay the groundwork for future development.”

Huawei favoured agricultural metaphors at the conference, which was livestreamed earlier today. Xu explored a tangent about plum trees producing their sweetest harvest after harsh winters. This was essentially a continuation of the defiant position Huawei has adopted in the face of mounting US sanctions and pressure on its allies to ban Huawei from their networks. Those will be the non-market factors he mentioned.

“Despite substantial pressure in 2022, our overall business results were in line with forecast,” said Huawei CFO Sabrina Meng (pictured, top). “At the end of 2022, our liability ratio was 58.9% and our net cash balance was CNY176.3 billion. In addition, our balance of total assets reached one trillion yuan, largely composed of current assets such as cash, short-term investments, and operating assets. Our financial position remains solid, with strong resilience and flexibility. In 2022, our total R&D spend was CNY161.5 billion, representing 25.1% of our total revenue – among the highest in Huawei’s history. In times of pressure, we press on – with confidence.”

Alongside the publication of the annual report came the announcement that Meng was stepping into the Rotating Chair role. While this had been on the cards for a year, it still seemed symbolic that the person the US had put under house arrest for years, as it pursued a failed prosecution against her, is now running the show.

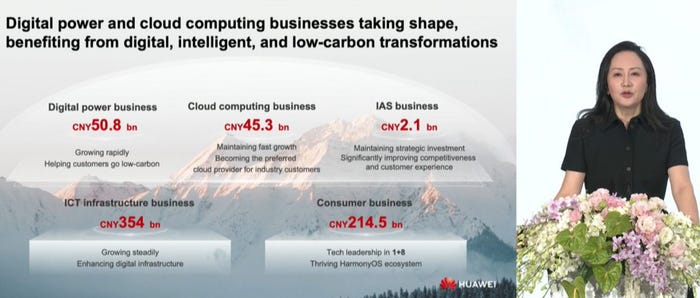

There was an extensive media Q&A after the announcements which you are free to review at your leisure from the embedded video below. Leaving aside whatever state support it may be receiving, Huawei’s main defence against US action is to diversify into areas it’s not currently prohibited from. The two screenshots taken from the presentation below show Xu describing Huawei’s claimed competitive advantages and Meng breaking down the main business segments.

Despite the best efforts of the US and its allies, Huawei is clearly not going away. Instead it will continue to diversify and hope that its R&D efforts eventually make it impossible to ignore by the West. It will also continue to be the most notable symbol of the great geopolitical tussle of our times, between the US and China, which threatens to split the technology and business worlds in two, to the detriment of everyone.

Get the latest news straight to your inbox. Register for the Telecoms.com newsletter here.

About the Author(s)

You May Also Like

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=800&auto=webp&quality=80&disable=upscale)